Google has opened up its conversational AI service Bard to trusted users as the company looks to protect its turf from OpenAI’s ChatGPT which many see as a major threat to the company.

In a blog post, Alphabet CEO Sundar Pichai said, “Bard seeks to combine the breadth of the world’s knowledge with the power, intelligence and creativity of our large language models. It draws on information from the web to provide fresh, high-quality responses.”

The company has been working on the platform for some time now and would eventually release it to all users in the coming week.

Notably, the dominance of Google and Facebook in the US digital ad market has come down and last year their combined market share fell below 50% for the first time since 2014.

Google launches Bard to take on ChatGPT

In the blog post, Pichai added, “We’re releasing it initially with our lightweight model version of LaMDA. This much smaller model requires significantly less computing power, enabling us to scale to more users, allowing for more feedback.”

He added that the company would utilize both external and internal feedback to ensure that Bard meets a “high bar for quality, safety and groundedness in real-world information.”

CNBC reported that Google’s AI chief, Jeff Dean told employees that the company is “more conservatively than a small startup” because of the “reputational risks” that it faces.

The move comes as ChatGPT continues to make waves globally. Last month, Microsoft announced a multi-billion dollar investment into OpenAI. The investment would be spread across several years but Microsoft hasn’t disclosed the exact amount.

Microsoft is working on ChatGPT powered version of Bing

Microsoft’s CEO Satya Nadella commented, “In this next phase of our partnership, developers and organizations across industries will have access to the best AI infrastructure, models, and toolchain with Azure to build and run their applications.”

Microsoft is said to be working on a ChatGPT-powered version of Bing to take on Google which has dominated the landscape for years.

Google Is Quite Optimistic on Bard

Google meanwhile sounds quite optimistic about Bard. Pichai said, “Bard seeks to combine the breadth of the world’s knowledge with the power, intelligence and creativity of our large language models. It draws on information from the web to provide fresh, high-quality responses.”

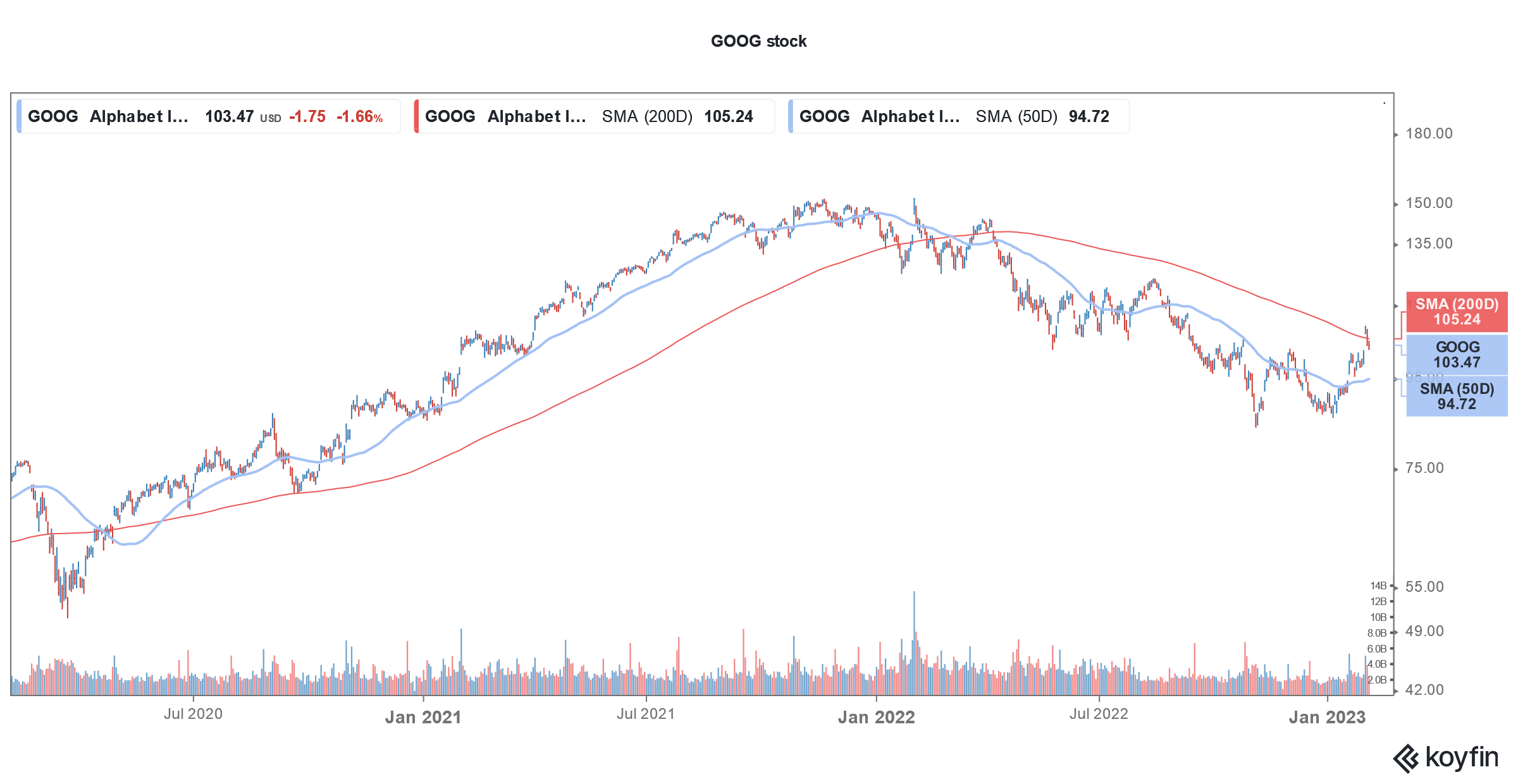

Bard’s success would be crucial for Google-parent Alphabet as the company battles slowing growth and rising competition. In Q4 2022, Alphabet’s revenues rose only about 1% YoY. Both Google search and YouTube revenues fell in the quarter. For YouTube, it was the second consecutive quarter of degrowth.

Google search revenues fell in Q4 2022

Along with the slowdown in the digital ad market, YouTube also faces headwinds from TikTok. Amid slowing growth, last month, Alphabet announced that it is trimming its workforce by 12,000, or 6%. Many other US tech companies with the notable exception of Apple have also announced mass layoffs. Companies relying on digital ad dollars have especially been hit hard.

Snap’s fortunes have also nosedived

Snap posted revenues of $1.30 billion in Q4 2022 which was slightly below the $1.31 billion that markets were expecting. The company’s revenues were similar to the corresponding quarter last year.

It is nonetheless the slowest pace of rise since the company went public in 2017. Snap’s revenue growth had previously stalled to an all-time low of 6% in Q3 2022. In the full year, the company’s revenues increased 12% to $4.6 billion.

The slowing digital ad market has hit Google

To put that in perspective, Snap’s revenues rose 64.2% in 2021. In the preceding three years, the company’s revenues rose by over 40% every year. There has been a slowdown in digital ad sales which has taken a toll on the revenues of Google and Facebook.

Incidentally, like Google, Facebook-parent Meta Platforms is also betting on AI. In the long term though, Meta Platforms’ CEO Mark Zuckerburg believes that metaverse would fuel the company’s growth.

He was meanwhile quite sanguine and said that the high growth rates that Meta Platforms has witnessed in the past might not be repeated. Meta Platforms’ revenues fell YoY in 2022. The lower end of the company’s Q1 2023 guidance implies yet another quarter of revenue decline. However, the top end implies a slight growth in revenues.

Alphabet also faces regulatory scrutiny

Meanwhile, both Google and Facebook are facing increased regulatory scrutiny. The US Department of Justice has sued Google for the alleged monopoly in the ad-tech business.

“For 15 years Google has pursued a course of anticompetitive conduct that has allowed it to halt the rise of rival technologies, manipulate auction mechanics, insulate itself from competition, and forced advertisers and publishers to use its tools,” said Attorney General Merrick Garland at a press conference.

DOJ Wants to Break Google Ad-tech business

The Department wants to break Google’s ad-tech business. Garland emphasized, “Google has engaged in exclusionary conduct that has severely weakened if not destroyed competition in the ad-tech industry.”

India too fined Google for the alleged monopoly. It also lost an antitrust case in the European Union, but in a reprieve, the region’s General Court reduced the fine.

All said, ChatGPT is probably the biggest threat that Google has faced in a long time. That’s why Bard’s success becomes all the more crucial for Alphabet.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account