US stock futures are rallying this morning during the European stock trading session on the back of a recovery in the banking sector after the FinCEN scandal.

Futures of the Nasdaq 100 tech-heavy index are leading the surge, jumping 183 points or 1.63% so far at 11,319 while S&P 500 E-mini futures and Dow Jones futures are up 1.25% each at 3,329 and 27,388 respectively.

Major European stock indexes are sharply higher this morning as well led by the German DAX which is gaining 2.82%, followed by the French CAC 40 and the FTSE 100, both of which are up 2.1% and 1.48% respectively, primarily led by a rebound in the banking sector.

Today’s rally is giving investors some confidence that the latest losing streak is over, although major threats remain on the horizon for companies including a resurgence of the virus in Europe and in certain key states of the US where the virus had already been temporarily contained.

Meanwhile, political tensions could also spark negative reactions in the markets as Tuesday’s debate between presidential candidate Joe Biden and US President Donald Trump approaches.

Moreover, post-Brexit talks are scheduled to be resumed this week, with the end of the year deadline to exit the European Union looming on the backdrop, which could force the United Kingdom to accelerate a trade deal to avoid another slump in their economic recovery resulting from a no-deal Brexit.

How is the forex market doing?

The US dollar – as tracked by the US dollar index – is retreating 0.38% this morning at 94.21 as investors are once again favoring riskier assets despite the significant economic and political uncertainty.

The pound sterling, the euro, and the Australian dollar are among the biggest winners this morning, advancing 0.20%, 0.21%, and 0.36% respectively in today’s early forex trading activity.

Gold is slightly profiting from the dollar’s retreat, although the precious metal is still trading far below its all-time high of $2,000, currently quoted at $1,865 per ounce.

What’s next for US stock futures?

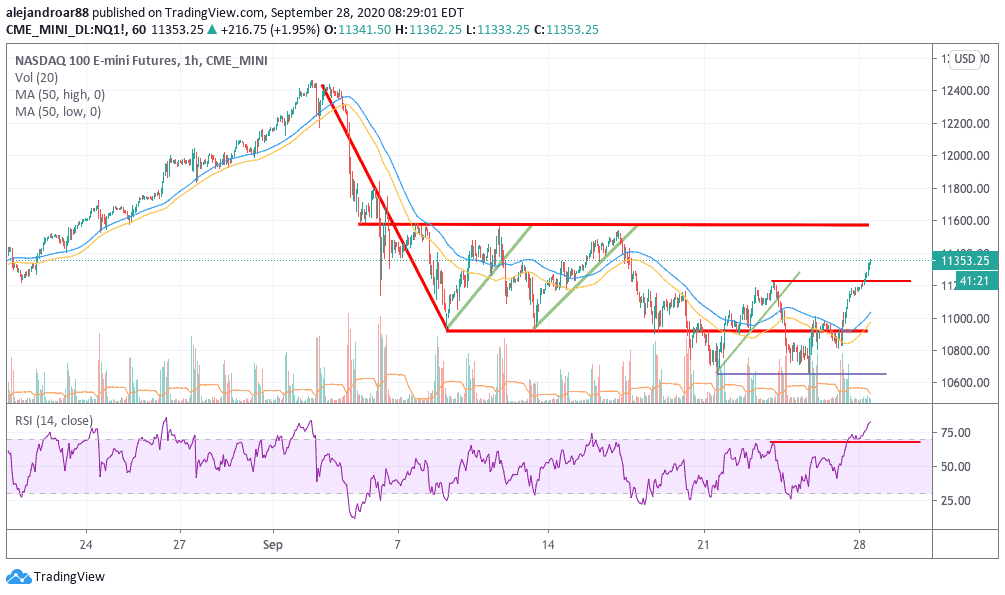

Nasdaq futures seem to be climbing above their intraday high of 23 September although they are still trapped in a bearish flag formation, a pattern that indicates that a potential continuation of the recent downtrend is in play.

A break above the flag at 11,600 could result in a trend reversal, which could again push the index above the 12,000 psychological resistance.

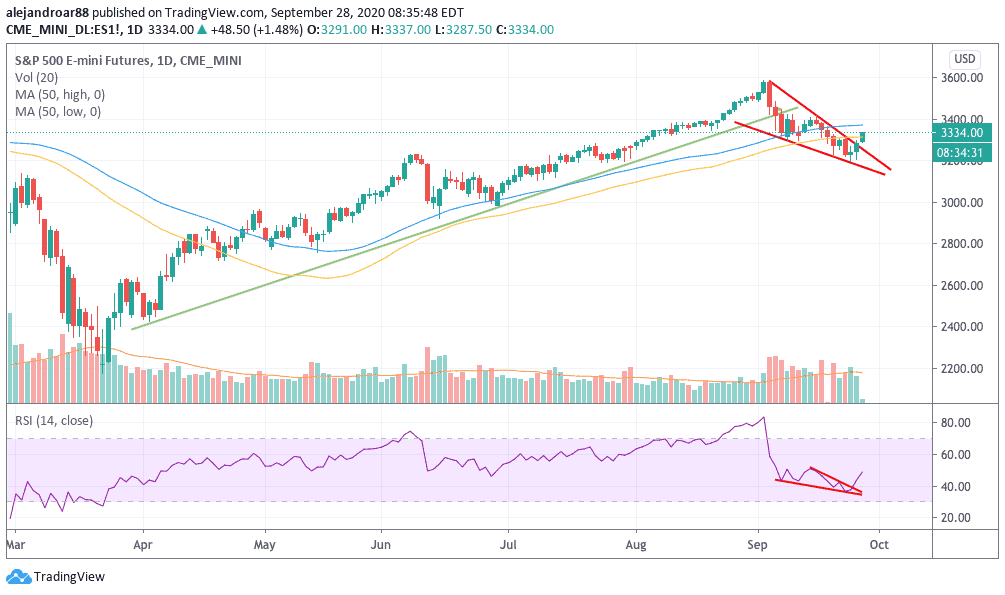

Meanwhile, E-mini futures of the S&P 500 are currently breaking above a falling wedge that formed as a result of the recent sharp drop in the index while posting a higher high in the RSI.

This is another sign that the market is significantly bullish ahead of Wall Street’s opening bell, although this bull run still has to be backed by US investors once the market opens in North America.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account