Oil futures have been trading choppy in the past few sessions as crude prices are struggling to move above the $46 level since a surprising inventory build-up in the United States last week seems to be capping their advance.

Crude prices reacted negatively yesterday to a surge of 15.2 million barrels last week in the United States, as reported by the country’s Energy Information Administration (EIA), while analysts were expecting a 1.4 million drop during the period.

“The significant increase in gasoline and distillate inventories is likely a result of lower oil demand post the Thanksgiving holiday, as well as additional stay at home measures across country”, said Andrew Lipow, president of Lipow Oil Associates to CNBC yesterday in regards to the surprising surge.

Futures of the West Texas Intermediate (WTI) – the US benchmark – retreated slightly by 0.2% during yesterday’s commodity trading session while they are advancing 1.5% today at $46.21 per barrel as traders appear to have shrugged off the build-up amid the prospect of an ongoing vaccine rollout around the world.

Meanwhile, the seemingly inevitable approval of Pfizer’s vaccine by the US Food and Drug Administration (FDA) along with the prospect of a steady rollout in the United Kingdom and Canada are lifting oil markets this morning, as other countries could follow through over the next few days.

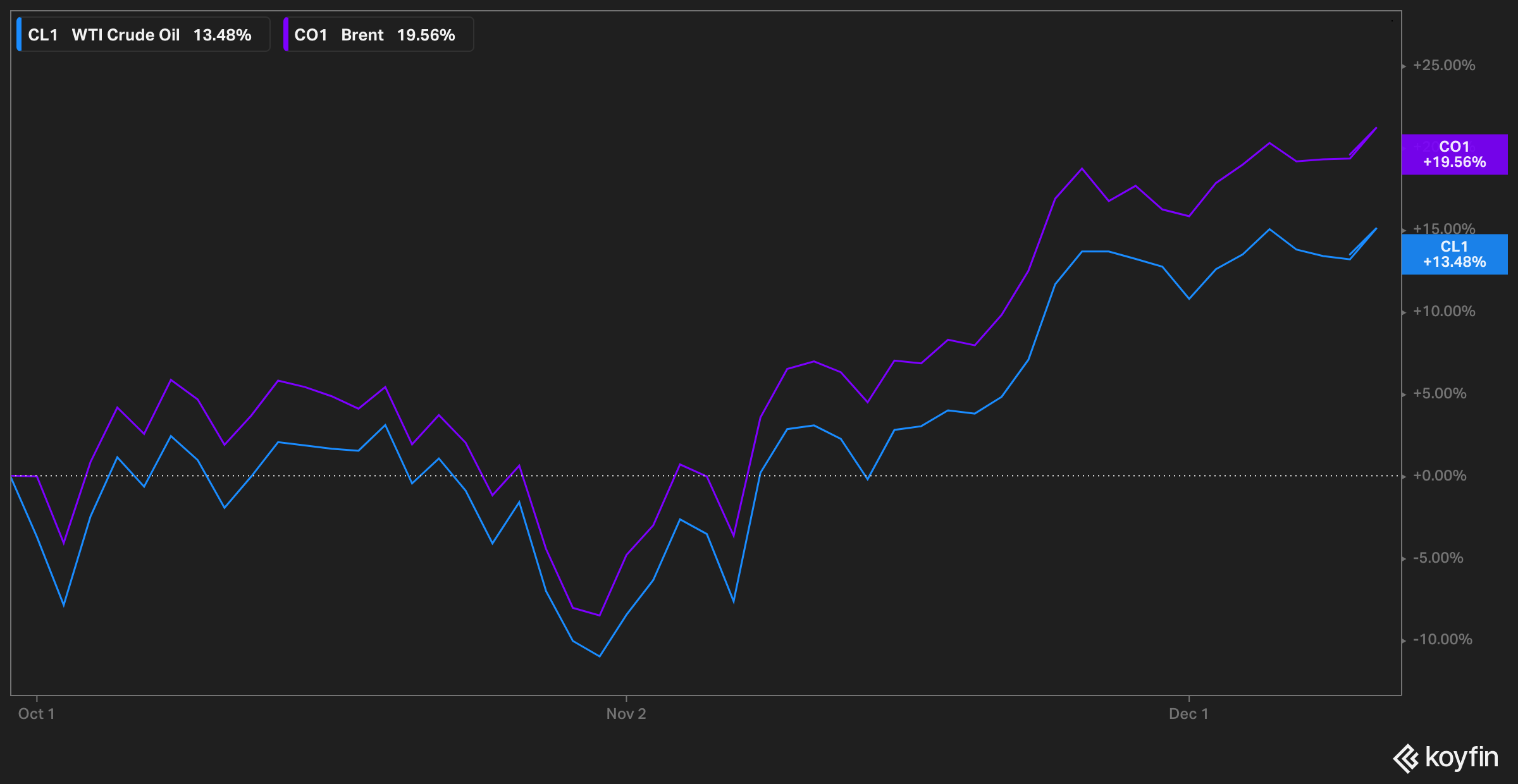

Curiously, Brent futures have been outpacing the WTI marker during this fourth quarter of the year, as the price of the global oil benchmark has advanced 19.5% while the US marker has underperformed its peer by roughly 6% at 13.5%.

This performance gap is possibly prompted by the severity of the latest wave of the virus in the United States, with cases surging to their highest level since the pandemic started during the beginning of the month according to virus-tracking website Worldometers.

On 4 December, there were 238,000 contagions in the North American country – the highest one-day tally so far – while deaths have already breached their April all-time high as the country reported more than 3,000 deaths for the first time.

What’s next for oil futures?

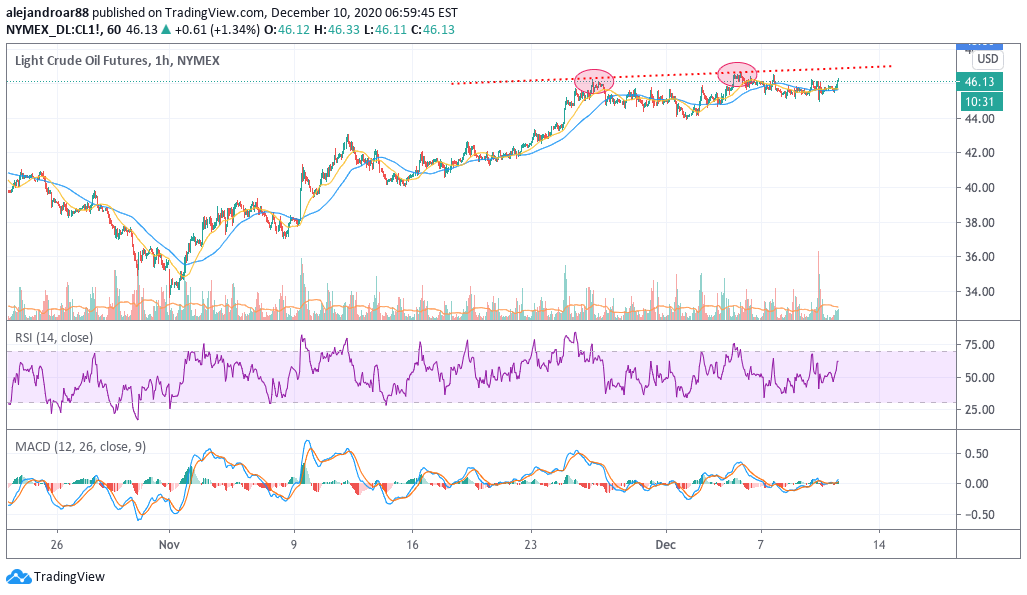

WTI futures seem to be struggling to move above the $46 level as the virus situation in the United States continues to get worst.

A rising number of hospitalizations in the country could end up resulting in stricter lockdown measures across multiple states, which would affect the demand for crude and distillates in short notice, possibly capping or tanking the US benchmark for oil as a result.

The chart above shows how the $44 level served as a temporary support during the 1 December session but the price has already rejected a move above $46 twice – although posting a slightly higher high on 4 December.

The FDA’s decision in regards to Pfizer’s vaccine will probably determine the path that oil will take in the next few sessions as the US agency is expected to meet today to discuss if they will grant emergency-use authorization to the treatment in the country.

If the trend line shown in the chart were to be trespassed amid the news, oil could start a strong bull run over the coming days as traders would look forward to a more pronounced recovery in the demand for crude during the first quarter of 2021.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account