Chinese EV maker NIO has announced that CYVN Holdings L.L.C., an investment vehicle majority owned by the Abu Dhabi Government would invest $738.5 million in the company by purchasing newly issued shares.

Like fellow startup EV companies, NIO is battling perennial losses and cash burn and needs funds to keep its cash-guzzling operations running.

UAE to invest over $700 million in NIO

NIO would issue 84,695,543 shares to CYVN at a price of $8.72 in a private placement. It also said that CYVN has entered into a share purchase agreement with Tencent – its existing shareholder – to purchase over 40 million shares.

After the two transactions are completed, CYVN would hold around 7% of NIO and would be entitled to put a director on the company’s board as long as the beneficial ownership is over 5%.

It also announced that NIO and CYVN “agreed to cooperate to jointly pursue opportunities in NIO’s international business following the closing of the Investment Transaction.”

Notably, NIO has started selling its cars in Europe and eventually plans to enter the US market which is the world’s second-biggest automotive market after China. However, when it comes to profitability the US is the most profitable market for automakers.

NIO and UAE to partner on international expansion

In his prepared remarks, NIO CEO William Bin Li, said “The strategic investments from CYVN Holdings demonstrate NIO’s unique values in the smart electric vehicle industry. The Investment Transaction will further strengthen our balance sheet to power our continuous endeavours in accelerating business growth, driving technological innovations and building long-term competitiveness,”

He added, “In addition, we are excited about the prospect of partnering with CYVN Holdings to expand our international business. With the vision of Blue Sky Coming, we will continue to strive for technological breakthroughs and user experiences beyond expectations, contributing to a more sustainable future for the globe.”

Saudi Arabia is also investing in EV companies

Notably, oil-rich countries in the Middle East are diversifying into renewable energy and have invested in several green energy and EV ventures. Saudi Arabia is the biggest stockholder of Lucid Motors and has invested another $2.7 billion in the company over the last year.

Lucid Motors is setting up its next plant in Saudi Arabia and the kingdom has placed an order for upto 100,000 cars with Lucid Motors.

Responding to an analyst question on the delivery timeline for these cars, Lucid Motors’ CEO Peter Rawlinson said, during the Q1 2023 earnings call, “We are in active dialogues. We’re in the process of building out the specs for the first vehicles that they want to receive later this year.”

Separately, Saudi Arabia has also formed a joint venture with Foxconn to produce EVs in the country.

Chinese EV companies’ recent performance

Coming back to NIO, the company has disappointed markets with its recent operational and financial performance.

It delivered only 6,658 cars in April and 6,155 cars in May and the Q2 delivery guidance implies June deliveries between 10,187-12,187. The bottom end of the guidance implies an 8.2% YoY fall in June deliveries.

Over the last few months, both NIO and Xpeng Motors have struggled with deliveries while Li Auto has raced ahead and its cumulative deliveries are now way ahead of both these companies.

While the monthly deliveries of NIO and Xpeng Motors are sagging below 10,000, Li Auto’s monthly deliveries have been more than 20,000 for three consecutive months.

NIO posted a steep fall in gross margins

In Q1 2023, NIO reported a gross margin of only 1.5% as compared to 14.6% in the corresponding quarter last year.

In the earnings release, its CFO Steven Wei Feng said, “In the face of the changing market environment, we will observe and analyze the dynamics of the operating environment and competition landscape promptly, and continue to strengthen our competitive advantages in an agile and efficient manner.”

NIO too joined the EV price war

In April, NIO said that it does not want to join the EV price war. However, it has also recently lowered car prices amid sagging sales. The price cut might further dampen its margins and cash flows.

NIO held cash and cash equivalents of $5.5 billion at the end of March and burnt $1.1 billion in the quarter.

EV companies are burning a lot of cash

Startup EV companies are burning a lot of cash towards both operating losses as well as capex. Lucid Motors for instance posted an operating loss of $772 million in Q1 2023 – wider than the $597 million that it posted in the corresponding quarter last year.

It reported a per-share loss of 43 cents – which was much wider than the per-share loss in Q1 2022 – and also higher than what the markets were expecting.

Rivian posted negative free cash flows of $1.8 billion in Q1 2023 – wider than the $1.45 billion in the corresponding quarter last year.

Last month, Lucid Motors raised $3 billion through a stock sale – which was preceded by a $1.5 billion stock sale in Q4 2022 also.

Nikola has also raised cash by selling shares, most recently in April. The company is looking to increase the share count further which would enable it to sell even more shares in the future.

Nikola meanwhile could not get that proposal cleared in the annual meeting earlier this month and has now reconvened the meeting in July.

Lordstown Motors has warned of bankruptcy if Foxconn walks out from the funding deal and is contemplating suing the company to complete the funding deal.

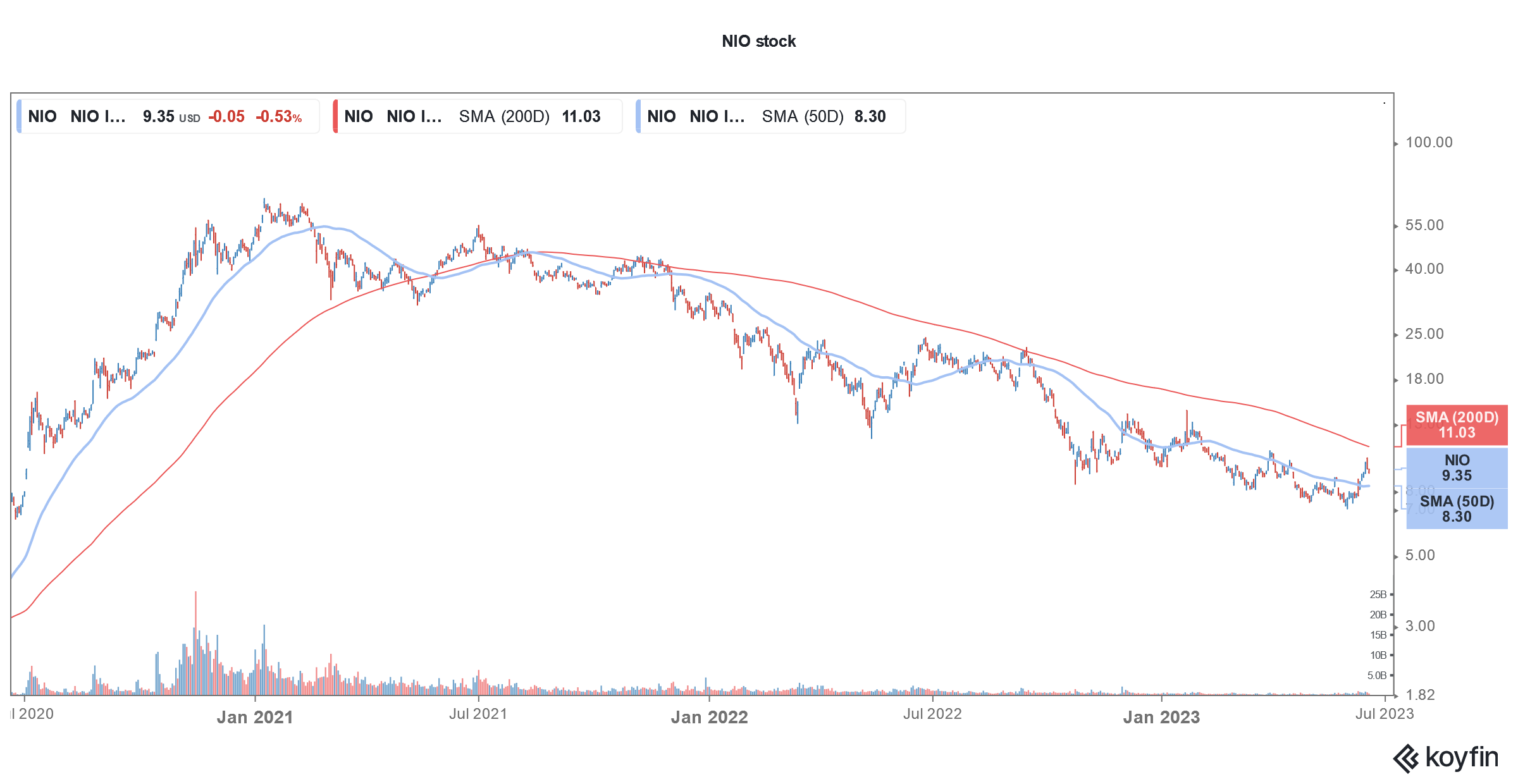

NIO stock has crashed

NIO stock is down 2.9% this year even as Tesla has delivered returns in excess of 150% over the period. The stock has been sliding ever since it peaked in February 2021. The stock, which had soared over 1,100% in 2020 has closed with losses in every year since then.

The UAE investment looks like a win-win proposition for both parties though. While the oil-rich kingdom would get exposure to an EV company, NIO would need the cash to support its operations as well as capex.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account