Investors will pay close attention to how the impact of the coronavirus outbreak has hit demand of ride-hailing firms Uber and Lyft when they post their earnings on Thursday and 12 August respectively.

What are analysts expecting?

Uber (UBER), led by chief executive Dara Khosrowshahi (pictured), will be the first to disclose its second-quarter earnings, covering the peak of the pandemic in the US. Revenues are expected to come in at $2.17bn, resulting in a 32% drop compared to the previous year.

This drop in revenue will be cushioned by its Uber Eats and Uber Freight operations, which have enjoyed higher demand during the health crisis, while sales from rides are expected to decline by around 80% during the period.

Meanwhile, analysts forecast total revenues of $339m for Lyft during this quarter, a 61% fall compared to what it made a year ago. Lyft has no other operations apart from rides.

Uber is expected to lose $0.78 per share compared to $4.71 it lost the year before, while Lyft is expected to lose $1.55 per share against $2.23 it lost a year ago. These narrower losses are primarily driven by cost cuts across the board including a 17% staff cut at Lyft and a 14% cut in jobs at Uber.

The impact of the pandemic on ride-hailing

The ride-hailing industry have been significantly disrupted by the coronavirus outbreak, with certain estimates pointing to a drop in the demand for rides of around 70% to 80% between April and June.

A recent poll conducted by a gig-economy surveyor known as “The Rideshare Guy” found that nearly 58% of drivers refused to provide their services for Uber and Lyft during the pandemic while another survey found that 49% of Americans will not use a ride-hailing service while the pandemic persists.

Which of the two companies are better placed to withstand the fallout?

Uber’s diversified revenue stream is currently a plus for the company, as Uber Eats allows it to ease the pain the company is taking, especially if the crisis continues for longer in the US.

By contrast, Lyft is directly exposed to the outbreak, with the company relying mostly on its US operation to generate revenue.

Is Uber a better buy than Lyft?

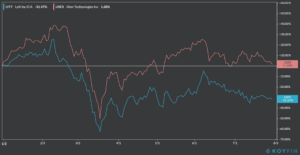

The market certainly seems to think at this point that Uber has a better chance of surviving the economic fallout caused by the pandemic, as shares of the ride-hailing business have soared above their 200-day moving average at $30.24, which is an indicator of long-term price strength.

Lyft shares have fallen below their 50-day moving average at $29.48, which is an indicator of the short-term price strength of the stock, pointing to the fact that there’s a downbeat sentiment towards the firm’s ability to ride the pandemic successfully.

Shares of Uber and Lyft can be traded by using one of these free stock trading apps or by signing up with one of the brokers from our list of best stock brokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account