Home Depot released its second-quarter earnings today. The stock was trading lower despite the earnings beat

This week, several retail giants in the US are scheduled to release their earnings. Along with Home Depot, Walmart also reported its earnings today. Lowe’s, Bath & Body Works, Target, Kohl’s, and Macy’s have also scheduled their quarterly earnings for this week.

We also got the all-important July retail sales data today which showed that retail sales in the month fell 1.1% which was worse than the 0.3% decline that analysts were expecting. The data for June was revised upwards to show a sales increase of 0.7%, 10 basis points higher than the previous reading. Over the last couple of months, the final data has shown retail sales faring better than the initial reading.

Home Depot earnings

Home Depot posted revenues of $41.12 billion which was higher than the $40.79 billion that analysts were expecting. The company’s EPS came in at $4.53 which was ahead of the $4.44 that analysts were expecting. Meanwhile, despite the earnings beat, Home Depot stock was trading sharply lower in early price action today. The anomaly can be attributed to several factors. Firstly, the soft July sales data seems to be weighing on retail stocks today. Also, looking beyond the headline numbers, Home Depot reported US same-store sales growth of 3.4% in the quarter which was below what analysts were expecting.

The consumer transactions fell 5.8% in the quarter. The 11.3% increase in average consumer transaction helped propel the revenues. However, the higher transactions are coming mainly due to inflation. Higher lumber prices have led to a spike in several home improvement products. Meanwhile, Home Depot’s quarterly revenues surged to a new record and topped $40 billion for the first time in history.

Guidance

Another factor weighing down Home Depot stock could be the fact that the company did not provide a 2021 guidance. It cited uncertainty due to the COVID-19 pandemic for not providing guidance. Several companies have stopped providing forward guidance given the uncertain economic environment. Meanwhile, the company sounded upbeat on the recent performance. “Customer engagement and demand for home improvement is healthy,” said Home Depot CFO Richard McPhail. He added, “Housing remains strong, and we see a supportive environment for home improvement spending as we look out over the next several years.”

Analysts on Home Depot earnings

“Home improvement was a big Covid winner, and Home Depot performed masterfully through the crisis,” said Oppenheimer Senior Analyst Brian Nagel. He added “But I’ve got to believe that as the economy opens up, as people start to move around again, there’s going to be less of a focus on spending on the home. And that’s what we’re seeing in these numbers now.”

Meanwhile, Lowe’s stock is also sharply lower today. The company is set to report its earnings tomorrow. Analysts expect the company’s sales to fall 2% in the quarter. Its sales are expected to fall around 5% in the next two quarters also. That said, the fall in sales is coming from a high base as the company’s sales had risen sharply last year as consumers spent more on home improvement amid the lockdowns.

Stock forecast

According to the data from CNN Business, Home Depot has a median target price of $350 which is a premium of 9.5% over current prices. The highest and lowest target price for the stock is $391 and $300 respectively. Of the 34 analysts over the stock, 23 have rated it as a buy while ten have given it a hold rating. One analyst has a sell rating on the stock.

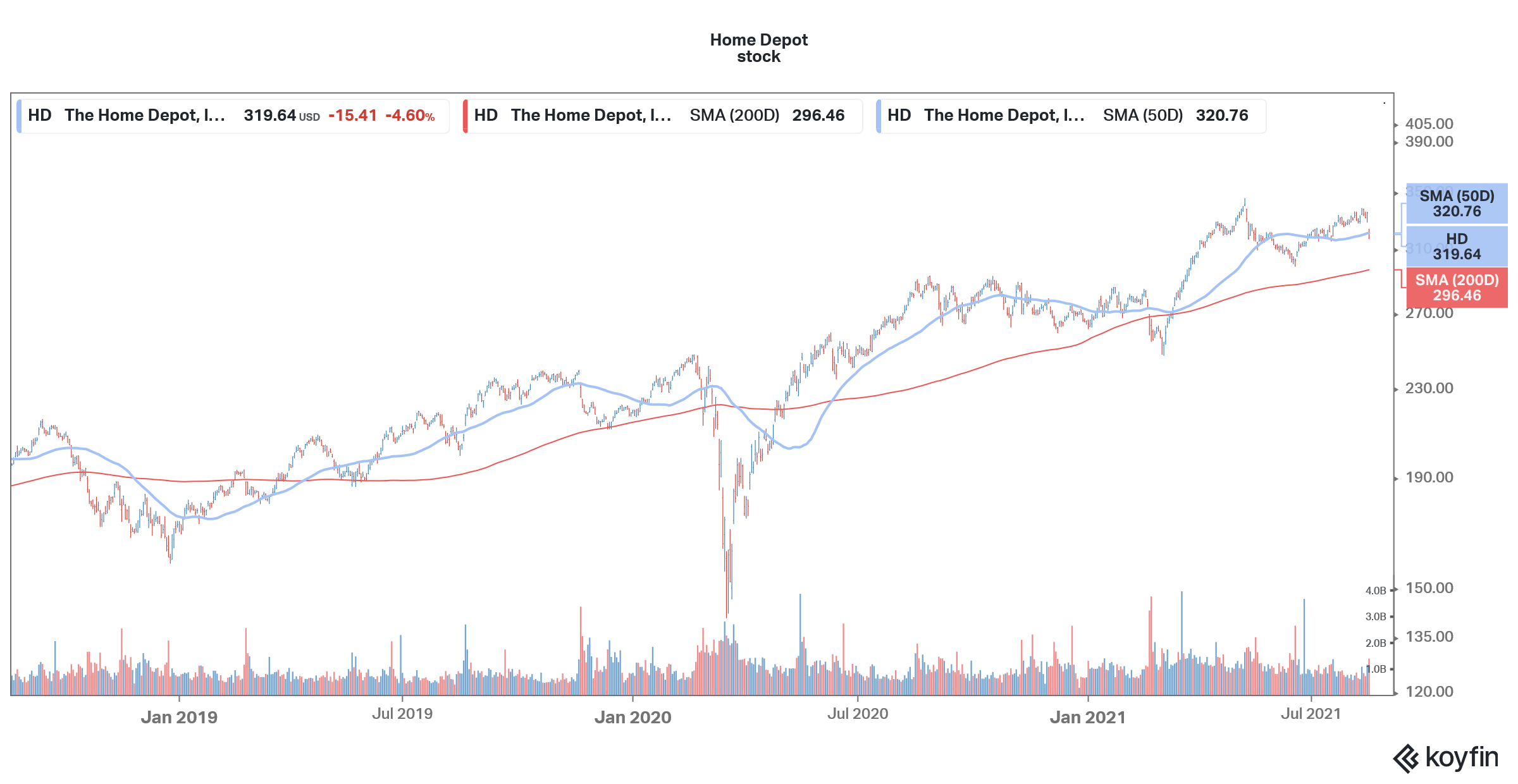

Home Depot stock was trading 4.7% lower at $319.22 at 11:30 AM ET today. The stock has a 52-week trading range of $246.59-$345.69.

How to buy Home Depot stock

You can buy Home Depot stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

An alternative approach to investing in retail companies could be to invest in ETFs that invest in retail stocks.

Through a retail ETF, you can diversify your risks across many companies instead of just investing in a few companies. While this may mean that you might miss out on “home runs” you would also not end up owning the worst-performing stocks in your portfolio.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account