A Jefferies report identifies the five biggest stocks that leading hedge funds are short on.

To be clear, you short a stock when you expect its price to fall. You can short a stock through instruments like futures, options, binary options, and contract for difference (CFDs). Theoretically, your risk is unlimited if you short a stock as the stock can rise to any high. Short sellers suffer loses when the stock rises. They gain when the stock falls.

Jefferies on long versus short

In its June report, Jefferies said: “Long-only investors have seemed to get the upper hand of late, as those names that are Short by Hedge Funds but “crowded” by Long-only investors have rebounded sharply from the low.”

It added: “Also, the S&P 500 has risen 44% from the March low, and thus it is very hard to be Net Short anything and thus names that are Short or moved into that position, have jumped. We do think that the market is range bound, thus we will see differentiation between stocks and shorting names will make a comeback.”

The biggest shorted stocks in the US

The report names the five largest hedge fund short positions. These are:

- AT&T

- Exxon

- IBM

- Tesla

- Trade Desk

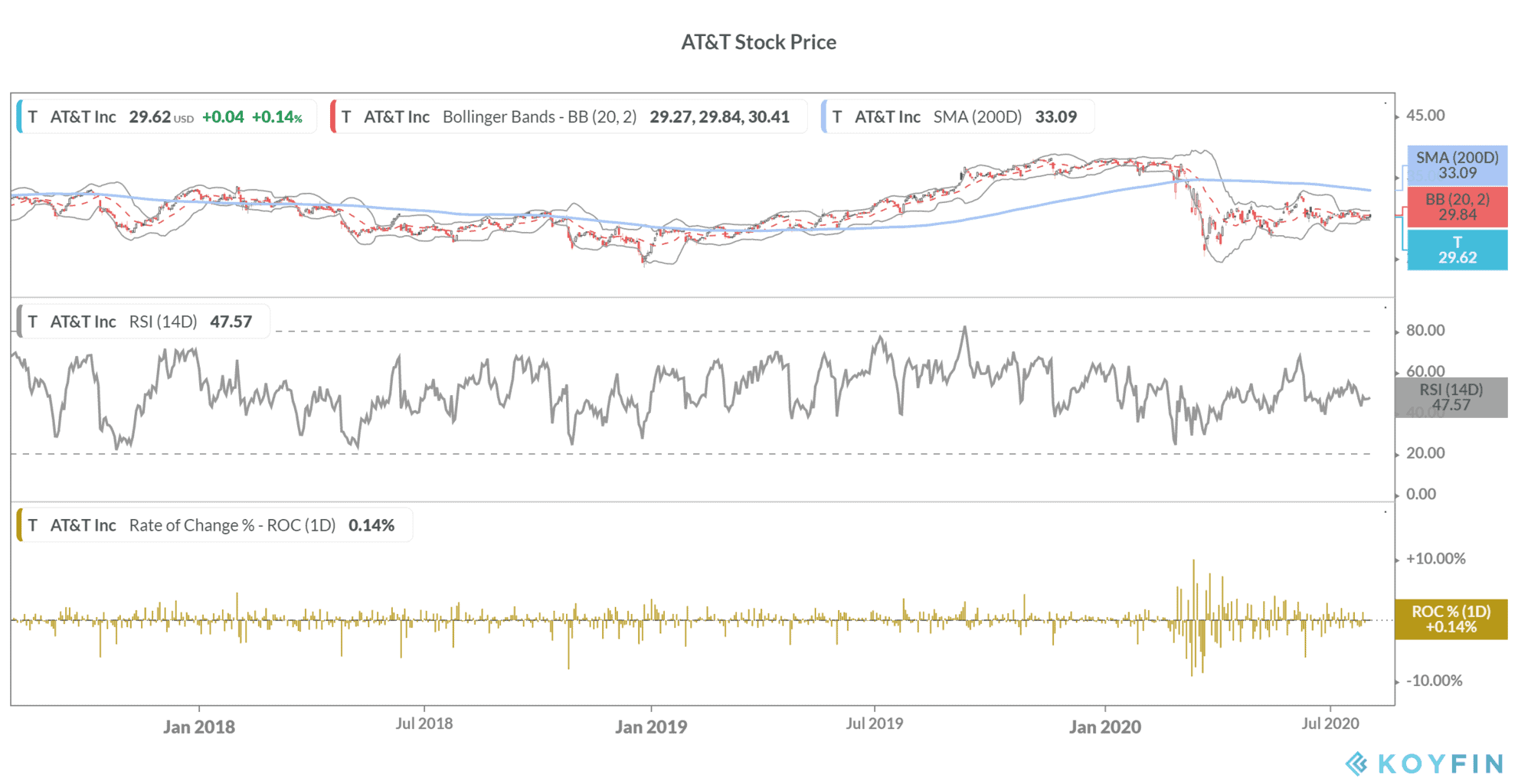

AT&T shares are down over 24% year to date. Based on yesterday’s closing prices, shares are down 25.3% from their 52-week high of $39.70. However, shares are up a mere 13.5% from their 52-week low of $26.08. That might sound surprising as US stock markets have recouped their losses and most shares are up sharply from their March lows.

AT&T

As for AT&T, the company’s debt pile is a cause of concern. Its debt levels soared after it acquired Time Warner for $85bn in 2018. The company had net debt (total debt minus cash and cash equivalents) of $151bn at the end of 2019 and the metric increased further to $152bn at the end of the second quarter of 2020.

Companies with high debt levels and weak balance sheets have been especially under pressure. Investors, particularly at this time, prefer to invest in companies with low leverage as they are better prepared to survive the pandemic.

Wall Street analysts have a split rating on AT&T stock. Nine analysts polled by Thomson Reuters have a buy or higher rating on AT&T stock. And 19 have a hold rating while the remaining three analysts have a sell rating on AT&T stock. Its mean consensus price target of $32.46 represents a potential upside of 9.6% over yesterday’s closing prices.

Exxon Mobil

Exxon Mobil stock is also high on hedge funds’ short sell list. Exxon Mobil is the world’s largest integrated oil and gas company. Integrated companies have operations across the range of an industry, from extracting crude oil to refining it into usable products like gasoline and diesel.

The upstream energy space has been especially under pressure this year due to the sharp fall in crude oil prices. While West Texas Intermediate (WTI) prices have recovered to above $40 per barrel, they are still far below what they were at the beginning of the year.

Also, hedge funds seem bearish on Exxon Mobil stock due to its high debt levels. It has a total debt load of over $47bn. Meanwhile, as crude oil prices bounced back from their April lows, Exxon Mobil stock has also recouped some of its 2020 losses. Based on yesterday’s closing prices, it is up over 40% from its 52-week of $30.11. Shares are however down almost 40% for the year.

According to consensus estimates, analysts expect ExxonMobil stock to rise 13.2% over the next 12-month period. That said, Exxon Mobil’s price action would follow the direction of crude oil prices in the near term. However, the stock could rise in the medium term as crude oil prices rise to $60s per barrel as many analysts forecast.

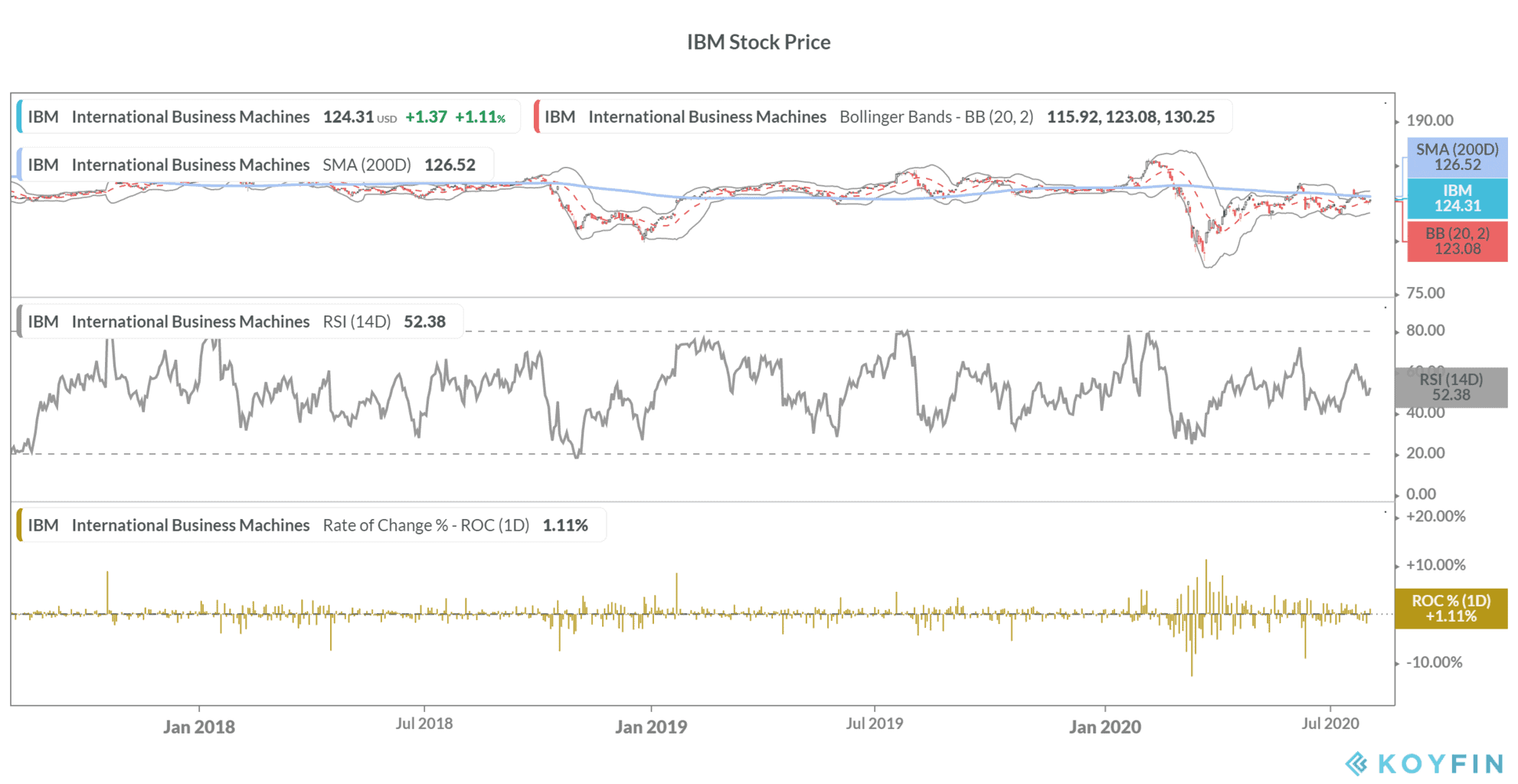

IBM

Hedge funds are also short on IBM stock. IBM shares are down 7.2%, underperforming the S&P 500. The common link here again is debt. IBM has a total debt of $64bn while its market capitalization is roughly $110bn. In 2019, IBM acquired Red Hat, a cloud company for $34bn. The deal further added to IBM’s obligations.

While many tech companies’ have been immune to the coronavirus, IBM reported a year over year fall in its second-quarter earnings as well as revenues. IBM has five buy or higher ratings and 12 hold ratings. The remaining two analysts polled by Thomson Reuters have a sell rating on the stock. Its mean consensus price target implies an upside of 7.8% over the next 12 months.

While hedge funds find IBM a short-worthy candidate in 2020, famous investor Warren Buffett exited the stock completely in 2018. Generally, Buffett has avoided tech stocks. However, he sees Apple as a tech company and has increased his stake gradually. Berkshire Hathaway is now Apple’s second-largest shareholder.

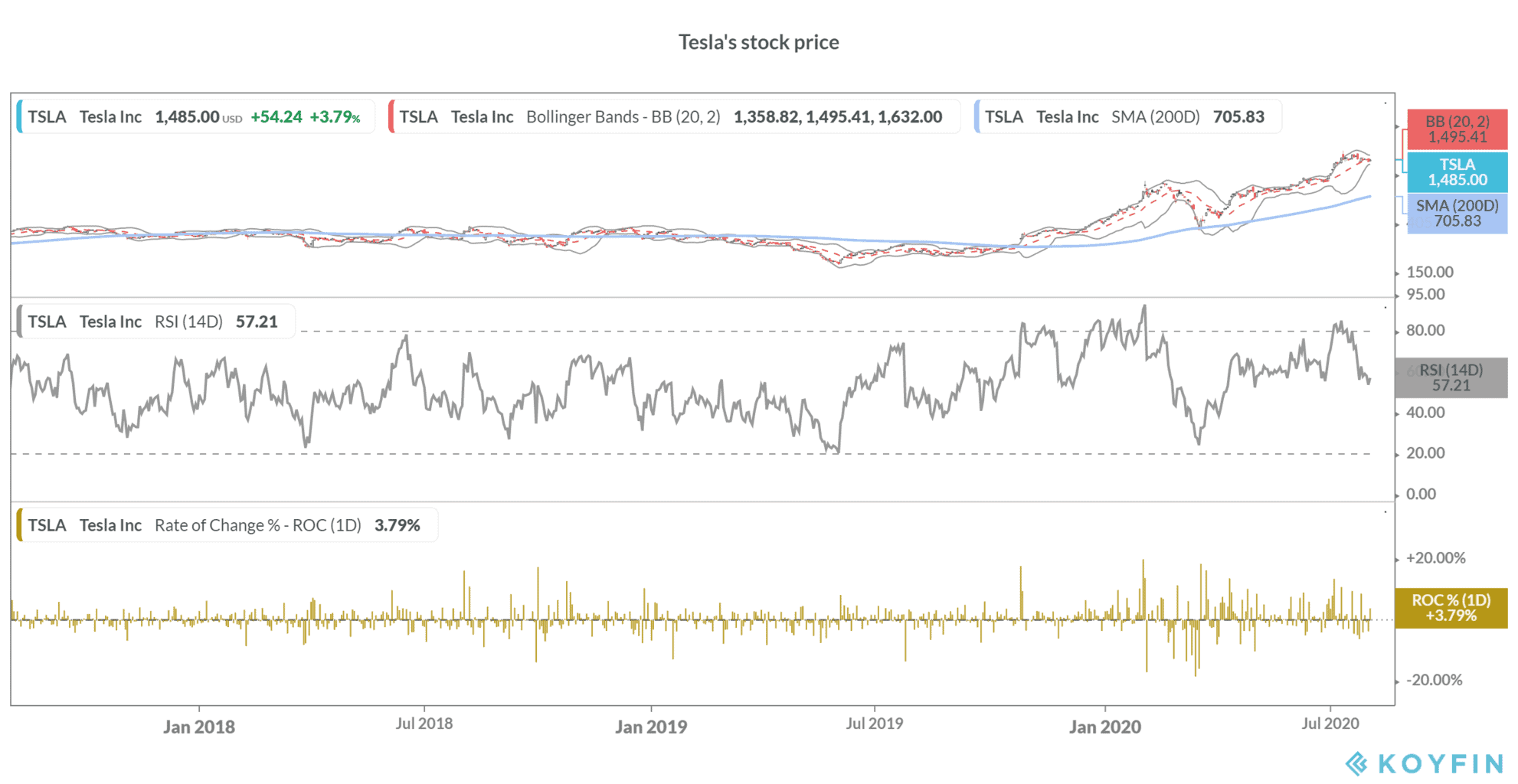

Tesla

Tesla is among the most shorted stocks on the New York Stock Exchange. While hedge funds are also short on Tesla, short sellers have lost billions this year betting against Tesla as well as other electric vehicle makers. Tesla stock is up 255% year to date.

Unlike IBM and AT&T, Tesla does not have a debt problem. The company issued shares in February that further boosted its balance sheet and liquidity position. Hedge funds are not having the best of times shorting Tesla’s stock. David Einhorn and Jim Chanos are among the two hedge fund managers that are big Tesla shorts.

In April, Jim Chanos said that he is “maximum short” on Tesla. Einhorn’s Greenlight Capital also added Tesla puts in the first quarter. Tesla’s chief executive Elon Musk (pictured) frequently jibes short sellers.

In June, Tesla launched a limited-edition short shorts which was sold out quickly. Mocking short sellers, the company said: “Tesla Short Shorts, featuring our signature Tesla logo in front with “S3XY” across the back. Enjoy exceptional comfort from the closing bell.”

While Tesla stock has rallied sharply, many Wall Street analysts have been bearish on the stock. Its mean consensus price target of $1,239 represents a potential downside of 16.6% over the next 12 months. Many leading analysts have warned of a bubble in Tesla and other electric vehicle stocks. Last month, Tesla’s market capitalization soared above Toyota Motors even though it has less than 5% of the production of Toyota.

Trade Desk

Hedge funds are also short on Trade Desk stock. However, it is up 83% this year. Trade Desk is among the tech stocks that have soared this year. Wall Street analysts see it falling 27% over the next 12 months.

Trade Desk lets its clients purchase and manage advertisement campaigns in the US as well as globally. The stock has a 14-day relative strength index of 68, that looks overbought in the short term.

For more information on trading in stocks, please see our selection of some of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account