How to Buy Uber Stock Online in 2021

Since its establishment in 2009, Uber is the brainchild of the cab-hailing wave that currently sweeping over the world. This model of a capitalist economic principle based on a peer-to-peer sharing was at the core of the company’s values.

More than a decade later, this ride-sharing service provider already has 19,000 employees and more than 75 million users across 600 cities in 69 countries worldwide.

In this article, we share with you a step by step guide on how to buy Uber stocks online. We also review three of the best online brokers while highlighting some of the reasons you might consider buying the Uber shares today.

-

-

Buy Uber Stock in 3 Quick Steps

Don’t have time to read our guide in full? Follow these three quick steps to buy Uber stock right now.

[three-steps id=”200921″]Where to Buy Uber Stock?

Uber went public in May 2019 and was listed on the New York Stock Exchange. But even though Uber stock is quite popular, not many online brokers currently offer the option to buy this stock. Furthermore, before you choose a broker you will have to take into consideration the costs, spreads, initial deposit requirement, and day-trading margin requirements of the different online brokers. Below you will find our top three online stock brokers currently allowing users to trade Uber stock.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

How to Buy Uber Stock from eToro

This review finds eToro as the best trading platform to buy Uber stocks. The trading platform is intuitive and the broker allows you to buy non-leveraged real stocks as well as CFDs. Below, we have listed a step-by-step guide to show how to buy Uber stocks.

Note: You will first need to open an account with eToro, upload your ID, and deposit some funds. You can then proceed to buy Alphabet (Google) stock in a matter of minutes.Step 1: Search for Uber Stock

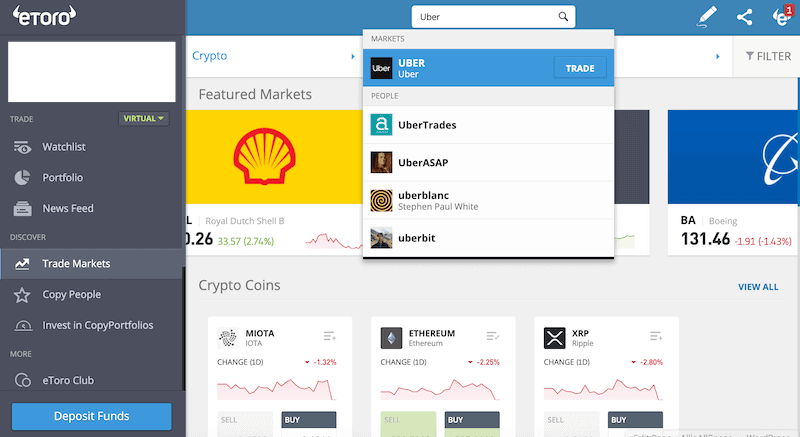

The eToro platform is very similar to other social networks. Simply log in to the trading dashboard and type in ‘UBER’ at the search box.

Step 2: Click on ‘Trade’

eToro immediately channels you to the Uber stock page where you can make your research about the stock. Once you are ready to make your first transaction, click on the ‘Trade’ button.

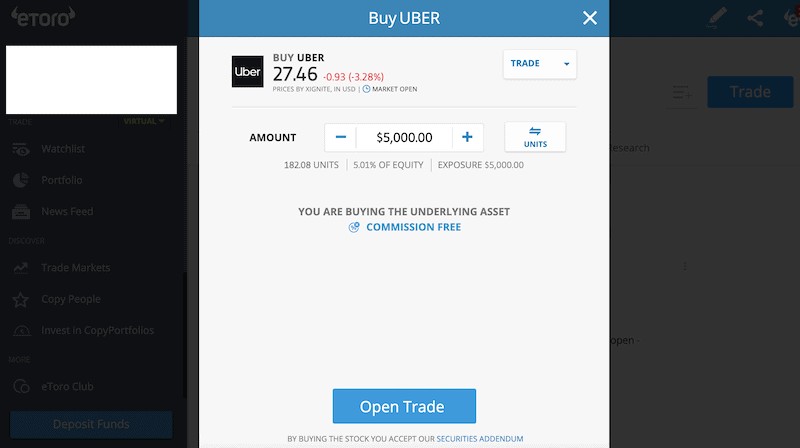

Step 3: Set-Up a Market Order and Buy Uber Stock

Now, you will need to set up your trading parameters at the order box. Those include the amount, type of order (market or limit order), the leverage ratio, stop loss, and take profit orders (not mandatory, but recommended).

Finally, click on the ‘Set Order’ button to complete your order.

Why Invest in Uber?

Uber was the first ride-sharing company in the world and has since ventured into food delivery service that is expected to expand and cover groceries. These are responsible for 98% of Uber’s revenue and the company has shown remarkable growth in 69 countries around the world.

At the time of writing, the most crucial factor regarding Uber is when and if it becomes profitable. For investors, that could be a great opportunity as every report, announcement, and news can significantly impact Uber’s stock price. Eventually, Uber is a high-reward start-up tech stock, which means there is an enormous potential for growth. With that said, below we have outlined some of the reasons why Uber might be a great investment.

Note: Never purchase shares in Uber, or any company for that matter, without doing your own research. The positive investment notes listed below are subjective, so there’s no guarantee that the Uber stock will increase in value. In fact, you could just as easily lose money.Diversification of Services

Uber was originally founded as a ride-hailing service, however, the company has diversified its core offering over the years. Those include the UberEats, UberNight, UberPop, UberPool, Uber Freight (a free app that matches carriers with shippers), Uber Health, and the JUMP bike and scooters (rental of electric bikes).

A Future of Driverless (Autonomous) Cars

The most notable factor in the development of Uber is its investment and success in operating autonomous cars. The company has a self-driving division called the Advanced Technologies Group (ATG) and is highly committed to its autonomous-vehicle program. More than 1,500 employees in Uber are dedicated to the research and development of autonomous self-driving cars.

Uber is planning to get a permit for its self-driving cars in California and is expected to test the new car on public roads by the end of 2021. The bottom line, Uber has high expectations to become one of the leading self-driving car companies in the world. Some might say that investing in Uber is investing in self-driving cars, which appears to be rapidly approaching.

Uber is an Innovative Company

One thing you can certainly say about Uber is that it is an innovative company. Apart from the Advanced Technologies Group (ATG) that is in charge of the developments of a self-driving autonomous car, the company efforts to be a leading power in the future of mobility in many aspects. For instance, the UberElevate project is developing shared air transportation. The Aerial ridesharing is a project taken up by Uber and Hyundai and might revolutionize the way people transfer goods. Furthermore, Uber develops advanced self-driving system features that include latest-generation vehicle hardware, safe navigation software, and many more.

About Uber Stock

Company and Stock history

Uber was founded after the company’s two co-founders, Garrett Camp and Travis Kalanick, could not get a taxi in Paris and had to spend $800 for a simple ride. In the beginning, the company was called UberCab, however, in 2011 the founders of the company have shortened the name to Uber following complaints from taxi companies in San Fransisco. The application was officially launched in San Francisco in 2011.

Though Uber was facing complaints, lawsuits, and great competition from new companies, the revolutionary ride-sharing service was a hit across the United States and worldwide. At the time of writing, Uber had revenue of $4.1 billion, growing 37% year-over-year, however, keep in mind that the company is not yet profitable and expects 2021 to be its first profitable year.

Uber Stock

Uber’s IPO in 2019 was the most anticipated since Facebook’s IPO in 2012 and though many believed it was a failure after prices did not spike at the first trading day, Uber is still one of the most popular tech start-ups companies worldwide.

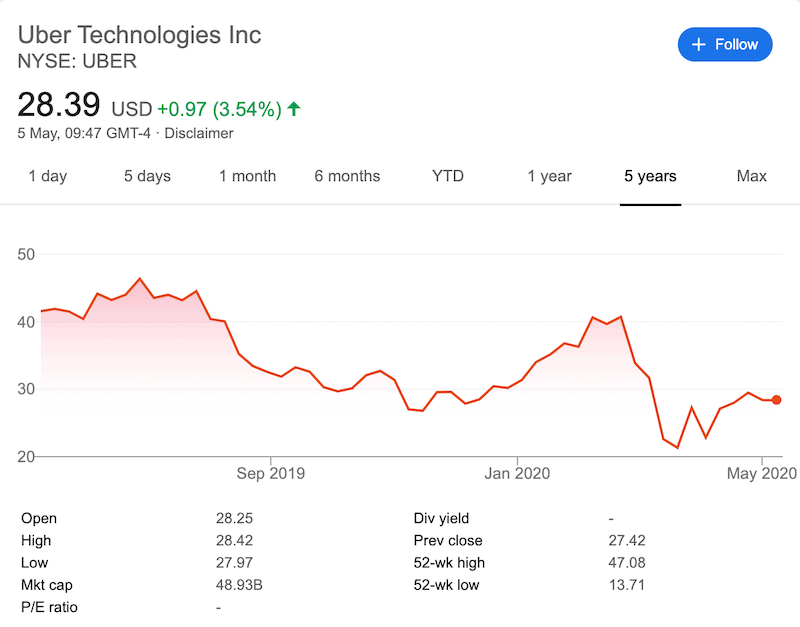

Uber reached its all-time high of $46.38 on June 28, 2019, and since then the stock was trading at a range of $26-$46. Since February 2020, the stock lost almost 50%, mostly due to the recent Covid-19 pandemic. Uber was, in fact, one of the biggest losers on the stock market since the Coronavirus outbreak started. Yet, according to MarketBeat which collects ratings from 45 Wall Street analysts, the consensus target price for Uber is $44.54, reflecting a 57.43% upside of the stock’s price. As a matter of fact, many experts believe that the long-term potential of Uber has not changed.

One factor you must consider; if you are looking to trade Uber, you must pay close attention to Lyft, which is Uber’s major competitor in the ride-sharing market.

Should I Buy Uber Stock?

Buying the right stock at the right time is a difficult decision, and without knowing more about the company, it might be a risky investment. Uber has never been a profitable company, and yet, the ride-sharing company may be a great long term investment, particularly if you have faith in sharing economy applications and autonomous self-driving cars. Regardless, you should keep in mind that you can trade Uber on both directions and the result of its high trading volume and volatility make it a great asset for day/swing trading.

The bottom line, Uber continues to fight to turn profitable but once the coronavirus lockdown is lifted, Uber’s stock price is expected to rise, particularly with the recent development in the oil market. Uber’s CEO, Dara Khosroshahi, has recently mentioned that the company’s goal is to get to profitability by 2021.

Having said that, you should remember that investing in Uber in the current situation comes with several risks and high growth potential. Even though the company is not yet profitable, and faces high competition Uber is also the first ride-sharing service in the market and has tightened its grasp in the industry.

Our Recommended Stock Broker - 0% Fees

Our Rating

- 0% Commission on Stocks

- Trade Stocks, Forex, Crypto and more

- Only $200 Minimum Deposit

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQ

How much were Uber stocks originally?

On its Initial Public Offering (IPO), Uber offered 180 million shares at a price of $45 per share.

How many drivers work for uber?

As of 2020, Uber has 3.9 million drivers around the world, another indication of the company’s strength.

Does Uber pay dividends?

Uber does not currently pay a dividend for its shareholders. As such, you’ll only be able to make profits through swings in Uber’s stock price.

What stock exchange is Uber stock listed on?

Uber is listed on the New York Stock Exchange (NYSE), the largest stock exchange in the world.

What is the symbol for Uber stock on NYSE?

Uber is listed on the NYSE exchange under the ticker symbol ‘UBER’.

Can I short Uber stock?

Yes. A short position is a trading technique that allows traders to sell the stock and then buy it, meaning make a profit when the price of stocks goes down. CFD brokers such as eToro and Plus500 enable users to short-sell stocks, including Uber.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Tom Chen

View all posts by Tom ChenTom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. He has a B.A. in Economics and Management and his work has been published on a range of publications, including Yahoo Finance, FXEmpire and NASDAQ.com.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up