Gold is plunging this morning to a 4-month low as investors keep shunning safe havens amid vaccine optimism.

The price of the precious metal is diving for the second day in a row, currently losing 1.4% at 1,811 per ounce, after dropping almost 1.8% yesterday following an announcement from British vaccine maker AstraZeneca which showcased what would be the third highly effective vaccine developed by Western companies.

Gold’s pullback today comes despite a retreat in the US dollar – as reflected by Bloomberg’s US dollar index – with the greenback sliding 0.2% so far in early forex trading activity at 92.296.

This would be the precious metal’s sixth losing session in the past seven days and experts coincide that today’s move could mark what could be the beginning of a full-blown trend reversal.

Other factors driving gold’s downtick today include Bitcoin’s increased appeal as a safe-haven among the younger generations – and even among a group of professional investors – as the cryptocurrency keeps advancing above the $19,000 level amid a market-wide risk-on attitude.

Only a few days ago, a chief investment officer from America’s top asset manager, Blackrock, said that Bitcoin could replace gold as it offered a “more functional” way to be distributed, referring to how easy it is to transfer Bitcoin in contrast to the hurdles of transporting and storing physical gold bars.

Although multiple risks are still threatening the short-term stability of equity markets, investors seem to be shunning gold and the downtrend could be more pronounced in the coming days as the precious metal has slipped below major supports.

What’s next for gold?

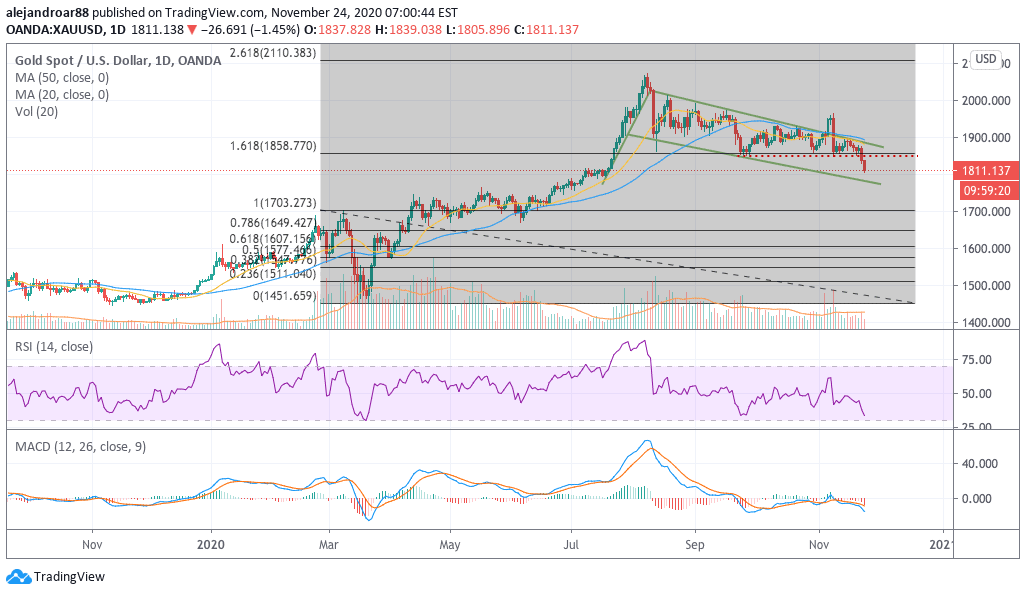

The chart above shows how the spot price of gold slipped below its $1,860 historical support level just yesterday while it could retest the lower trend line shown in the chart – which could be seen as the last line of defense for the precious metal before it melts to the low 1,700s.

Gold’s $1,860 support served as a stronghold for the price action during the August, September, and November downticks, which increases the importance of today’s breakout as a potential trend reversal signal.

The outlook for the precious metal remains bearish, especially as the backdrop is not as favorable as it was a few months ago, since the prospect of en-masse vaccinations during the first quarter of 2021 – at least in the United States and other developed countries – keeps prompting a risk-on attitude among investors.

That said, a weaker US dollar could cushion gold’s free-fall, as accommodative policies from central banks around the world – including the Federal Reserve – are likely to remain unaltered for the following years, while further fiscal stimulus from US Congress could also contribute to weakening the greenback.

For now, a key level to watch would be the $1,780 – $1,770 level – gold’s lower trend line shown in the chart. If the price slips below that threshold the likelihood of seeing gold trading at or below $1,700 would increase dramatically.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account