The US Fed released its minutes for the January meeting yesterday. Here are the key takeaways from the minutes.

At the meeting, which began on January 31 and concluded on February 1, the Fed raised rates by 25 basis points. It was the slowest pace of rise since March 2022 when the US central bank embarked on its rate hikes.

It raised rates by 50 basis points in December which was preceded by four rate hikes of 75 basis points. After the rate hike at the most recent meeting, which is the first for the year, the Fed funds rate stands at 4.50-4.75%, which is the highest since October 2007.

Fed minutes show more rate hikes ahead

The summary of the Fed’s meeting said that the participants agreed that “while there were recent signs that the cumulative effect of the Committee’s tightening of the stance of monetary policy had begun to moderate inflationary pressures, inflation remained well above the Committee’s longer-run goal of 2 percent and the labor market remained very tight, contributing to continuing upward pressures on wages and prices.”

Here it is worth noting that the meeting took place before the January nonfarm payroll data was released which showed that the US economy added 517,000 new jobs in the month which further pulled down the unemployment rate to a new multi-decade low of 3.4%.

US January jobs report was quite strong

Speaking at an event in Washington earlier this month, Powell said, that the jobs report was “certainly strong—stronger than anyone I know expected.”

He also said that a strong job market and wage growth make the job of lowering inflation tougher.

In the past also, Powell has expressed concern over strong wage growth and a tight labor market. Many, meanwhile don’t agree with his assessment and say that wage growth has lagged behind inflation.

Coming back to the Fed minutes, the summary said, “Against this backdrop, and in consideration of the lags with which monetary policy affects economic activity and inflation, almost all participants agreed that it was appropriate to raise the target range for the federal funds rate 25 basis points at this meeting.”

It, however, added that some participants favored a 50-basis point rate hike at the meeting. Meanwhile, all the participants agreed that the Fed should continue to reduce the size of its balance sheet.

Fed Sees More Rate Hikes Ahead

The summary stated that “Members anticipated that ongoing increases in the target range would be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

On multiple occasions, the Fed has reaffirmed its resolve to lower inflation towards the targeted range even if it means sacrificing some growth.

The minutes added, “Members concurred that, in determining the extent of future increases in the target range, they would take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

US economic data

Some of the recent economic data has meanwhile been quite strong. While the jobs report shattered estimates, January CPI and wholesale inflation came in higher than expected. US retail sales also rose 3.1% in January. The strong economic data and sticky inflation show that the Fed has a long way ahead in reducing inflation to 2%.

Notably, Wharton Professor Jeremy Siegel who had previously said that the Fed should stop its rate hikes now believes that even a 50-basis point rate hike is on the table.

Powell talked about “disinflation”

After the Fed meeting, Powell talked about “disinflation” for the first time since the US central bank began its tightening cycle. Powell acknowledged, “We can now say I think for the first time that the disinflationary process has started.”

He meanwhile added that it is “very premature to declare victory or to think we really got this.” In the past also he has cautioned against premature pivot. At the press conference after the meeting, Powell yet against dashed pivot hopes and said, “Given our outlook, I don’t see us cutting rates this year, if our outlook comes true.”

Fed might raise rates further amid sticky inflation

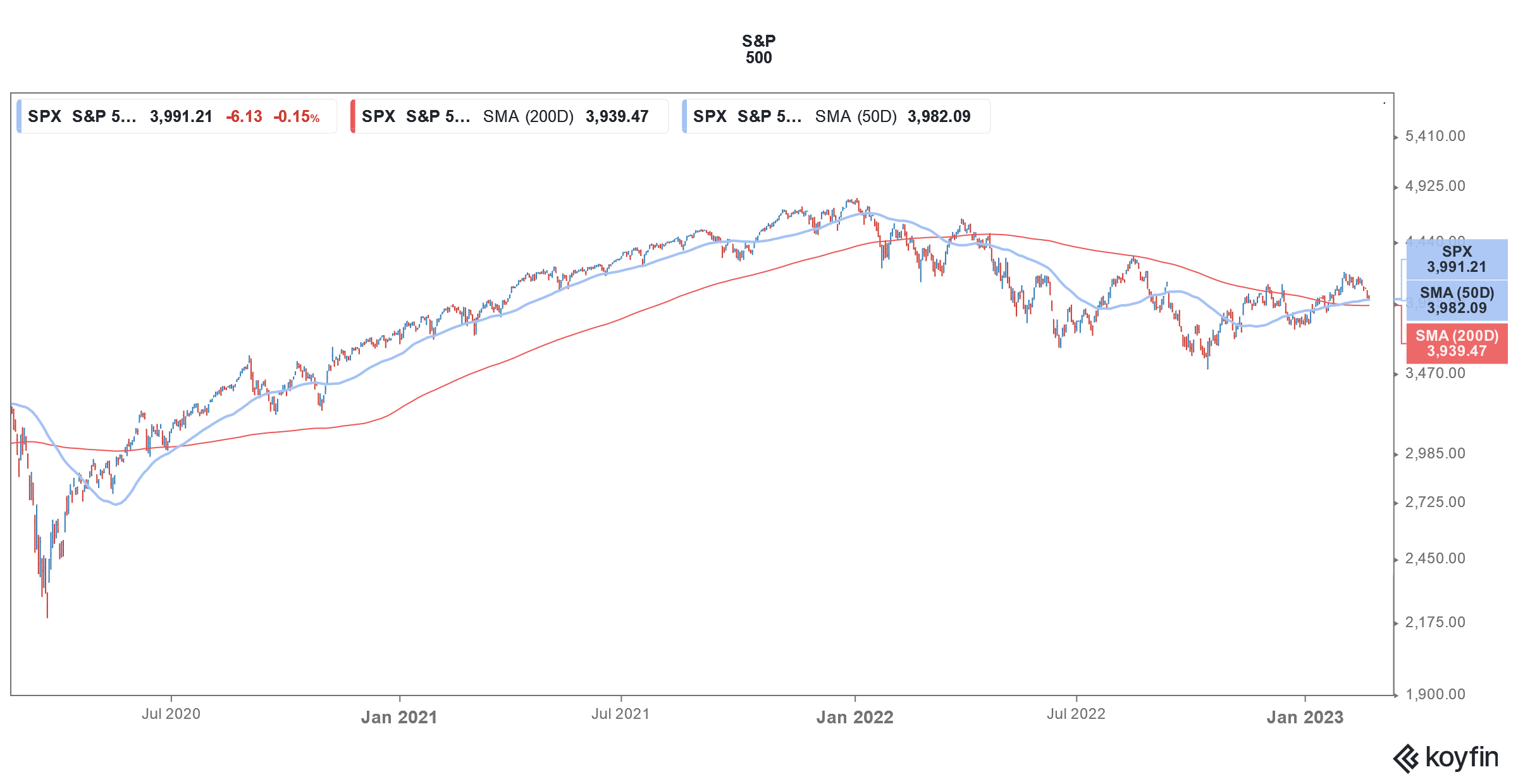

After the recent economic data, traders have also raised the odds of a 50 basis point rate hike in March. US stocks have also come off their 2023 highs as markets fear that the Fed would not halt its rate hikes anytime soon.

Speaking with CNBC, Mohamad El-Erian said that the markets should closely watch the two-year treasury yield and said that he “would be worried” if that goes up. He added that markets now realize that the “disinflation story is more complex than we’ll like it to be.”

He added that now inflation in some goods is going up. El-Erian also emphasized that “service inflation is not going to happen in a long time.” He said that as the uncertainty over inflation has gone up, the uncertainty over Fed’s rate cuts has also risen.

El-Erian believes inflation would not come down in a hurry

El-Erian also warned that while the debt market has adjusted, the stock markets haven’t yet factored in the fact that inflation could stay higher for much longer. He pointed out that at his press conference, Powell used the word “disinflation” 11 times and the “markets loved it.”

Now with January inflation coming ahead of estimates, the “disinflation” story has been shaken. Markets now look forward to January PCE (personal consumption expenditure) data. The metric is Fed’s preferred inflation gauge and if it also shows that the fall in inflation has stalled, markets—both debt and equity—might further reprice themselves.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account