Goldman Sachs believes that the US Fed would not raise rates at its upcoming March meeting. The outlook for rate hikes has changed drastically over the last week.

At the beginning of the last week, a 25-basis point rate hike at Fed’s March meeting looked almost like a done deal. However, after Fed chair Jerome Powell’s Congressional testimony, traders started bracing for a 50-basis point rate hike.

However, after the collapse of SVB and Signature Bank, markets now expect a 25-basis point rate hike at the most likely scenario. Goldman Sachs has gone a step further and said that Fed might not raise rates at all in March.

Goldman Sachs believes Fed won’t hike rates in March

In his note, Goldman economist Jan Hatzius said, “in light of the stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its next meeting on March 22.”

That said, Goldman still expects the Fed to raise rates by 25 basis points each in May, June, and July which would take the Fed fund rates to between 5.25%-5.50%.

Meanwhile, CME’s Fed Watch tool shows that 97.4% of traders see a 25-basis point rate hike at Fed’s March meeting while the remaining 2.6% believe that the Fed won’t raise rates.

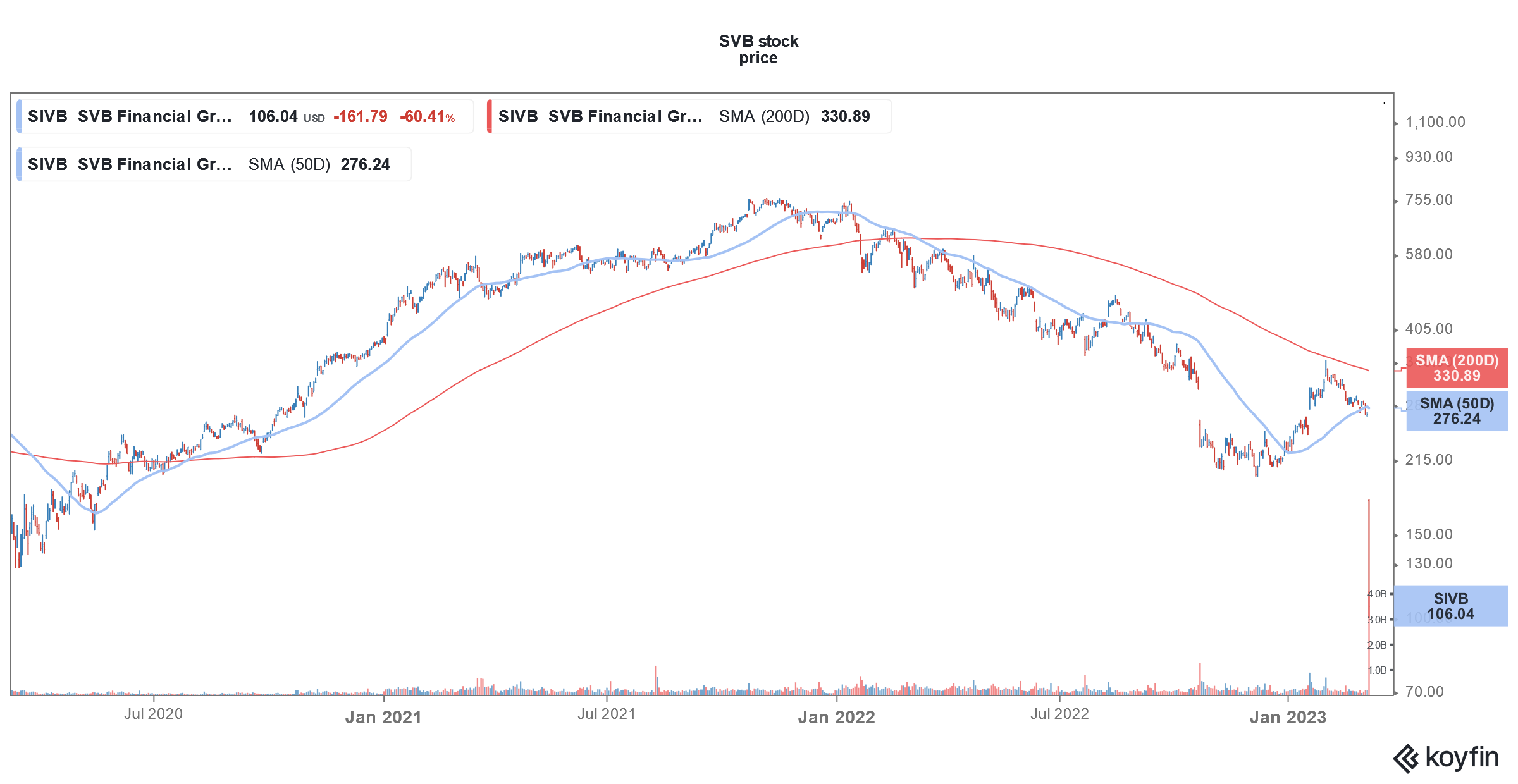

How the SVB crisis unfolded

In a mid-quarter update on Thursday, SVB said that it has sold all of its AFS (available for sale) securities valued at $21 billion, at a post-tax loss of $1.8 billion. Notably, US interest rates have spiked over the last year. Bond prices are inversely related to the yields and as a result bond prices have fallen sharply since the Fed started its monetary policy tightening in 2022.

SVB also announced a $2.25 billion capital raise. It talked about raising around $1.75 billion in a mix of stock and mandatory convertible preferred stocks. SVB said that General Atlantic has also committed another $500 million at the same terms as its stock offering.

SVB faced a bank run

However, SVB faced the typical “bank run” as depositors scrambled to move their funds away from the troubled bank. Its cash balance with the Fed went negative after depositors withdrew $42 billion in a single day. Its capital raise plan also went into limbo amid the crash in its stock price.

In its regulatory filing, the California Department of Financial Protection and Innovation said “The precipitous deposit withdrawal has caused the Bank to be incapable of paying its obligations as they come due, and the bank is now insolvent.”

Meanwhile, amid fears of a domino effect, the US government has come forward and said that depositors would be able to access their funds now. Notably, 89% of SVB’s total deposits were in excess of the FDIC’s (Federal Deposit Insurance Corporation) limit of $250,000.

Fed rate hike probability changes drastically

Fed rate hike probabilities have whipsawed over the last week. Many economists including Ed Hyman of Evercore ISI believe that the Fed should take a breather on rate hikes for now. Here it is worth noting that Powell has said multiple times that the US central bank is committed to lowering inflation to its targeted 2%.

Powell reiterated his views at last week’s Congressional testimony and spooked markets with his hawkish comments.

In his prepared remarks for the Congressional testimony, Powell said, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

Fed be data dependent

In his remarks, Powell said, “Although inflation has been moderating in recent months, the process of getting inflation back down to 2 percent has a long way to go and is likely to be bumpy.”

He reiterated his previous stance and said that the Fed would be data-dependent. In his Congressional testimony, Powell said, “We will continue to make our decisions meeting by meeting, taking into account the totality of incoming data and their implications for the outlook for economic activity and inflation.”

In January, US CPI rose by 6.4% YoY. While it was below the December reading of 6.5%, it was ahead of the 6.2% that analysts were expecting.

The CPI as well as wholesale inflation rose on a monthly basis in January. Some of the recent economic data has meanwhile been quite strong. US retail sales also rose 3.1% in January.

Also, in February, the US economy added 311,000 jobs which was ahead of the 225,000 that the market was expecting. The strong economic data and sticky inflation show that the Fed has a long way ahead in reducing inflation to 2%.

January nonfarm payroll was revised down

The Labor Department revised the January nonfarm payroll to show that the US economy added 504,000 new jobs which was lower than the previous reading of 517,000. Nonetheless, the reading still looks quite strong.

Last month, referring to the January nonfarm payroll data, Powell said, that the jobs report was “certainly strong—stronger than anyone I know expected.”

He also said that a strong job market and wage growth make the Fed’s job of lowering inflation tougher.

He reiterated similar comments in his testimony and said, “Although nominal wage gains have slowed somewhat in recent months, they remain above what is consistent with 2 percent inflation and current trends in productivity. Strong wage growth is good for workers but only if it is not eroded by inflation.”

Markets would next look forward to the February retail sales and inflation data this week, which would be the last major economic indicator ahead of the upcoming Fed meeting.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account