The US government has picked five firms currently developing a coronavirus vaccine as part of its operation ‘Warp Speed’, to find a fast treatment for the disease.

Operation Warp Speed seeks to compress a vaccine process that is typically years long into a matter of months, in part by spending as much as $10bn on research, manufacturing and agreements to guarantee purchase of the vaccines.

The five companies include US-based biotech Moderna (MRNA), pharma giants AstraZeneca, Pfizer, and Merck, and health care conglomerate Johnson & Johnson.

The program aims to assist at least three out of the five companies in conducting large-scale randomized clinical trials to ensure the safeness and effectiveness of their vaccines, while it also seeks to assist them in the development of suitable treatments and diagnostics for the disease.

US President Donald Trump on Tuesday tweeted: “Vaccines are coming along really well. Moving faster than anticipated. Good news ahead (in many ways)!”.

From these five candidates, Moderna appears to be the company that has moved faster towards the development of a potential vaccine, as the biotech’s mRNA-1273 candidate has already moved on to Phase 2, which involves testing the drug in a group of 600 patients, after a successful Phase 1 that managed to produce antibodies to neutralize the virus.

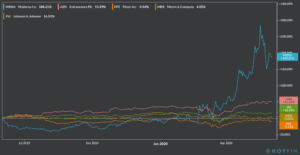

Shares of US biotech firm Moderna (MRNA) have skyrocketed during the year, after the company emerged as the front-runner in the race towards finding a vaccine for the virus causing the world’s latest pandemic.

The stock accumulates a gain of 188% since January, a performance that overshadows its four rivals in Operation Warp Speed, with AstraZeneca (AZN), Johnson & Johnson, Merck, Pfizer posting 52%, 17%, 7% and -9% gains respectively. Moderna ended up yesterday’s stock trading session at $59.89 and its up 1.4% during pre-market trading.

Even though the shares of Moderna led by chief eccutive Stéphane Bancel (pictured), have rallied recently, analysts are still bullish on it as reflected by the stock’s $84 12-month price target, which represents a 40% upside based on yesterday’s price.

Meanwhile, Merck’s chief executive Ken Frazier recently commented about the aggressiveness of vaccine development time frames, saying that very large clinical trials often take years to complete.

The pharma boss added: “Speed is one factor, but in some ways we don’t really accept the concept of a race … We understand the urgency, but our goal isn’t to be the frontrunner in the early stages — it’s to develop a vaccine that is safe and effective”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account