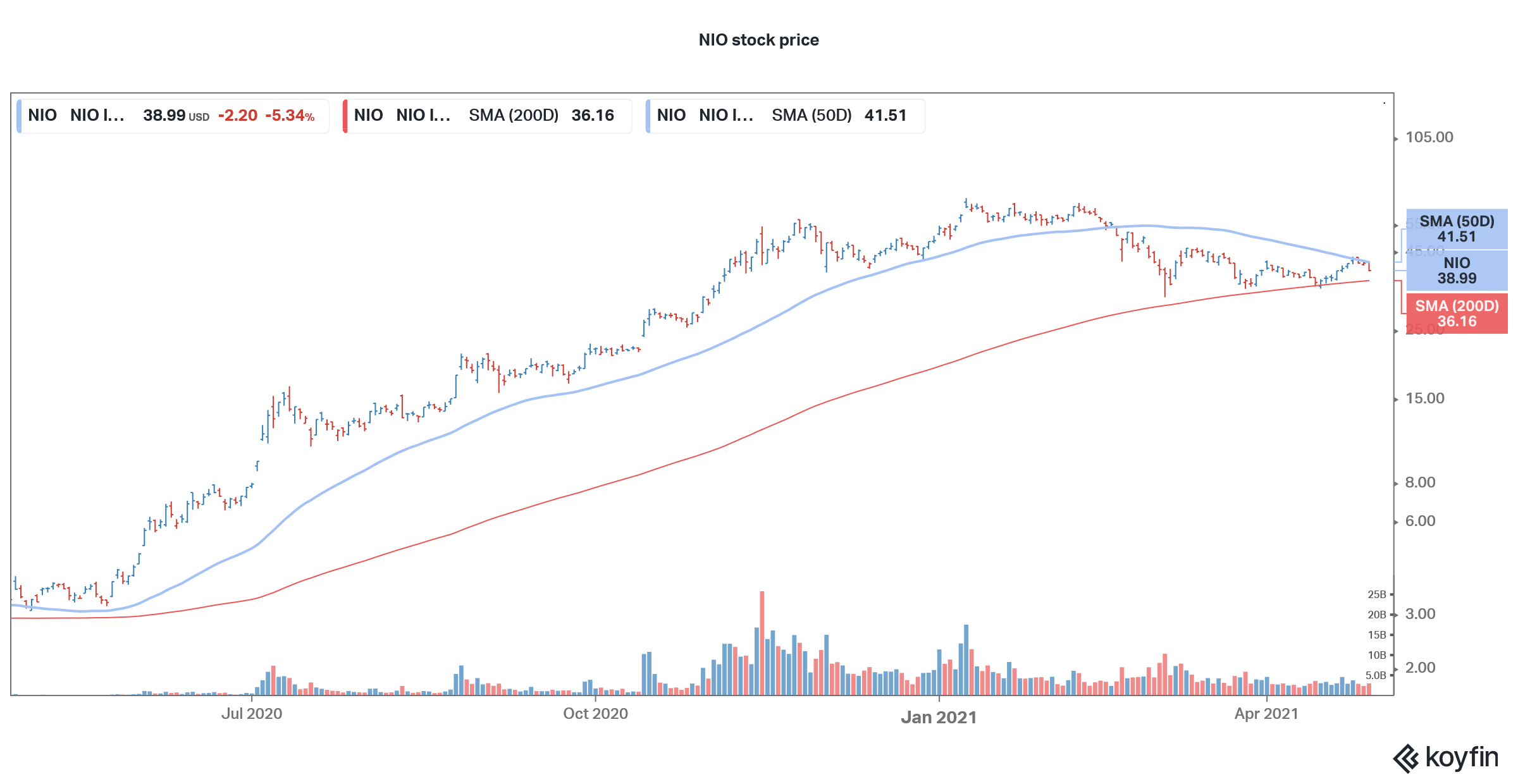

NIO stock was trading flat in US premarket trading after reporting mixed first-quarter results. The company sees tepid production growth in the second quarter due to global chip shortage.

NIO reported revenues of $1.22 billion in the quarter which were higher than the $1.02 billion that analysts were expecting. While the company’s GAAP EPS of $0.48 was below the $0.81 that analysts were expecting, its non-GAAP EPS of -$0.04 was much better than the forecast estimates and was pretty close to breakeven.

NIO first-quarter earnings

Notably, barring Tesla, all other pure-play electric vehicles are making losses. Even for Tesla, the profitability has been coming from the sales of carbon credit. Now, the company seems to have found another way of making profits and booked a gain of over $100 million on bitcoins in the quarter.

NIO has come a long way from early 2020 when there were genuine concerns over its ability to continue as a going concern. The company posted a gross profit for the first time in the second quarter of 2020 and since then it has improved incrementally.

It reported a gross profit margin of 19.5% in the first quarter of 2021 as compared to 17.2% in the fourth quarter of 2021 and -7.4% in the first quarter of 2020. The vehicle gross margin rose 400 basis points quarter over quarter to 21.2%.

NIO gave tepid guidance

Meanwhile, NIO expects to sell between 21,000-22,000 cars in the second quarter of 2021 as compared to 20,060 cars in the first quarter. Notably, NIO had to tone down its delivery guidance for the first quarter as it had to shut the plant for five days due to the chip shortage.

The chip shortage is showing no signs of abating and is expected to get worse given the fire incident at the Naka 3 facility of chipmaker Renesas. Ford also pointed to the chip shortage and expects it to wipe out half of its production in the second quarter after a 17% hit in the first quarter. Ford however expects things to get better in the second half of the year and is forecasting a production loss of about 10% in the back half of the year.

Global chip shortage is hurting automakers

“Now, while we expect the flow of chips from Renesas to be restored in July, we and many in the industry now believe the global shortage may not be fully resolved until 2022,” said Ford’s CFO John Lawler during the earnings call. While NIO did not talk about the chip supplier, it might also be hurting from the fire incident.

Meanwhile, Tesla expects its deliveries to rise more than 50% year-over-year in 2021 and maintain a CAGR of 50% annual growth over the long term. While the company admitted to supply chain issues related to chip shortage, they don’t seem to be hurting its production much, unlike other automakers.

Automakers’ loss is chipmakers gain

According to consulting firm AlixPartners, the global automotive industry would lose $60.6 billion in revenues in 2021 due to the chip shortage. Apart from the automotive industry, while goods, gaming, and smartphone companies are also grappling with the chip shortage.

Meanwhile, the chip shortage has also been a boon for many chip companies. The Auto and power unit of STMicroelectronics NV reported a 280% increase in first-quarter profits.

The chip shortage is expected to persist at least for the new few quarters. “The second quarter is going to be worse for automakers than the first quarter,” said Song Sun-jae, an analyst at Hana Daetoo Securities Co. in Seoul. He added, “The chip-shortage problem could end up lasting longer, maybe into next year.”

Ford expects its pre-tax profits to be almost $2.5 billion lower in 2021 due to the chip shortage. NIO meanwhile gave second-quarter revenue guidance between $1.24-$1.3 billion.

“The overall demand for our products continues to be quite strong, but the supply chain is still facing significant challenges due to the semiconductor shortage,” said William Bin Li, NIO’s founder, and CEO.

NIO generated positive free cash flows

Meanwhile, NIO generated positive free cash flows in the first quarter and ended the quarter with cash and cash equivalents of $7.3 billion. Both Tesla and NIO have raised capital by issuing shares thrice over the last year. Tesla raised $13 billion in 2020 and now has more cash than debt on its balance sheet. The company invested excess cash in bitcoins given the low yields of other instruments.

Like Tesla, NIO is also investing in ramping up its capacity. “Going forward, we will continue to invest in new products and core technologies, as well as in our service and power network expansion, particularly battery swapping and charging facilities,” said Steven Wei Feng, NIO’s CFO.

NIO to enter Norway

Notably, NIO would enter the Norway market now. This would be the Chinese electric vehicle makers’ first foray outside its home market of China. Last year, the company had hinted that it would target the European market, to begin with.

Volkswagen is the biggest electric vehicle seller in Europe after it dislodged Tesla from that position in 2020. Volkswagen wants to become the leader in electric vehicles and autonomous driving by 2025. With Tesla setting up its Gigafactory in Berlin and NIO entering the continent, competition would heat up in the European electric car market also.

Tesla and Ford also reported better than expected earnings

Meanwhile, NIO stock was trading flat today in US premarket trading. Both Tesla and Ford had tumbled despite posting better than expected earnings. In Ford’s case, tepid guidance and the massive impact from chip shortage dampened sentiments. As for Tesla, given its astronomical valuations, markets expect it to deliver much more than an “earnings beat.”

You can invest in electric vehicle stocks like NIO through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account