Gold’s fortunes have nosedived this year after their hit their record high in 2020. As the economy has rebounded, investors have pivoted from safe-haven assets to risk assets. What should you expect from precious metals like gold now?

Gold prices are down almost 8% in 2021. The fall in gold prices has also hit mining stocks. As a safe-haven asset, the precious metal tends to do well in periods of economic turmoil like we had last year. However, positive progress on COVID-19 vaccines triggered a sell-off in prices and it hasn’t been able to recover since then.

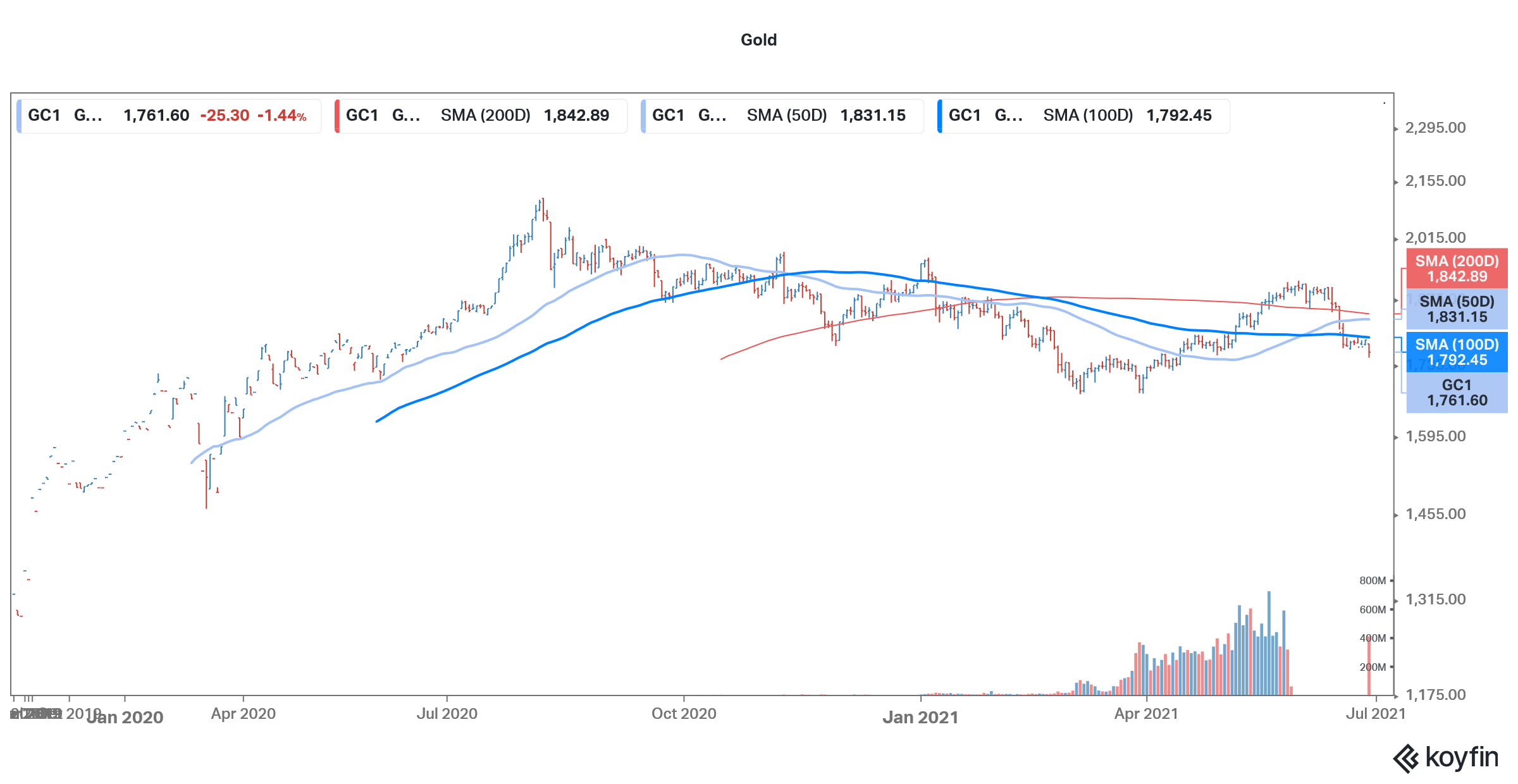

Gold prices

Looking at the current macro factors, gold is getting pulled in both directions. We have high inflation, geopolitical tensions, a rise in new coronavirus cases in several regions including the US where Delta variant cases have been going up. However, expectations of a sooner than expected rate hike and lightning by the US Federal Reserve are weighing down prices.

As a non-interest-bearing asset, gold tends to do well when we are in a low interest environment. The precious metal’s investment appeal fades when rates rise as investors pivot towards debt assets to chase higher yields.

Mining stocks

So far, the bearish narrative has been playing out well especially given the continued momentum in the global economy. However, many experts see better days ahead for gold. Hedge fund manager David Neuhauser sees the fall in the precious metal as a buying opportunity and advises to invest in small miners. It is worth noting that miners are a leveraged play on the underlying commodity and they generally rise or fall more than the movement in commodity prices.

Neuhauser sees the potential for stagflation which is basically a period of low economic growth coupled with high inflation. “I think even on a pullback in economic data and economic activity, you’re gonna see those prices remain pretty robust, and … at least my view is that we have a real potential stagflation in future years,” said Neuhauser.

He finds gold miners attractive as the fall in the US dollar would help them increase their free cash flows. Since mining companies have most of their costs priced in domestic currencies, a weaker dollar helps them lower their unit cash costs.

Palantir is buying gold

Last week, data analytics company Palantir made headlines when it revealed that it has bought gold bars worth $50 million. The amount is not much to move the needle for prices. However, the fact that it is coming from a company like Palantir makes it newsworthy. The company sees the precious metal as a hedge against a “black swan” event.

“Given what the company does and its huge ability to analyze big data and recognize trends, I think they’re onto something,” said Leigh Goehring, managing partner at Goehring & Rozencwajg. He also sees Palantir buying gold as a warning for investors.

Tesla bought bitcoin

Meanwhile, there is another angle to Palantir buying gold. The company is flush with cash and has been investing in several SPACs. Since the yields on other assets are too low, it found gold attractive. Incidentally, earlier this year Tesla also invested $1.5 billion in bitcoins. The digital currency soared on the news and eventually went on to hit its all-time highs. However, bitcoin prices tumbled thereafter. While prices have since recovered their still trade way below their 2021 highs.

Commenting on Palantir’s gold purchase, Jim Paulsen, chief investment strategist at Leuthold Group said, “We wouldn’t normally see companies buying a lot of gold, but in a world of zero interest rates, with a monetary authority that has abused and overused their policy and with current runaway inflation, you even got them taking those bold steps.”

Gold price outlook

Coming back to gold, the outlook for the precious metal looks positive. Experts advise investing a part of your portfolio towards gold, even as the allocation could vary based on an investor’s risk-return appetite.

Jim Rogers is among those who are bullish on gold. “Both gold and silver are going to go through the roof. History shows that whenever people lose confidence in governments and money, all of us peasants buy gold and silver. Peasants like me have some gold in the closet. We like to have some silver under the bed,” he said earlier this year.

On the other side of the spectrum, we have people like Warren Buffett who see the precious metal as a dead asset. That said, Berkshire Hathaway bought a stake in Barrick Gold last year which it quickly sold. The stake though might have been bought by a different asset manager given Buffett’s pessimistic views on the precious metal.

Technical analysis

Looking at the charts, gold prices are facing strong resistance at the 100-day SMA (simple moving average). They also trade below the 50-day and 200-day SMA. The 14-day RSI (relative strength index) of 47 is a neutral indicator though.

All said, given the current turmoil, it could make sense to allocate a portion of your portfolio towards the precious metal.

How to buy gold

You can buy gold either in physical form or in digital form. You can buy the yellow metal through any of the reputed brokers for precious metals. Alternatively, you can also trade in precious metals through CFD (Contract for difference). We’ve compiled a list of some of the best CFD brokers.

If you are looking at a long-term allocation, you can also invest in ETFs. By investing in an ETF, you get returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs. You can also choose from ETFs that invest in gold mining companies.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account