Media giant ViacomCBS will report its second-quarter earnings on Thursday and analysts will have a close eye on how far cord-cutting is affecting the business.

Viewers around the world flock to streaming services such as Netflix (NFLX) and Amazon (AMZN) Prime. This has left ViacomCBS, which owns Paramount Pictures, and other established production studios struggling to compete for original content as revenues slide.

Also, advertising sales may have also taken a hit during this quarter as the coronavirus pandemic has forced media buyers to slash their marketing budgets to save money. However, the firm’s streaming services – such as CBS All Access and Comedy Central – which makes Chappelle’s Show starring Dave Chappelle (pictured) – may provide a cushion.

Analysts expect to see revenues coming in at $6bn, up 58.6% from the $3.8bn the company reported a year ago. However, much of this growth comes from the merger of Viacom and CBS in late 2019.

Meanwhile, earnings are expected to land at $0.90 per share for the second quarter, which is $0.28 less than the $1.18 per share the company earned the previous year.

How has the stock performed?

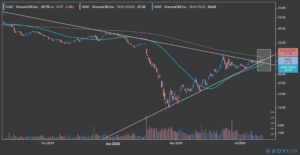

ViacomCBS shares have been consolidating around the $24 – $26 level in the past few days in anticipation of these quarterly results.

With the stock trading in the middle of its 50-day and 200-day moving average at $25.70 per share, it is plausible to think that favorable results could push it above the 200-day moving average while a poor performance could push it down to its short-term moving average.

The extent to which cord-cutting has affected both the top and bottom-line of the firm and the impact of lower advertising revenues along with the tone of the guidance provided by the management team will determine the path the stock takes.

How to trade ViacomCBS after it posts earnings?

Traders should keep an eye on how the stock behaves once the quarterly results are posted as a move below that trend line (above) could end up triggering a sizable correction.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account