The unemployment rate in Europe rose to 7.9% in July among the 19 countries that have adopted the euro as their official currency, highlighting the region’s struggle to recover from the pandemic’s economic fallout.

This increase represents a 0.2% increase from the 7.7% joblessness rate the region saw during June, while also 0.4% higher than last year’s rate of 7.5% during the same month.

The combination of higher unemployment levels, a historically-severe economic contraction, and another spike in the number of virus cases reported by key countries including Germany, the UK, Italy, and Spain are causing concerns regarding the region’s ability to quickly recover from the health crisis.

Moreover, the inflation rate in the eurozone was also lower than analysts’ expectations, posting a 0.4% increase in prices against 0.8% analysts were forecasting. Deflation continues to be a concern as well as it points to a deceleration in private consumption, one of the main sources of growth for the region’s economy.

Member countries of the Eurozone recently passed a €750bn fiscal stimulus package to assist the most battered economies in the region accompanied by a loose monetary policy from the European Central Bank’s, which has injected approximately €1.35trln to the financial system through asset purchases, similar to what the Federal Reserve has been doing in the United States.

However, with virus cases once again spiking it is unclear if these measures will be sufficient to contain the fallout that another wave of lockdowns could cause in the region’s economy.

How are European stock markets reacting to the news?

European stock markets are mixed this morning with the FTSE 100 index falling 1.29%, losing almost 77 points so far in today’s stock trading session while the Euronext 100 index is up 0.44% at 984.28.

Meanwhile, France’s CAC 40 index is up 0.14% at 4,954 while Germany’s DAX index is up 0.48% at 13,007.5 following Wall Street’s mixed results from yesterday and today’s positive performance of US index’s futures.

Investors should keep an eye on how European markets react to this latest spike in virus cases in the Eurozone, as the US markets reacted quite negatively to similar news back in June, losing around 8% in the week that followed a spike in cases over there.

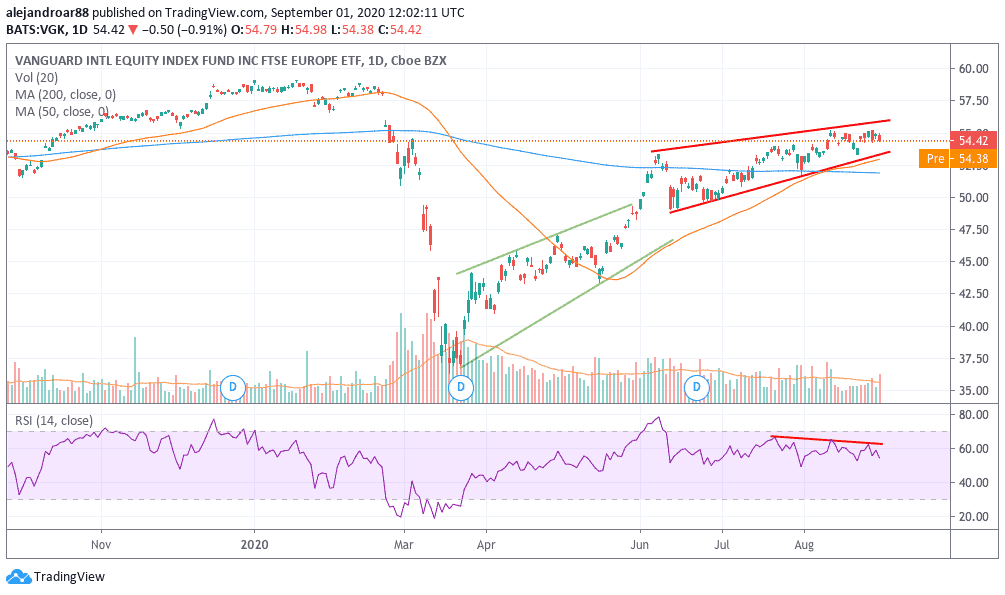

The price action of the Vanguard international Equity Index Fund FTSE Europe ETF (VGK) seems to be currently forming a rising wedge accompanied by a bearish divergence in the RSI – which indicates a weakening trend.

This could result in a trend reversal at some point if the virus situation creates sufficient negative momentum, especially if news of another wave of lockdowns hit the market.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account