The US unit of Germany’s fallen digital payments giant Wirecard has put itself up for sale, saying it continues to operate normally.

“Wirecard North America continues to operate without any disruption to clients and cardholders. The strong, independent cash flow and financial position of Wirecard North America allow us to operate the business on a completely standalone basis” said Seth Brennan, the managing director of Wirecard North America in a statement released yesterday.

The unit added that it operates separately from its insolvent parent company in Germany and is a well-capitalized and self-sustaining entity with its own client base in the United States and Canada.

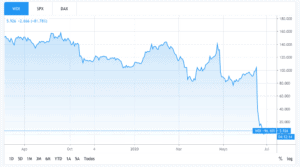

This is the latest move from Wirecard (WDI) to emerge from the crisis, after the firm was swept into one of the worst accounting scandals of the year, along with that of Lucking Coffee, since auditors found inconsistencies in the firm’s records that led to reveal €1.9bn in lost cash.

Since then the company has declared itself insolvent and its former chief executive, Markus Braun, has been arrested – and then released on bail – as a result of the findings. Shares have lost nearly 95% of their value, trading at around €5.9 per share on Tuesday.

Wirecard’s board of directors has appointed James Freis as the new interim chief executive to try salvage the situation, and this latest move to sell the business’ North American unit could be his strategy to strengthen the company’s liquidity, as creditors threatened to call in around €1.3bn ($1.5bn) of loans, which would collapse the firm.

Wirecard North America, formerly the Citi Prepaid Card Services business, was bought by Wirecard in 2016, a deal that helped the firm in setting its foothold in the massive US digital payments market, led by big companies like PayPal and Square.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account