The asset management unit of JP Morgan just launched two actively-managed exchange-traded funds (ETFs), as it bids to chip away at the dominance of larger rivals.

The JP Morgan International Growth ETF (JIG), exposes investors to growth opportunities beyond US borders by investing in shares of companies overseas that present interesting growth potential, as other countries appear to be recovering quicker than the US after the pandemic struck the global economy.

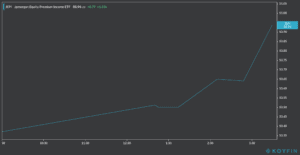

Meanwhile, the JP Morgan Equity Premium Income (JEPI) is designed to attract investors seeking a steady stream of income derived from corporate dividends without exposing their portfolios to higher volatility, offering monthly distributions and relying on the expertise the bank’s equity management team, led by industry veteran Hamilton Reiner.

Reiner, JEPI’s portfolio manager, said: “JEPI provides an attractive solution to help investors realize their financial goals and round out their portfolios with conviction”.

Meanwhile, Bryon Lake, the head of Americas ETF distribution for the New-York based bank, added: “We are eager to combine our firm’s global active equity management platform with the benefits of the ETF technology as part of the next wave of active solutions we bring to market for our clients”.

These actively-managed ETFs will be transparent financial vehicles, which means that they will disclose their holdings to investors in real-time, contrasting other similar offerings that report their holdings with a certain delay or only partially.

Actively-managed exchange-traded funds (ETFs) have a higher portfolio turnover, which means that they buy and sell securities more often than passively-managed ETFs, which commonly results in higher expense ratios for investors, even though actively-managed alternatives are traditionally seen as a better choice during times of financial turmoil.

JP Morgan manages $1.9trn of assets for its clients, of this $36.1bn are held in EFTs. By comparison, the world’s largest fund manager BlackRock manages $2trn of ETF assets, which is roughly a third of global ETF assets.

Last month, BlackRock cut the fees on its largest ETF by one basis point, 0.01%, to match the charges of its rival Vanguard.

BlackRock said it would now charge 0.03% for its iShares Core S&P 500 ETF which has assets under management (AUM) of $195bn making it the second-largest ETF tracking the S&P 500. The largest S&P 500 ETF is State Street’s SPDR S&P 500 ETF with an AUM of $296bn. Vanguard ranks third and its S&P 500 ETF has AUM of $124bn.

State Street charges a fee of 0.09% on its S&P 500 ETF which is three times what BlackRock and Vanguard charge.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account