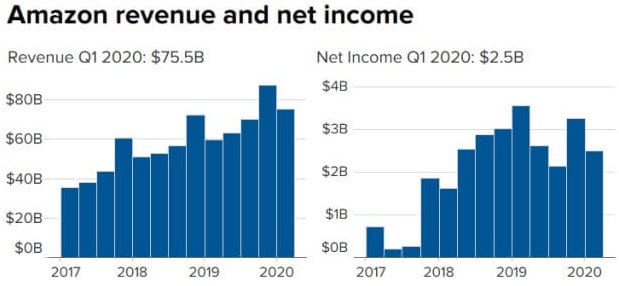

Amazon (NASDAQ: AMZN) reported record first-quarter net sales of $75.5bn as the coronavirus lockdown boosted demand for the firm’s groceries, online marketplace and cloud computing services.

But the hiring of 100,000 extra workers and new social distancing measures to protect staff helped swell operating costs at the world’s largest e-commerce retailer to $71.5bn, up from $55.3bn a year ago. Net income for the quarter was down 30 per cent to $2.5bn compared to a year ago.

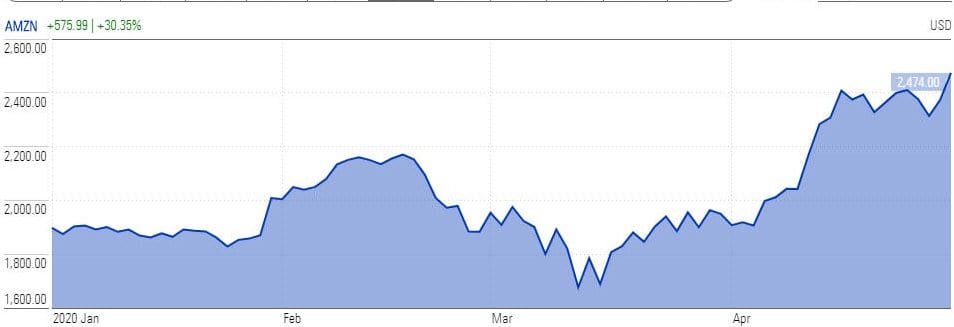

The report, released on Thursday, after the closing bell sent the Seatle-based firm’s earnings down from an all-time high of $2,474 to trade 4.4% down in pre-market trading on Friday.

But founder and chief executive Jeff Bezos (pictured) said that the health emergency meant more high costs are to come. He said the firm would spend a further $4bn on coronavirus measures in the three months to June.

He said: “If you’re a shareowner in Amazon, you may want to take a seat, because we’re not thinking small.”

Bezos added: “Under normal circumstances, in this coming second quarter we’d expect to make some $4bn or more in operating profit. But these aren’t normal circumstances. Instead, we expect to spend the entirety of that $4bn, and perhaps a bit more, on COVID-related expenses getting products to customers and keeping employees safe.”

The group’s first-quarter net income dropped to $5.01 per share from $7.09 per share in the year-ago period. Wall Street was expecting earnings per share in the range of $6.11 for the first quarter.

The company expects second-quarter revenue in the range of $75bn to $81bn while the consensus estimate is around $77.9bn. It had reported revenue of $63bn in the second quarter last year.

If you are interested in options trading or day trading, you can check out featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account