Paulson & Co, the hedge fund run by billionaire investor John Paulson (pictured), has upped its stake in jewelry maker Tiffany & Co (TIF), which is in the middle of a sale to luxury goods giant LVMH.

The New York-based investment fund disclosed a 350% increase in its stock position in Tiffany, owning 603,800 shares by the end of the first quarter of 2020, valued at around $77m on current prices, according to a recent regulatory filing.

Paulson’s decision to stockpile shares of the US jewelry retailer comes at a time when Tiffany’s is moving forward with an acquisition by luxury brand holding LVMH, headed by French billionaire Bernard Arnault, at a price of $135 per share, valuing the business at $16.2bn.

Tiffany’s board of directors has already approved the acquisition, but the completion of the deal has been pushed back to October 2020, after Australia’s foreign investment regulator asked for a postponement.

According to this recent filing and the price offered by LVMH, Paulson’s transaction would net a potential $2m for his hedge fund, even though it is unclear if the billionaire plans to hold on to the stock for a longer period.

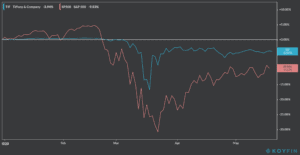

Tiffany shares recouped from their 23 March bottom that followed the coronavirus sell-off and have been trading relatively in line with their early-2020 prices as the completion of LVMH’s acquisition seems like a done deal.

The stock is trading at just over $126 and has only lost 6% of its value so far this year, compared to an 8.8% drop in the S&P 500 during the same period.

Paulson’s stake at Tiffany seems to follow the billionaire’s event-driven philosophy, which seeks to profit from mergers, bankruptcies, restructuring and other corporate events that may boost the value of the hedge fund’s holdings once things are settled.

After a successful career in investment banking, John Paulson founded Paulson & Co. in 1994 to put his experience at mergers and acquisitions to work.

In 2005, the fund took a short position on credit default swaps, anticipating the collapse of the subprime mortgage market. After the crisis unfolded, Paulson jumped to Wall Street’s hall of fame by racking up around $15bn in profits in 2007. His investment fund manages around $8.7bn for his investors according to recent estimates.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account