The merger between former President Donald Trump’s TMTG (Trump Media & Technology Group) and Digital World Acquisition Corp. (NYSE: DWAC) looks in trouble as PIPE (private investment in public equity) investors seek a better deal.

This is the latest headwinds for the DWAC-TMTG merger as the SPAC (special purpose acquisition company) has been delaying stockholder vote for merger extension. Now, as the deadline for the PIPE investment expired, investors are reportedly looking at a better deal.

SPAC bubble has burst

2020 was a pivotal year for SPACs as the total number of SPAC IPOs surpassed that of the previous ten years combined. The SPAC mania continued in 2021 even as there were visible signs of a bubble.

However, the SPAC bubble was now fully burst and no wonder the PIPE investors in the DWAC-TMTG merger are seeking better terms. Notably, unlike the usual norm where PIPE investors are revealed while announcing the merger, in DWAC’s case, the $1 billion PIPE investment was revealed after the initial merger announcement.

Under the original terms, PIPE investors got preferred shares with a conversion price of $33.60 if DWAC stock traded above $56. In case DWAC stock was to fall below $56, the conversion price was to come down proportionately, with a floor at $10 which is the SPAC IPO price.

DWAC PIPE transaction is in trouble

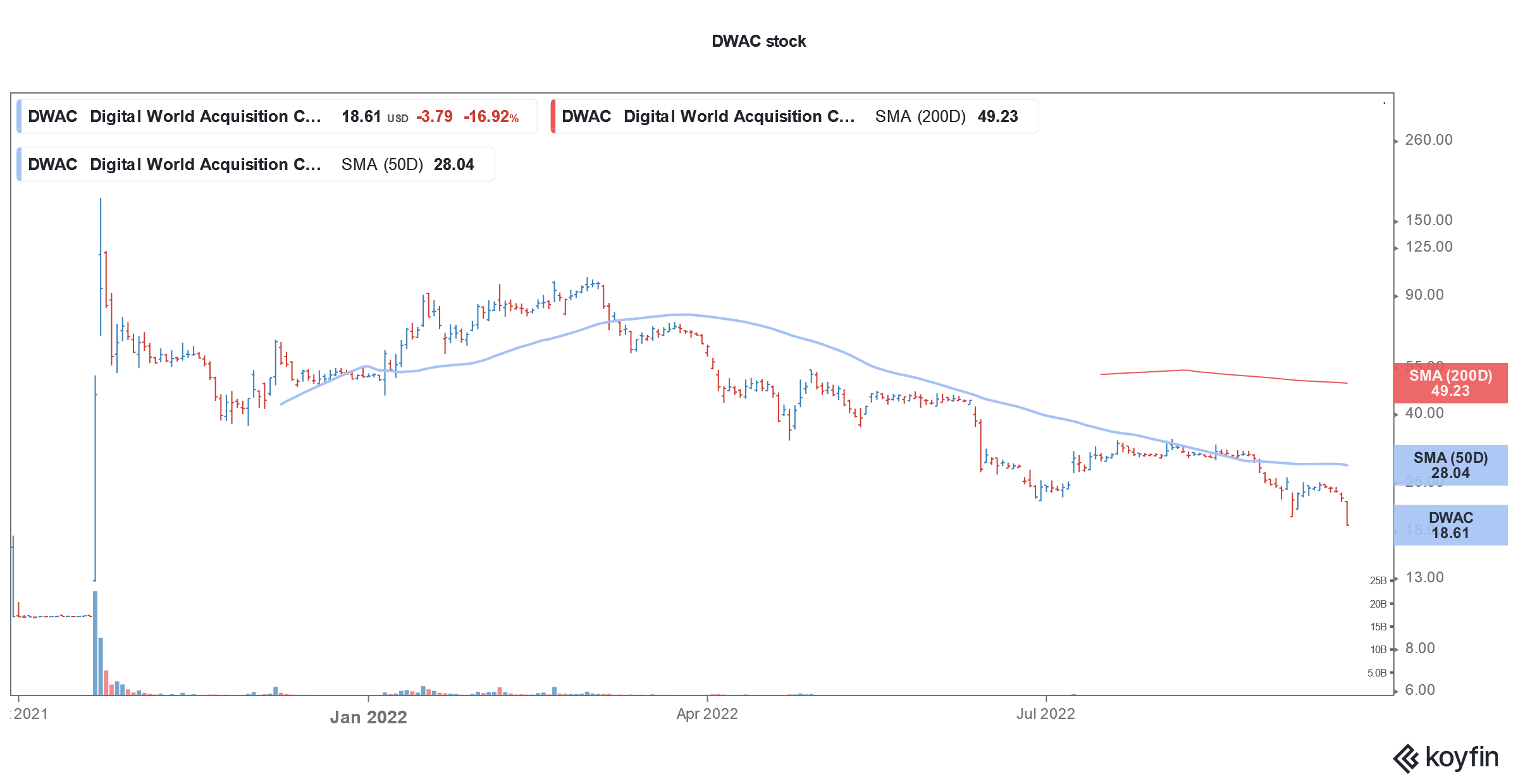

DWAC stock soared amid optimism over its merger and almost hit $100 price level. Not many SPACs have risen to such price levels ahead of the merger. While there have been multiple instances of short squeeze rallies after the merger voting, none of the SPAC surged 10x after the merger announcement.

Churchill Capital, the SPAC that took Lucid Motors public, went as high as $65 on rumors of its merger. However, the stock plunged after the merger announcement. Once touted as a “Tesla killer,” Lucid Motors is struggling with production.

Coming back to DWAC, PIPE investors now reportedly want the conversion price to be slashed to as low as $2.

This would mean a much bigger dilution for Trump’s TMTG, something which the former President reportedly wants to avoid. Citing a person who is involved in the transaction, the Financial Times reported “Trump wants to make sure he doesn’t face a lot of dilution.” They added, “Optically, he wants to avoid a $2 floor. It looks weak and he doesn’t want to look weak.”

DWAC extension vote has been delayed

DWAC has also delayed the voting on the extension. Notably, most of DWAC’s stockholders are retail investors, many of whom happen to be Trump’s fans. However, retail investors usually do not participate in corporate voting which has been a headache for DWAC as it seeks their approval to extend the SPACs life.

If the extension voting wasn’t enough, the troubles related to PIPE investors are another headwind for the DWAC-TMTG merger. Notably, the SEC and other federal agencies are also studying the merger.

While multiple SPACs were struggling to find merger targets, DWAC announced a merger with TMTG shortly after its IPO. This raised eyebrows and many allege that the SPAC had decided on the merger target even before the IPO, a practice that is barred by law.

Regulators have sought more information from DWAC related to the merger. SPAC sponsors have a fiduciary responsibility towards stockholders.

Why did SPACs get so popular?

There are multiple reasons why SPACs became so popular in 2020. Firstly, the SPAC merger is a good way to go public for little-known companies that otherwise would not get much traction in a traditional IPO. SPAC investors rely on sponsors to identify these “hidden gems.” Indeed, some of the SPACs identified good merger targets at an attractive valuation.

Secondly, they are a much easier way to raise capital unlike traditional IPOs, and also are less time-consuming. The costs for a SPAC are much lower than IPOs where underwriters get a fat fee. It’s a lucrative business for SPAC sponsors also who make a killing by getting shares at nominal prices.

Finally, the regulatory environment is very lax for SPACs as compared to traditional IPOs. In a SPAC merger, the companies can provide forward projections which are not allowed in an IPO. In DWAC’s case, TMTG presented a rosy picture of the business and pitched itself as a worthy competitor to Twitter, Netflix, as well as Amazon.

DWAC is trying to capitalize on Trump’s popularity

However, it was only trying to capitalize on Trump’s popularity. So far, Truth Social’s growth has failed to excite. Trump himself has around 4 million followers on the platform which is less than 5% of the 89 million Twitter followers he had before his account was suspended.

The platform has faced teething troubles and was also blocked by Android. TMTG hired former Congressman David Nunes as the CEO but he has no experience in any of the businesses that TMTG is present into.

Chamath Palihapitiya has dissolved two SPACs

Just when DWAC is facing troubles from its PIPE investors, Chamath Palihapitiya, also known as the “king of SPACs” has dissolved two of his SPACs. Previously, Bill Ackman also dissolved his SPAC after the billionaire fund manager failed to identify a merger target.

Meanwhile, DWAC stockholders might not want a dissolution of the SPAC as despite the recent crash it is trading above $18. If the SPAC indeed gets dissolved, investors would get only $10 plus any accrued interest in the SPAC trust account.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account