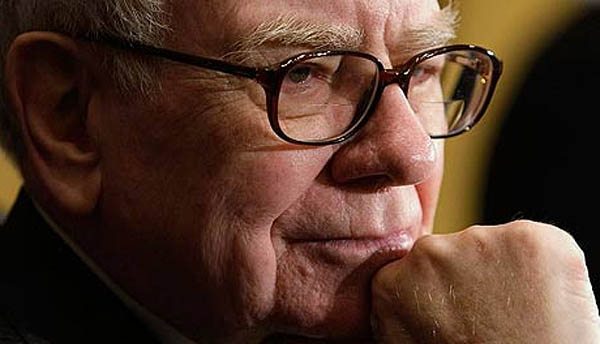

Warren Buffet, one of the richest men in the entire world, just put more money in the stock of his favorite bank, the Bank of America. Berkshire Hathaway Inc., his investment firm, now has $29 billion in the company.

A Long Time Coming

According to MarketWatch, Buffet’s firm, of which he is both the CEO and Chairman, revealed this information via a Form 3 filing with the Securities and Exchange Commission on Thursday. There, we learned that he takes up close to 950.0 million shares within the Bank. That’s more than 10% of the total shares. Beforehand, the space held 896.2 million or close to 9.4% of shares.

Berkshire Hathaway was already the leading shareholder here, but now it’s the highest by a significant amount more. In second is the Vanguard Group, which holds 6.4%, and third is SSgA Funds Management Inc., which has 4.1%.

Thanks to Buffet’s investment, the Bank of America’s stock went up 1.7% this Friday afternoon. This would be a ten-month closing high for them. With that surge, the $29 billion investment would now by $29.32. Interestingly, Berkshire Hathaway’s second-largest investment is 409.8 million shares in Wells Fargo. This is around $20.14 billion as of this writing.

The SEC filing reads:

“The beneficial ownership of the shares of common stock reported herein exceeds 10% as a result of the issuer’s repurchases of its own securities, based on the issuer’s most recently announced number of shares of common stock outstanding.”

This massive investment in the company didn’t come quickly, either. According to the publication, Buffet started by taking advantage of warrants that were provided to him back in August of 2011. At that time, the man put $5 billion into a stock that gave him a 6% annual dividend. This was during a time where the Bank was still recovering from the economical crisis from back in 2008.

Overall, the share price for Bank of America has gone up around 1.7% over the past couple of months.

Click here to learn more about stock brokers and stock trading.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account