Tesla Motors Inc can assign a large portion of its success to the lack of formidable rivals currently in the market. The Silicon Valley company has a billion-dollar head-start in the luxury EV segment. Though other luxury, long-standing car makers have produced their own high-end EVs, the sales of these vehicles compare poorly to those of Tesla Motors. A few more auto industry leaders are preparing to launch their own big Tesla competitors. Even small start-ups have lined themselves up, designing fantastic concept cars that promise be the EV market’s next best vehicle.

Ford plans to dedicate $4.5 billion towards building EVs. Porsche says it is gearing up to get its Mission-E concept into production. Other EV names like Faraday Future have also made headlines with the momentum behind readying their cars for production. The EV start-up is already reported to be setting up a factory in Nevada.

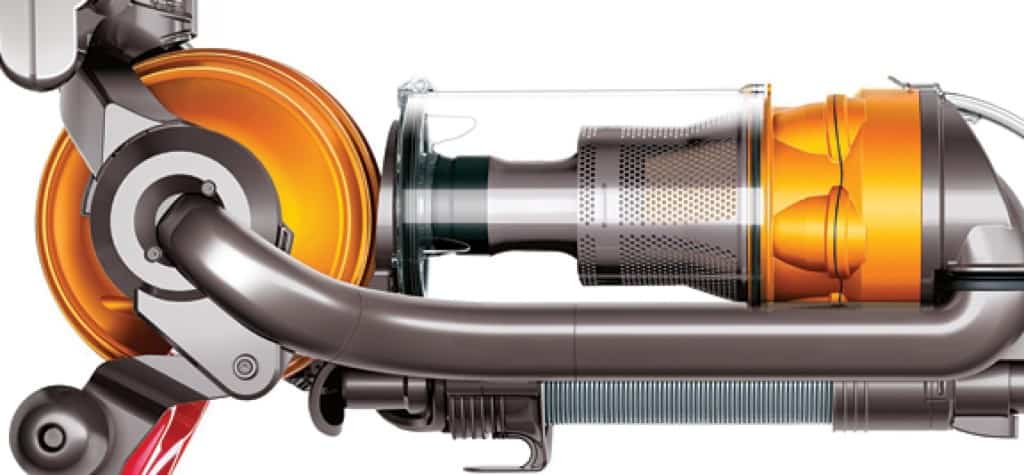

Dyson to rival Tesla?

Now a high-end and popular vacuum maker is said to be getting ready to make a name for itself in the EV market. News arose this week stating that U.K.-based company Dyson is making an electric vehicle.

On Wednesday, U.K. govt. documents revealed that Dyson is building an EV at its HQ in Malmesbury. According to reports, the news is said to have been disclosed by accident and was seen corrected the next day.

“The government is providing a grant of up to ₤16m to Dyson to support research and development for battery technology at their site in Malmesbury,” the amended copy read. This was pointed out by the Guardian on Thursday.

Though popular as a household brand, Dyson aims to be more than a vacuum maker. It already has plans laid down to invest $1.44 billion in building advanced battery solutions. The effort will continue to span over the next four years. These batteries could possibly be used to power its EV. If not, the company could also compete heavily against Tesla’ battery business.

Tesla Motors is nearing the completion of its Gigafactory. The plant is where the EV firm will soon efficiently make more of its battery products at a faster pace. Its batteries and energy storage solutions are gaining more demand globally. The Gigafactory will also greatly reduce Tesla’s battery production costs. This is thought to be crucial in ensuring a good return on the company’s next car.

Tesla Model 3

On March 31st, Tesla Motors Inc will reveal its latest prototype — the Model 3. Set to be released next year, the upcoming EV will be Tesla’s most affordable car. It will be the company’s break into the mass-market EV space. Sporting a price tag of $35,000, experts report that the car’s success would rely mostly on cheaper component costs. Tesla’s Gigafactory would ensure this. Could Dyson too be following a similar strategy to break into the electric vehicle space?

New on the scene

A number of days ago, the website of yet another EV start-up went live. It is called Edison Destiny. Currently, all the website features is a dimmed rendering under it E logo.

From auto industry leaders to mass-market dominators to promising start-ups, Tesla Motors is about to find itself in a far more competitive market.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account