Zoom Video Communications (NYSE: ZM) stock is trading higher in US premarket price action today after it reported better-than-expected earnings for its fiscal fourth quarter of 2023 and also provided upbeat guidance.

Zoom reported revenues of $1.12 billion in the fiscal fourth quarter that ended in January. The revenues rose 4% YoY on a reported basis and 6% on a currency-adjusted basis. The metric was ahead of the $1.095 billion to $1.105 billion that the company forecast during the fiscal third quarter earnings call. Wall Street analysts were expecting Zoom to report revenues of $1.10 billion in the quarter.

In the full year, Zoom reported revenues of $4.39 billion—a YoY rise of 7%. It is the slowest pace of growth for the company since it went public in 2019.

Zoom posted better-than-expected earnings

Zoom reported an adjusted EPS of $1.22 which surpassed analysts’ estimate of 81 cents. The company forecast fiscal fourth-quarter EPS between 75-78 cents. However, on a GAAP basis, the company lost $104 million in the quarter on account of stock-based compensation

The company generated operating cash flows of $1.29 billion in the fiscal year and ended with total cash and cash equivalents of $5.41 billion. In the past, Zoom said that it would look at opportunistic acquisitions considering its strong balance sheet.

The company reiterated similar views during the fiscal fourth quarter earnings call. Zoom CEO Kelly Steckelberg said that the company looks at three criteria for acquisitions which are technology, culture, and valuations. She added that acquisitions are part of the company’s strategy for the current fiscal year.

Key takeaways from ZM’s fiscal fourth quarter earnings

Looking at the breakup of Zoom’s fiscal fourth quarter revenues, the company’s Enterprise revenue soared 18% YoY to $636.1 million. It had 213,000 enterprise customers at the end of January which is higher than 209,300 customers at the end of October.

Zoom said that at the end of October, it had 3,471 customers who contributed more than $100,000 to its trailing 12-month revenues. The metric increased 27% YoY. It reported a 115% trailing 12-month net dollar expansion rate for Enterprise customers.

Zoom provided guidance

Zoom said that it expects to post revenues between $1.080 billion to $1.085 billion in the fiscal first quarter of 2024 which is below the $1.11 billion that analysts were expecting. However, the company’s adjusted EPS guidance of 98 cents was higher than the 84 cents that analysts were expecting.

For the full year, Zoom forecasted revenues between $4.435 billion to $4.455 billion. The metric trailed analysts’ estimate of $4.6 billion. Even the top end of the guidance implies a YoY revenue growth of 1.4% which would mean that the company’s growth rates continue to taper down.

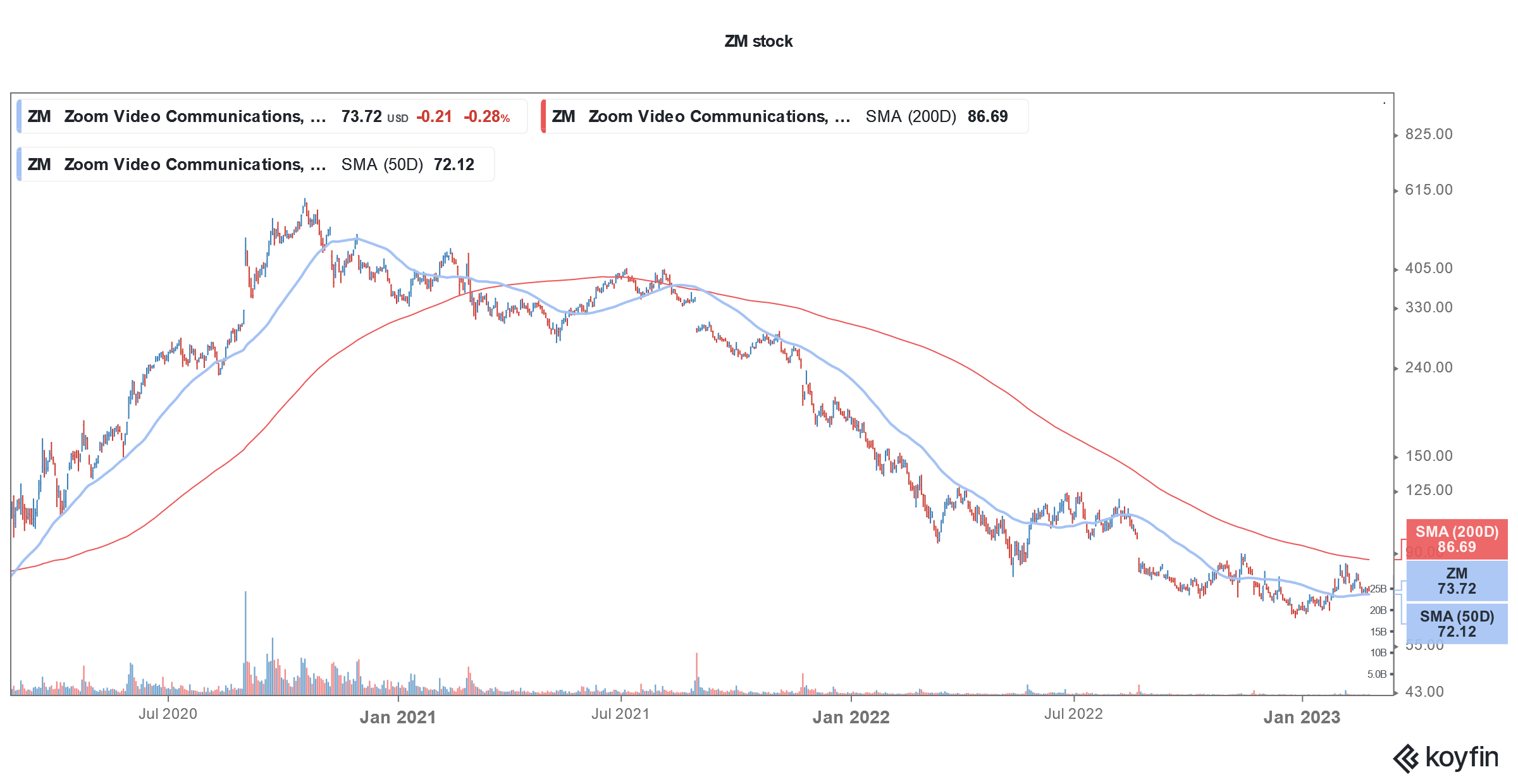

Notably, during the lockdowns, the so-called “stay-at-home” companies like Zoom saw a spike in revenues. Fast forward to 2023 and far from reporting triple-digit revenue growth, Zoom is struggling to post even low single-digit revenue growth.

Zoom is looking to control costs

Meanwhile, while Zoom’s revenue guidance was subpar, it forecast upbeat profits. It expects to post an adjusted EPS between $4.11 and $4.18 which is ahead of the $3.66 that analysts were expecting.

Notably, as topline growth has sagged, tech companies are looking to cut costs. There have been widespread job losses in the US tech industry even as the overall job market is still quite tight.

ZM announced layoffs

Earlier this month, Zoom announced 1,300 layoffs which were 15% of its workforce. In a blog post, Zoom CEO Eric Yuan said that as growth spiked during the pandemic, Zoom increased its workforce by 3 times in a span of 24 months and said that the company “needed to staff up rapidly to support the quick rise of users on our platform and their evolving needs.”

He added, “But we also made mistakes. We didn’t take as much time as we should have to thoroughly analyze our teams or assess if we were growing sustainably, toward the highest priorities.”

Going through the layoff announcements from tech companies, one would find that the tone is almost similar. These companies overhired during the pandemic on the assumption that revenues would continue to grow at a fast pace.

Eric Yuan on strategic priorities

Zoom CEO Eric Yuan termed the fiscal year 2023 as “challenging.” He added, “We experienced headwinds in terms of currency impact, online contraction and deal scrutiny, which continued into Q4.”

He also listed the company’s priorities for the current fiscal year and beyond. Yuan said, “First, we’ll help redefine teamwork through offering new immersive experiences that improved employee engagement and modern collaboration tools for ideation across locations and modalities.”

Secondly, he talked about layering more AI into the company’s products. AI incidentally is the buzzword among tech companies and companies ranging from Alphabet, Baidu, Alibaba, and Microsoft see it as the next key growth driver.

Thirdly, he talked about tailored solutions for customers. Yuan said, “You can expect additional industry-specific and department-specific applications developed both by us and our third-party partners. All of this comes together as a collaboration platform that unites people to unlock their potential, enables more dynamic and intelligent experiences and allows us to reimagine productivity and work.”

Zoom stock is trading higher today

Zoom stock is trading higher today as markets seem impressed with the company’s earnings beat and profitability guidance. While its revenue guidance was below what the markets were expecting, the strong profit guidance more than offset that.

Cathie Wood of ARK Invest doubled down on ZM stock amid the crash and it is the second-largest holding for her flagship ARK Innovation ETF (NYSE: ARKK) accounting for 8.5% of the portfolio.

It briefly became the largest holding but Tesla is now the leading holding after the steep rise in Tesla’s stock price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account