Zoom Video Communications (NYSE: ZM) stock is trading flat in US premarket price action today after even as the company beat earnings estimates for the first quarter of fiscal year 2024 and also raised its annual guidance.

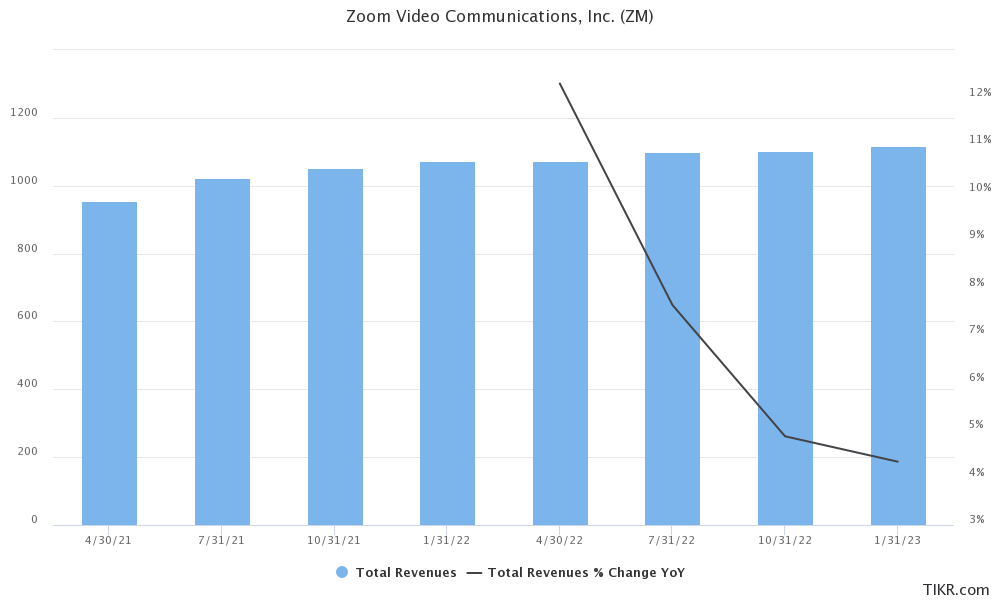

Zoom reported revenues of $1.11 billion in the fiscal fifth quarter that ended in April. The revenues rose 3% YoY on a reported basis and 5% on a currency-adjusted basis. The metric was ahead of the $1.080 billion to $1.085 billion that the company forecast during the fiscal fourth quarter earnings call.

The revenues were also slightly ahead of what analysts were expecting. Its adjusted EPS came in at $1.16 in the quarter – ahead of the 99 cents that analysts were expecting.

Zoom stock rises on earnings beat

Notably, this is the second consecutive quarter when Zoom has posted better-than-expected earnings.

In his prepared remarks, Zoom CEO Eric Yuan said, “Our customers see Zoom as mission-critical in how they collaborate internally and externally across the globe.”

He added, “This relationship with our customers helped us to exceed our guidance due to Enterprise growth and stabilizing Online revenue while driving greater efficiencies in our business to deliver strong profitability and free cash flow margin.”

Key takeaways from ZM’s earnings

Looking at the breakup of Zoom’s fiscal first quarter revenues, the company’s Enterprise revenue soared 13% YoY to $632 million. It had 215,900 enterprise customers at the end of April which is higher than 213,000 customers at the end of January.

Zoom said that at the end of April, it had 3,580 customers who contributed more than $100,000 to its trailing 12-month revenues. The metric increased 23% YoY. It reported a 112% trailing 12-month net dollar expansion rate for Enterprise customers.

Meanwhile, as has been the case for the last many quarters, Zoom’s Online revenues fell 8% to $473.4 million in the quarter. It reported online monthly churn of 3.1% which was 50 basis points lower than the corresponding quarter last year.

Zoom generated positive free cash flows in the quarter

The company generated operating cash flows of $418.5 million and free cash flows of $396.7 million in the quarter. At the end of the quarter, it had total cash and cash equivalents of $5.46 billion. In the past, Zoom said that it would look at opportunistic acquisitions considering its strong balance sheet.

Last month, Zoom acquired Workvivo which is an employee communication and engagement platform

The company recently invested in an AI startup Anthropic and said that it would soon begin integrating its AI assistant Claude into different Zoom products, starting with the contact sector.

During the earnings call, Yuan said, “With Claude guiding agents toward trustworthy resolutions and powering self-service for end-users, companies will be able to take customer relationships to the next level.”

Tech companies across the board are investing to either build or acquire AI capabilities. Yuan took a swipe at companies chasing AI and said while others have “just woken up to AI” Zoom has “been busy AI for a few years.”

Zoom raised annual guidance

Zoom said that it expects to post revenues between $1.110 billion and $1.115 billion in the fiscal second quarter of 2024. It said that the Online segment’s revenues would be around $480 million and would “stabilize” at that level over the course of the fiscal year.

For the full year, Zoom forecasted revenues between $4.47 billion to $4.49 billion, which is higher than the previous guidance of $4.435 billion to $4.455 billion.

It also raised its full-year adjusted EPS guidance from $4.11 and $4.18 to $4.25 and $4.31.

Notably, as topline growth has sagged, tech companies are looking to cut costs. There have been widespread job losses in the US tech industry even as the overall job market is still quite tight.

ZM is lowering its cost base

Earlier this year, Zoom announced 1,300 layoffs which were 15% of its workforce. In a blog post, Zoom CEO Eric Yuan said that as growth spiked during the pandemic, Zoom increased its workforce by 3 times in a span of 24 months.

However, it admitted to over hiring and trimmed its workforce to better align with the current economic realities.

However, during the earnings call, Zoom CFO Kelly Steckelberg admitted that the sales team witnessed “some distraction” due to a lower headcount.

Meanwhile, ZM stock is up trading in the premarket today even as it was up ovr 1% in post markets yesterday.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account