Intel Corporation has been one of the best performing Dow stocks of the past one month. Shares are up a big 11 percent, compared to a 6 percent gain in the DJIA during the same period.

However, one noted technical analyst and trader reckons Intel has run into significant resistance, and is ripe for a major correction.

Is the Intel Corporation Rally Over?

“I think Intel is overbought and due for a sell off,” Andrew Keene of AlphaShark Trading told CNBC. “We’ve had this nice run off the low, but we are finding sellers here at $32.”

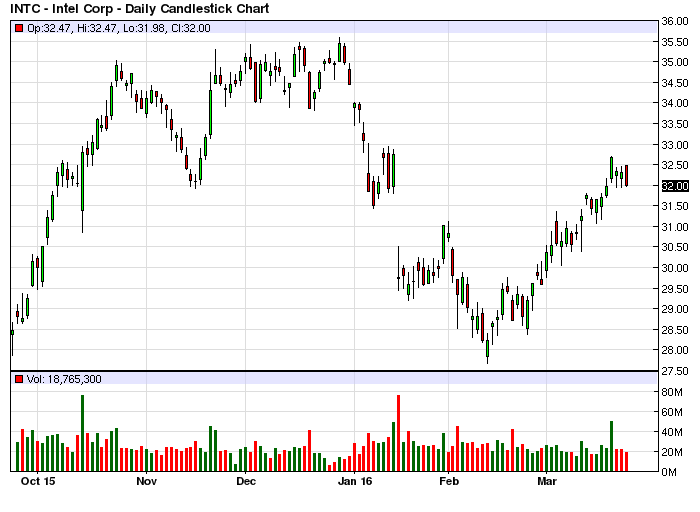

A look at the daily price chart of Intel Corporation shows that $32 coincides with multiple price pivots made in the past. The last time it went there was in January, when sellers came in droves, and hammered the stock lower. “I think that is going to serve as resistance,” Keene added.

Furthermore, the longer term Intel chart shows that shares are kissing the 100 week moving average, which Keene expects to be another key price ceiling.

To play this projected dip in the stock, Keene has bought the April 32/31 put spread at 25 cents apiece. The put spread is a bearish options strategy where a trader buys a put and then sells a lower strike price put of the same expiry to offset the cost of initiating the trade. The goal, in this case, is for the underlying stock to drop to the short strike, or $31 by April. That’s close to 3 percent lower than Intel’s Wednesday closing price.

“If Intel can end up at $31 or lower, I can end up with 300 percent returns within 3 weeks,” Keene said.

Wall Street Still Bullish on Intel Corporation

Despite the bleak outlook from technical charts, a majority on Wall Street expect Intel Corporation shares to continue outperforming the broader market. The average rating of the 44 analysts covering the stock is “overweight,” with a 12 month target price of $36.07 a share, according to a Thomson Reuters poll.

Earlier this week, Teresa Rivas wrote in Barron’s that given the strength of its data center business, Intel shares could rise a further 25 percent. Another top market voice, John Pitzer of Credit Suisse, recently reiterated his “buy” rating on the stock with a $40 price target, amid the growing supplies to Apple Inc’s iPhone.

Shares of Intel Corporation ended yesterday at $32, down 1 percent for the session. The stock has a 52 week high of $35.59, and a 52 week low of $24.87.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account