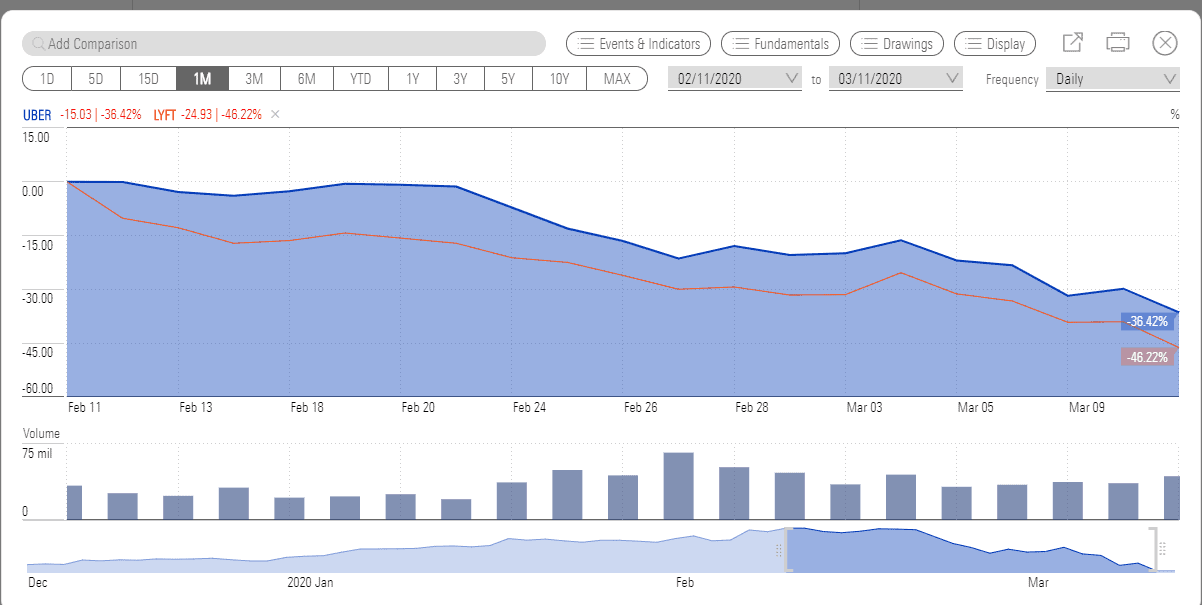

Uber (NYSE: UBER) stock price plummeted in the past couple of weeks amid investor’s concerns over the coronavirus outbreak. The ride-hailing giant said it provides drivers with disinfectants and will suspend drivers who have shown symptoms of the virus, but investors believe that passengers will be less likely to use shared vehicles if the outbreak gets worse.

The outbreak has raised similar questions about ride-hailing rival Lyft (NASDAQ: LYFT).

Uber stock price plunged close to 40% over the last three weeks while with the outlook turning for the worse after the World Health Organization declared the outbreak was now a pandemic.

“We could be entering a much more troublesome phase for Uber and Lyft where people choose not to go out at all,” said Atlantic Equities analyst James Cordwell, adding that up until now we were in the sweet spot for ride-hailing where people still went out, though were reticent to take public transport.

Lyft is also suffering, losing almost half of its value in the last month alone. The firm’s management said it remains optimistic about demand trends and expects to meet first-quarter guidance. It anticipates first-quarter revenue in the range of $1.055-1.06bn and adjusted earnings loss around $140-145m.

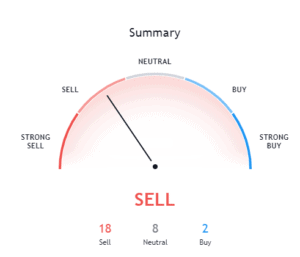

Uber has also recently announced that they maintain their profitability guidance for the fourth quarter with growth at its Uber Eats unit, offsetting problems at its airport ride-hail business. Tradingview analysts recommend selling in the short-term.

The analysts forecast a bleak outlook for both companies. “As travel slows and consumers work from home/go out less, we see potential for both companies to see slowing ride trends in March through April, and that creates ride-sharing revenue risk,” said Raymond James analyst Justin Patterson wrote in a note on Tuesday.

The shares of ridesharing firms Uber and Lyft slumped after high-profile initial public offerings (IPOs) last spring.

Uber stock currently trades around 16 per cent below its initial public offering New York last May when it launched at $45 a share, valuing the business at more than $82bn and raising $8bn of new cash. Its shares were hit as investors want to see solid signs of profit rather than just breakneck growth from big tech firms.

Investor have similar concerns about Lyft, which floated last March at $72 a share, valuing the business at $22.3bn on its first day of trading, raising $2.3bn. It currently trades around a third below its launch price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account