The US Dollar – as reflected by the US Dollar Index (DXY) – is marching higher this morning after four consecutive days of losses, as stimulus talks remain stalled while the FBI unveiled a plot to intimidate voters ahead of the elections.

The greenback is currently moving 0.3% higher at 92.87 during the European forex trading session, with the euro and the pound sterling losing an equal percentage against the North American currency following news that Britain is preparing to offer more stimulus to businesses amid a resurgence of the virus in the country.

Stimulus talks have been stalled for a few weeks now, with both Democrats and Republican still failing to find a middle ground before the election while COVID-19 cases keep surging both in America and overseas – adding more uncertainty to the backdrop and potentially causing a flight-to-safety move that is favoring the greenback this morning.

White House and Congress have given multiple deadlines to reach a deal but have failed to live up to their commitments, with Republican Senator and majority leader Mitch McConnell apparently opposing a bill larger than the GOP’s proposed $500 billion threshold.

Meanwhile, a surge in the number of infections in both the US and Europe is threatening to derail the pace of the global economic recovery, leaving investors scrambling to find ways to hedge against a potential downturn in equities if another wave of strong restrictions is to hit the developed world.

Moreover, the FBI informed last night that Iran and Russia were reportedly meddling with the US election, as the agency has evidence that both countries accessed American voters’ registrations in an attempt to intimidate workers through a series of e-mail threats, while also trying to generate confusion ahead of the presidential election by disseminating false information.

On the side of commodities, gold is reacting negatively to the strength of the dollar, with the yellow metal retreating almost 1% this morning at $1,905 per ounce during early commodity trading activity, although the precious metal remains on an uptrend amid this escalation in the level of perceived risk.

Where is the US dollar headed?

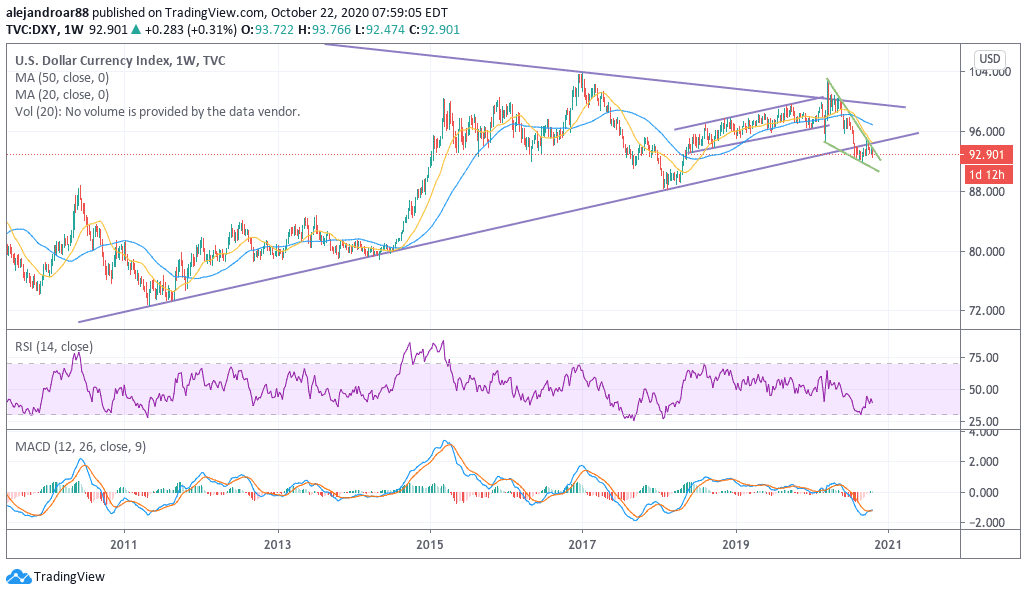

The weekly chart above shows that the greenback slipped below a long-dated uptrend in late July, as the US administration has debased the currency aggressively by injecting trillions of dollars to the economy to contain the virus fallout.

These strong measures have been mirrored by other countries as well, although to a lesser extent, which is the reason why the dollar is trading at such depressed levels.

On the other hand, a recent uptick in market volatility and the resurgence of the virus in Europe have contributed to lift the dollar a bit, although it is still trading below that support – which has now become resistance.

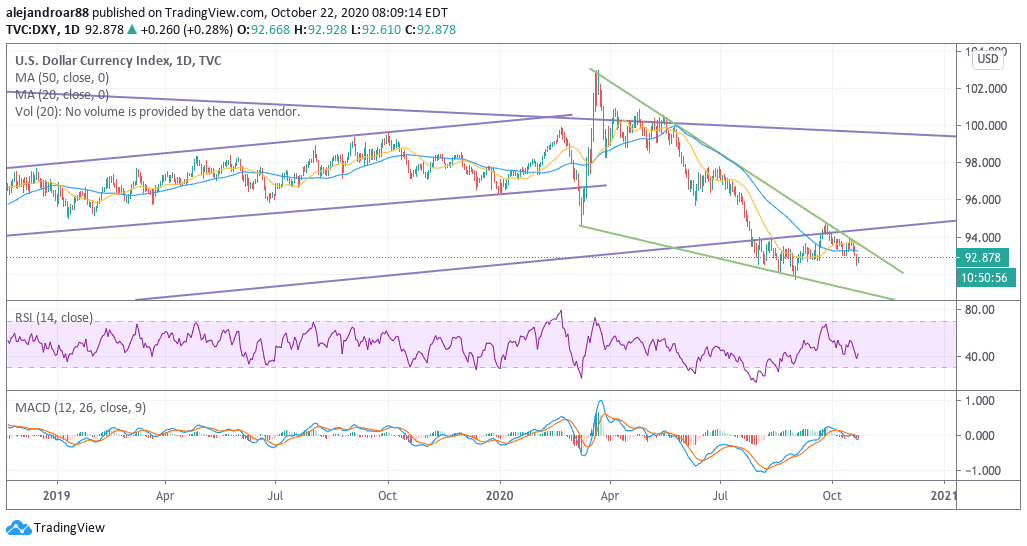

Meanwhile, the daily chart shows that the greenback is rebounding off a low level seen almost a month and a half ago, as the North American currency has been progressively dropping since it failed to move above the falling wedge pattern shown in the chart in late September.

This formation – typically a bullish pattern – is signaling that a potential trend reversal could take place at any given point, although the price action has not reached the degree of consolidation that would usually take for that to happen.

That said, given the significant number of tail risks that are looming on the backdrop – i.e. a contested US election, severe lockdowns across the world, or a rise in geopolitical tensions – the US dollar could see some strong upticks over the course of the next few months, which could give way to a short-term bull run.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account