Oil futures are heading lower in early commodity trading activity as a fresh wave of lockdowns in Europe weighs on the demand outlook for crude.

The front-month futures contract of the West Texas Intermediate (WTI) – the US benchmark – is down 2.43% this morning at $34.92 while Brent futures – the global benchmark – managed to pare some of their intraday losses as they are down only 0.5% at $37.21 per barrel.

The introduction of four-week lockdowns in Germany, France, and the UK is weighing on crude prices today, although the markets are also worried that, as winter season kicks in, governments may be forced to extend these measures beyond November – which would affect holiday shopping activity.

Stephen Innes, Chief Global Market Strategist for Axi, told CNN this morning: “Fresh worries that politicians worldwide will be pressured to lock down Christmas this year is hitting the oil markets like a ton of bricks”.

The three European countries account for nearly a tenth of the annual demand for crude, which is why oil prices have been heading down for a couple of weeks now, with WTI futures losing almost 17% since their last 20 October peak at $42.

Traders will be eagerly expecting the release of the monthly oil report issued by the International Energy Agency (IEA) on 12 November to see how the reintroduction of lockdowns could be affecting the forecasted demand for crude over the coming months, while the US Energy Information Administration (EIA) will be releasing its widely-followed weekly report this Wednesday.

What’s next for oil?

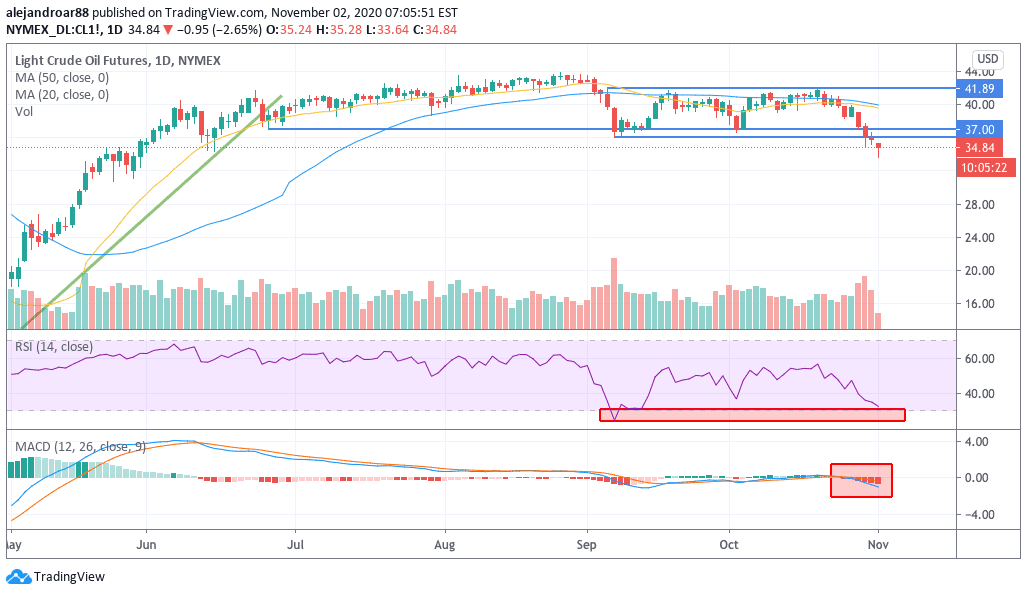

WTI futures are tumbling to their lowest levels since mid June as oversupply fears make a comeback.

With the front-month contract now trading below its $37 support, it is plausible to see oil prices moving lower – possibly to the low 30s – over the next few weeks, at least until the reports cited above cast some more light on the potential impact of this renewed wave of lockdowns.

Meanwhile, the daily RSI is approaching oversold levels, which could give oil prices a temporary breather as oil bulls step in to buy the dip.

That said, the MACD is already in negative territory and has already sent a sell signal, which reinforces the bearish outlook for crude prices over the coming weeks.

At this point, another wave of major production cuts seems unlikely given the deteriorated finances of countries in the Middle East and OPEC+ partners like Russia.

In this regard, the following days will be crucial in assessing how oil producers will respond to the weaker demand as their actions will determine if crude prices hold their ground above $30 or if a shakedown is to take place over the coming weeks amid no change in global supply levels.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account