When the private equity swoop for Victoria Secret fell apart earlier this month, L Brands has been left to deal with distressed financials, closed stores, and a potential forced sale of its Bath & Body Works operation.

The Ohio-based fashion retail group is set to report its first-quarter earnings on Thursday and analysts are expecting a 34% decline in revenues amid the coronavirus pandemic, which has led the company to close down all of its stores in both the US and Canada. Revenues are expected to end the quarter at $1.77bn, down from $2.63bn the company made the previous year.

Meanwhile, quarterly losses for the owner of Victoria Secret and women’s fashion retailer PINK are expected to end the three-month period at $0.65 per share, compared to $0.14 per share the company earned during that same quarter last year.

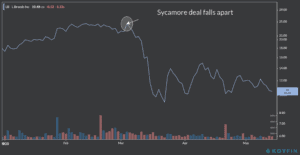

Shares in L Brands (LB) nosedived after the failed acquisition of Victoria’s Secret by the New York-based private equity firm Sycamore Partners. The stock slid 62.3% from 4 March, when the announcement was made, to 23 March, and have only recouped 11.5% since it touched a bottom at $9.17 per share. L Brand shares are trading down 2.5% at $12.39 on Tuesday morning, and have lost 29% of their value this year.

Some sources thought the company would pursue legal action if the deal collapsed, which consisted of the acquisition of 55% of Victoria’s Secret and its related brands by Sycamore for $525m.

However, when the deal fell through on 4 May the health crisis gave it more pressing thing to think about. L Brands chairman Sarah Nash said the business preferred to “focus our efforts entirely on navigating this environment to address those challenges and positioning our brands for success rather than engaging in costly and distracting litigation to force a partnership with Sycamore”.

The deal would have injected some much-needed cash into the troubled retailer and would have alleviated its finances from Victoria Secret’s poor financial performance in recent years.

The company is now considering a separation of one of L Brands’ crown jewels, Bath & Body Works, while the rest of the brands, including Victoria’s Secret and PINK, may be reorganized as stand-alone companies.

As part of its efforts to contain the financial fallout caused by the health emergency the company has already canceled its quarterly dividend, reduced capital expenditures to $250m, furloughed most of its employees, suspended rent payments, and cut inventory receipts by more than 20%.

On April 30, L Brands said it had around $900 in cash, while it also converted a $1bn revolving credit facility into an asset-backed bank loan due in 2024. L Brand’s liabilities by the end of 2019 amounted to $11.6bn, not including the $1bn credit line, while assets sat at $10.12bn, which means the company is operating with negative equity.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account