Electric vehicle startup Nikola (NKLA) gained over 15% yesterday and was trading higher in pre markets today amid speculation over its partnership with General Motors (GM).

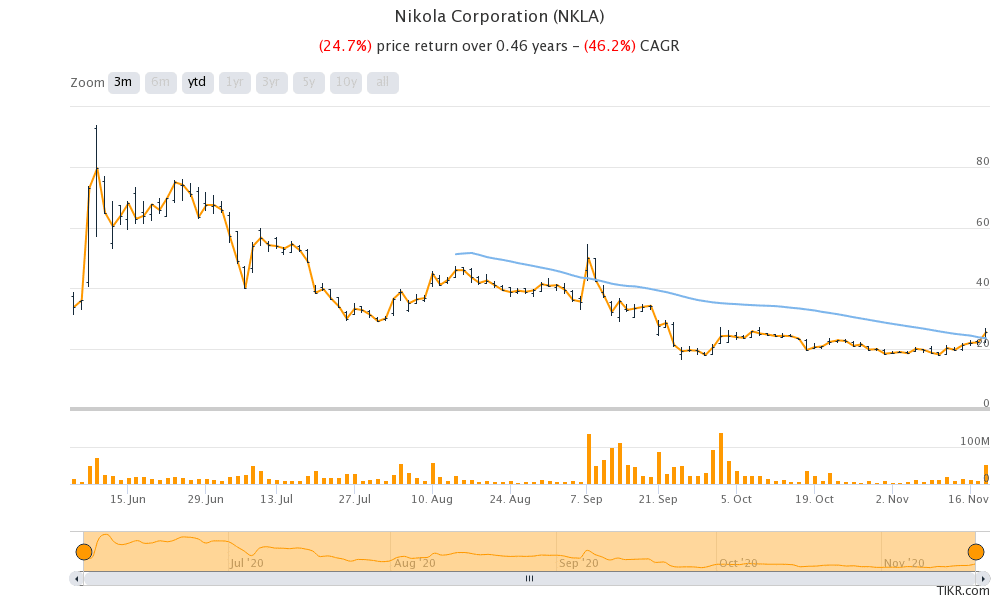

2020 has been a roller-coaster year for Nikola. It went public through the SPAC (special purpose acquisition company) route and soon its market capitalization soared above that of Ford Motors. Many had raised a red flag over its soaring valuations even as it did not even have a prototype for its upcoming vehicle.

Nikola GM partnership

Nikola stock rallied further after GM, America’s largest automaker, announced plans to invest $2 billion in the company. However, then came the shocker from Hindenburg Research which accused the company of “deception.”

Hindenburg Research

Hindenburg Research accused Trevor of using false statements to push the company into a $20 billion company. Taking a dig at Nikola’s partnership with General Motors, the report said that Nikola’s Founder and Executive Chairman Trevor “has inked partnerships with some of the top auto companies in the world, all desperate to catch up to Tesla and to harness the EV wave.”

Milton’s exit from Nikola

After the allegations made by Hindenburg Research, GM said that it is standing by its agreement. Meanwhile, after Hindenburg Research’s allegations, the US SEC opened an investigation into Nikola, and Milton Trevor resigned from the company. The closure of the GM-Nikola deal was later put on a hold.

Now, markets are again speculating on GM’s partnership with Nikola. Yesterday, a page on GM’s website that mentioned its partnership with Nikola was shared widely. “We signed an agreement with Nikola to engineer and manufacture the Nikola Badger using our Ultium battery system, and to be the exclusive supplier of Hydrotec fuel cells globally for Nikola’s Class 7/8 semi-trucks, except in Europe. The transaction has not yet closed.”

That said, the content has been there for quite some time now. However, in October, the last line related to the transaction’s closure was not there according to some screenshots. To sum it up, there is nothing new related to the GM-Nikola partnership that should trigger such a massive surge in Nikola’s stock price.

Electric vehicle stocks

But then, fundamentals have not meant much this year at least when it comes to electric vehicle stocks. Start-up electric vehicle stocks are commanding a higher market capitalization than established automakers. Tesla is now the world’s most valuable automaker with its market capitalization exceeding the combined market capitalization of Toyota Motors, Volkswagen, Fiat Chrysler, Ford, and General Motors.

In September, a little known company SPI Energy spiked 4,400% intraday just because it announced a subsidiary to produce electric vehicles. Many of the electric vehicle companies don’t currently have a model to sell and markets are valuing them based on pre-orders and hype.

Mary Barry might offer more insights on Nikola deal today

GM’s CEO Marry Barry would speak at Barclays 2020 Global Automotive Conference around 1:15 PM ET today. She is expected to outline GM’s electric vehicle plans at the conference and might also speak on the proposed partnership with Nikola.

General Motors and Ford are coming up with several electric vehicles over the next two years. Ford is coming up with the all-electric model of its F-150 pickup truck. The F-series trucks have been America’s best-selling pickup for decades and Ford hopes to take on Tesla’s Cybertruck with the all-electric version.

Analysts estimates

According to the estimates compiled by CNN, Nikola has a median target price of $26 which is 2% above its yesterday’s closing prices. Its highest price target of $47 is 85% premium over current prices while its lowest price target of $15 is 41% below current prices.

The stock was trading almost 3% higher in pre markets today and has a market capitalization of $9.7 billion.

You can buy stocks through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account