US stock futures are surging more than 1% this morning on vaccine hopes and strong M&A activity during the weekend while the US dollar is flinching almost 0.3% in early forex trading activity.

Futures of the Nasdaq 100 tech-heavy index are leading today’s jump gaining 148 points at 11,199 so far, accumulating a 1.4% gain, while S&P 500 E-Mini futures are up 1.21% trading at 3,363.5.

The Dow Jones is also in green territory but is seeing milder gains of 0.94% currently trading at 27,754 while NYMEX crude oil futures remain unchanged at $37 per barrel during the European session.

These gains are primarily being driven by the resumption of AstraZeneca’s vaccine trials, which were temporarily paused due to a serious illness experienced by one of the study’s patients.

Moreover, strong activity in the mergers and acquisitions market is also spurring positive sentiment, including the sale of British chip designer Arm to Nvidia by SoftBank for $40bn and the acquisition of Immunomedics by Gilead for $21bn.

Why is the US dollar falling?

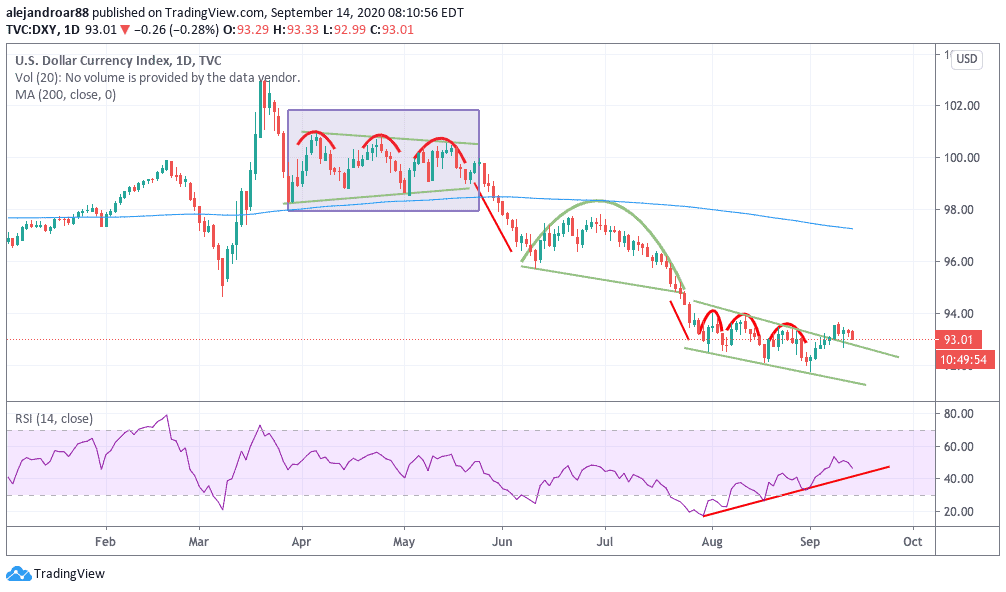

The US dollar is taking a step back this morning in contrast with positive futures trading activity, as reflected by the US dollar index (DXY), which is currently losing 0.23 points or 0.24% at 93.04.

The pound sterling is leading the dollar’s devaluation, as the British currency is gaining 0.6% so far during the European session at 1.2874 while the euro is up 0.2% at 1.1871.

Gold is also up this morning on the back of a weaker dollar, currently trading at 1,948.2 per ounce, 0.43% higher.

This drop in the dollar comes ahead of this week’s meeting of the Federal Reserve where the US central bank is expected to provide further guidance about its recent announcement that it will let inflation run higher to stimulate the country’s economy.

Meanwhile, the European Central Bank’s decision of not taking strong measures to counter the appreciation of the euro against the dollar has also been a factor that has pushed the dollar lower despite the fact that the North American currency recently broke above a downward price channel.

What to expect from the US dollar and from stock futures this week?

Despite the losses that the greenback has seen in the past two days, the North American currency is still trading above the upper line of its latest downward price channel while the RSI remains within its trend line.

A break below that upper trend line or a lower low in the RSI could point to further weakness and the Fed’s meeting remains the most important event this week to watch for to anticipate where the greenback is headed next.

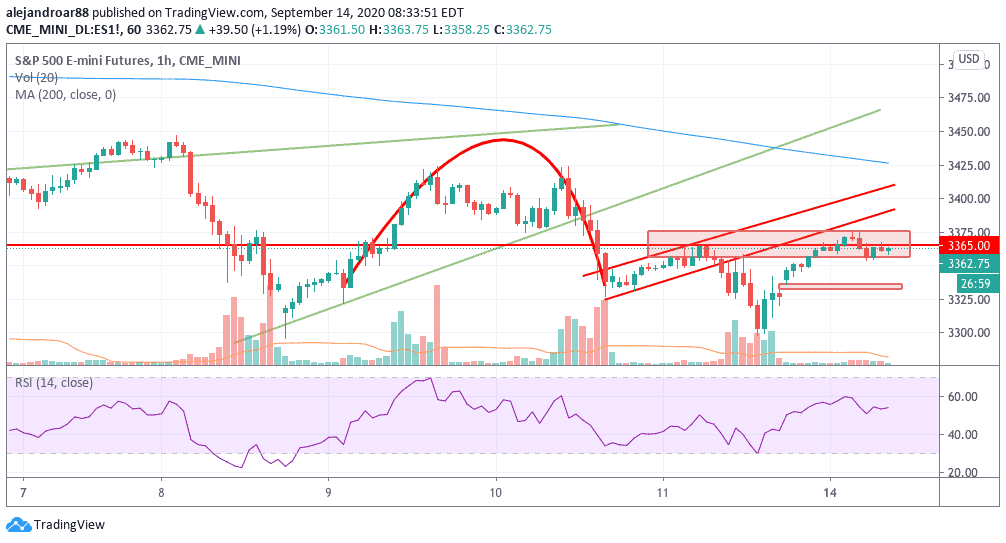

Meanwhile, S&P 500 futures fell on Friday after completing an inverse cup and handle pattern which led to a sell-off and today’s price action has left a price gap at 3,333, which market participants might be tempted to fulfill today.

The hourly chart of the S&P 500 E-mini futures also shows a rejection of the 3,365 resistance – which led to the sell-off on Friday – and this level is one to keep an eye on as another rejection could lead to a sharp downward move.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account