Oil futures are surging more than 3% today at $42.60 per barrel as crude prices keep moving higher on vaccine hopes and lower US inventories.

Futures of the West Texas Intermediate (WTI) – the US benchmark – are trading above the $42 mark for the first time since 20 October, while Brent futures – the global oil benchmark – are surging 4.6% so far during the European commodity trading session at $44.9 per barrel.

Oil prices reacted positively to reports from American drugmaker Pfizer that pointed to a strong immune response seen in a small subset of patients during the company’s COVID-19 vaccine clinical trials, a development that sent the WTI marker surging almost 9% on Monday as futures traders now trust that the vaccine could be available for distribution by the first quarter of 2021.

Meanwhile, the uptrend continued yesterday and apparently today following a report from the American Petroleum Institute (API) that showed a decline in US oil inventories of 5.1 million barrels, which far exceeded analysts’ expectations of 913,000 barrels.

That said, the outlook for crude continues to be capped by lower gasoline demand in developed nations, especially from Europe and the United States, as the reintroduction of lockdowns and travel restrictions can keep demand levels lower for longer than expected.

In this regard, the National Australia Bank wrote in a note this Wednesday: “Near-term demand prospects remain weak – particularly given a range of European countries implemented COVID-19 restrictions (albeit to varying degrees) which will negatively impact consumption”.

Analysts from the Australian bank added: “Beyond these measures, demand will take a considerable time to recover – as international travel remains constrained”.

What’s next for oil futures?

WTI futures are quickly approaching their post-pandemic highs of $43.8 per barrel this morning and could end up retesting that level by the end of today’s session as vaccine hopes keep infusing positive sentiment towards the energy sector.

That said, oil still has a long way to go to recover to its pre-pandemic levels and the demand from the commercial aviation sector is likely to remain low in the near future, which is possibly capping how high oil can go during what remains of the year.

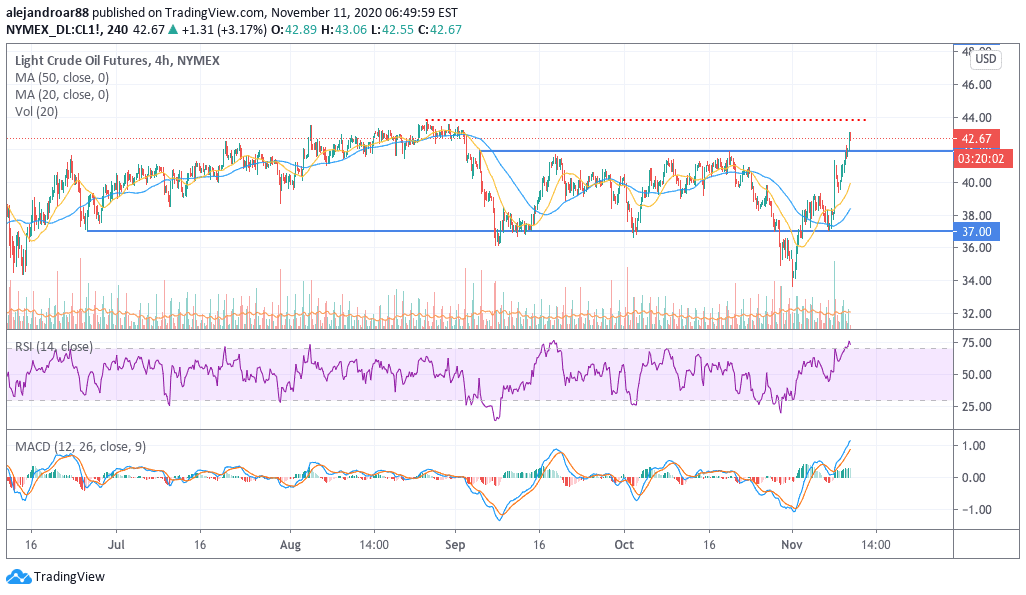

Although the hourly charts are already pointing to a potentially overheated bull run, the price action seen in the daily chart is still not sending any warning signals as the RSI remains below overbought levels while the MACD has just sent a buy signal while moving to positive territory.

At this point, oil traders could take some profits out of the 14% jump seen in the price of crude in the past 3 days, possibly once the price retests those August highs. However, the short-term prospect for oil remains bullish as vaccine hopes have proven to be a strong catalyst in past occasions.

If oil futures were to move above the $44 mark, the next stop could be $49 per barrel, as the likelihood of a strong rebound in the demand for fossil fuels in 2021 keeps increasing.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account