US stock futures are down ahead of Wall Street’s opening bell this morning as a mounting number of virus cases in the country appears to be instilling fears of a potentially prolonged economic shock on investors.

E-mini futures of the S&P 500 are trading 0.88% lower this morning slightly above the 3,400 psychological threshold, while Nasdaq 100 E-mini futures are also down 0.70% at 11,581 during early futures trading activity. Dow Jones futures are also down almost 1% at 27,922.

As experts repeatedly warned, the number of contagions has spiked during the fall season in the North American country, with the tally already reaching record levels at 81,400 cases per day recorded last Friday, according to data from Worldometers, while the number of daily deaths remains above 1,000.

This situation is causing concern among investors, as the economic woes resulting from the pandemic could endure for longer than expected, which puts more pressure on corporate earnings while US Congress keeps failing to move forward with another stimulus package.

Economic calendar for the week

Among the most important data releases this week there’s the quarterly GDP growth rate for the US – which will be published on Thursday – with economists forecasting an advance of 32.5% during the three-month period following the 31.4% drop seen in the last quarter as lockdowns took a heavy toll on the country’s economy.

The same figure will be published on Friday for the European Union, with economists expecting a much more modest advance of 7.8% for the region’s economy following the 12.1% plunge seen last quarter.

Market volatility is likely to remain high with the US election just around the corner, as the risk of a contested result is still weighing on market indexes and possibly capping their advance.

Moreover, investors will continue to follow the progress of the long-awaited stimulus bill from Congress, although market participants believe that a deal at this point seems unlikely given the closeness of the election date.

In this regard, House Speaker Nancy Pelosi told reporters during the weekend that she had sent a letter containing several concerns to White House Treasury Secretary Steve Mnuchin and she was hoping to get an answer as early as today.

What’s next for US stock futures?

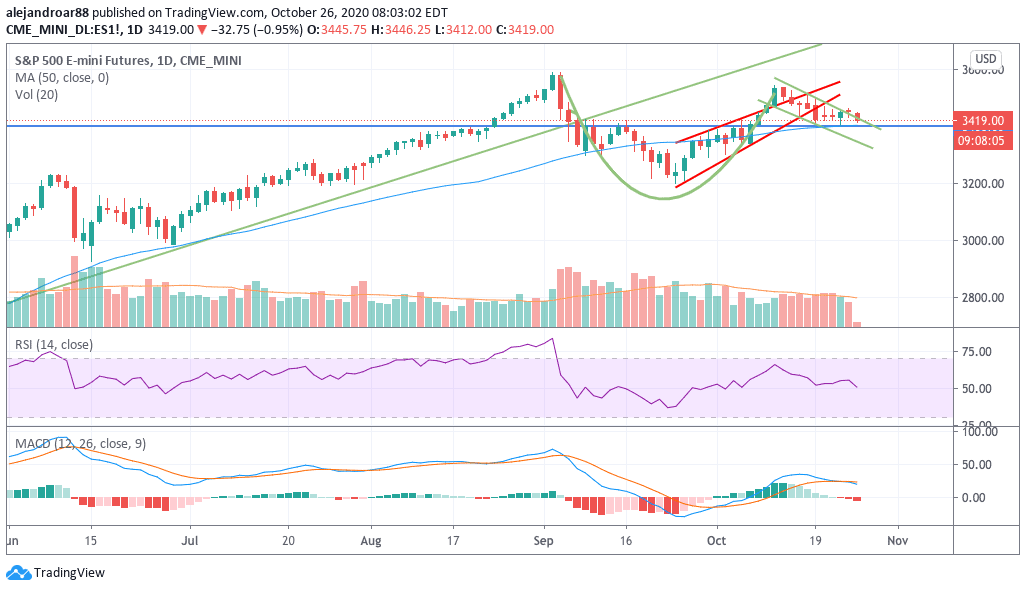

E-mini futures of the S&P 500 are holding their ground above their 3,400 psychological support, which has served as a stronghold during the latest downturn.

The price action around this level should be closely watched by market participants as a move below could signal that more pain is coming for the broad-market US stock index.

On the technical front, the price broke slightly above the upper trend line of the bullish cup and handle formation shown in the chart, although this breakout has not been followed by increased momentum.

On the other hand, contradicting this bullish break, there’s a rising wedge bearish pattern that could also be in play, which means that investors have to seek confirmation on other indicators aside from these setups to determine which could be the one that will ultimately lead the price action.

One indicator that could be providing an additional hint is the MACD, which has sent a sell signal at the moment, although the oscillator remains in positive territory.

At this point, a big move in any direction accompanied by a surge in trading volumes could provide further confirmation of where things may be headed in the following sessions.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account