Oil futures are heading for their third red day this morning in early commodity trading action despite a slower than expected inventory buildup in the United States, with analysts citing an upcoming nuclear deal between the US and Iran as a potential negative catalyst for crude prices.

The US Energy Information Administration (EIA) issued its weekly report yesterday where it informed that crude oil inventories increased by 1.321 million barrels – a figure that was almost 300,000 barrels lower than the market’s consensus forecast.

Meanwhile, the inventory of distillates went down 2.324 million barrels compared to 386,000 analysts had estimated for the week ended on 14 May while gasoline stocks reported a 1.963 million drop – far exceeding the market’s consensus by more than 1.1 million.

Although these numbers should have supported a move higher in crude oil futures, the situation is the opposite as of this morning as the two most important benchmarks for oil are dropping for the third consecutive day.

Futures of the West Texas Intermediate (WTI), the US benchmark for crude, are down 1.15% at $62.62 per barrel so far in today’s oil trading session, while Brent futures are sliding 1.4% at $65.76 per barrel.

Interestingly, analysts from Citigroup (C) categorized these downticks as “exaggerated” and recommended investors to consider buying the dip as oil could be set to rebound once the summer season starts and higher fuel demand from the commercial aviation sector kicks in.

A nuclear deal with Iran and the corresponding removal of the sanctions imposed on the Middle East country would increase supply levels in the oil market, a situation that should contribute to depressing oil prices further if such a landmark deal is stroked.

At the moment, the ball is on Iran’s court as the country must show its willingness to return to the Joint Comprehensive Plan of Action (JCPOA) to move forward with the lifting of sanctions. This is the agreement that was proposed by the States to lift sanctions in exchange for multiple commitments from the country including a commitment to stop developing nuclear energy and weapons.

Although government officials believe that there is a fair chance that Iran could re-enter the agreement, others continue to cite significant hurdles including Iran’s reluctance to negotiate directly with the United States while using third parties such as Russian and Chinese interlocutors to communicate its opinions.

“We talk to the Europeans and to the Russians and the Chinese. Then they talk to the Iranians, and then come back to us”, said a senior US Official to Argus Media in regard to the way the negotiations function.

He added: “Things get lost in translation. There is miscommunication, there are misunderstandings. So all of that takes longer. But (those are) the constraints under which the Iranian negotiators are operating”.

In any case, the markets appear to be believing that a deal is within reach and participants seem to be already discounting that fact from the price of crude. Therefore, a setback in the negotiations could send oil higher on short notice and traders should keep an eye on this situation as it appears to be the primary driver behind crude’s latest price action.

Meanwhile, the situation in India continues to keep a lid on the demand for crude, with research firm S&P Global Platts recently slashing its forecast for the country’s demand by almost 28% while anticipating a peak in Brent crude futures at $70 by end of the first semester of 2021.

This target is $10 lower than Goldman Sachs’ forecasts for Brent futures, as the investment bank recently stated that it sees the European benchmark rising to as much as $80 per barrel while Morgan Stanley has predicted a similar level than S&P Global as the American bank sees Brent futures rising to $70 per barrel during the third quarter of the year.

What’s next for oil futures?

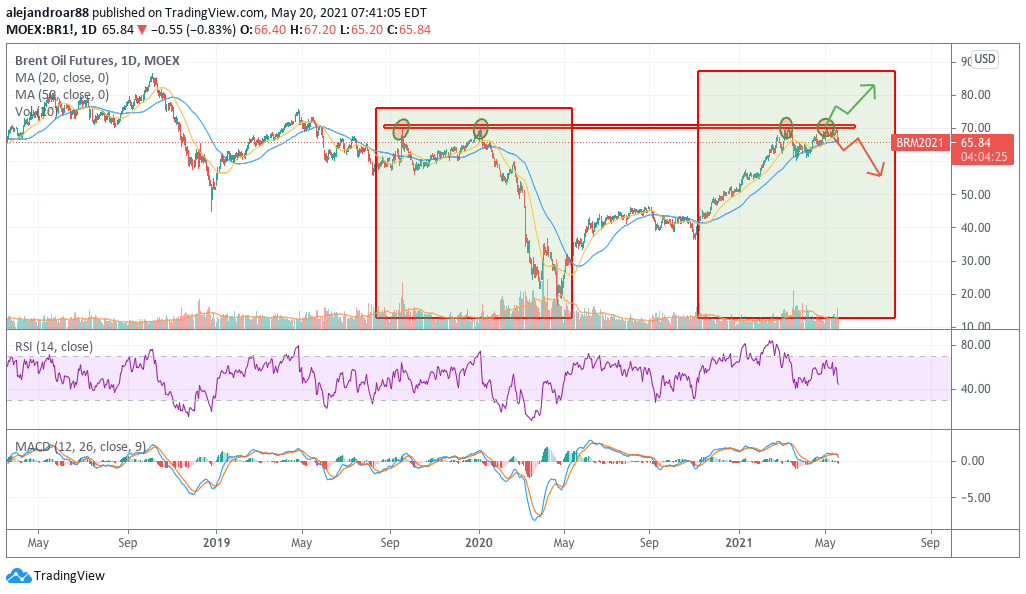

Our scenario for Brent futures remains the same, with the price action apparently indicating that the latest fourth tag to the benchmark’s multi-year resistance highlighted in the chart is resolving to the downside.

If this is the case, Brent futures should continue to drift lower from here, possibly aiming for the low 60s shortly, at least until the market gets a clearer view of what to expect from the negotiations with Iran.

The scenario shown above for crude prices is remarkably similar to that seen before the sharp drop that Brent futures experienced during the COVID-19 crash. However, there are no catalysts present at the moment that could prompt such a move and, therefore, it is highly unlikely that a downturn of that scale can unfold in the next few weeks or months.

That said, a short-term double-top is weighing on Brent’s outlook for now and, for that reason, the outlook remains bearish unless the technical setup changes.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account