GameStop (NYSE: GME) stock is trading higher in US price action today despite posting mixed earnings for the second quarter. The stock is among the favorite names among meme stock traders.

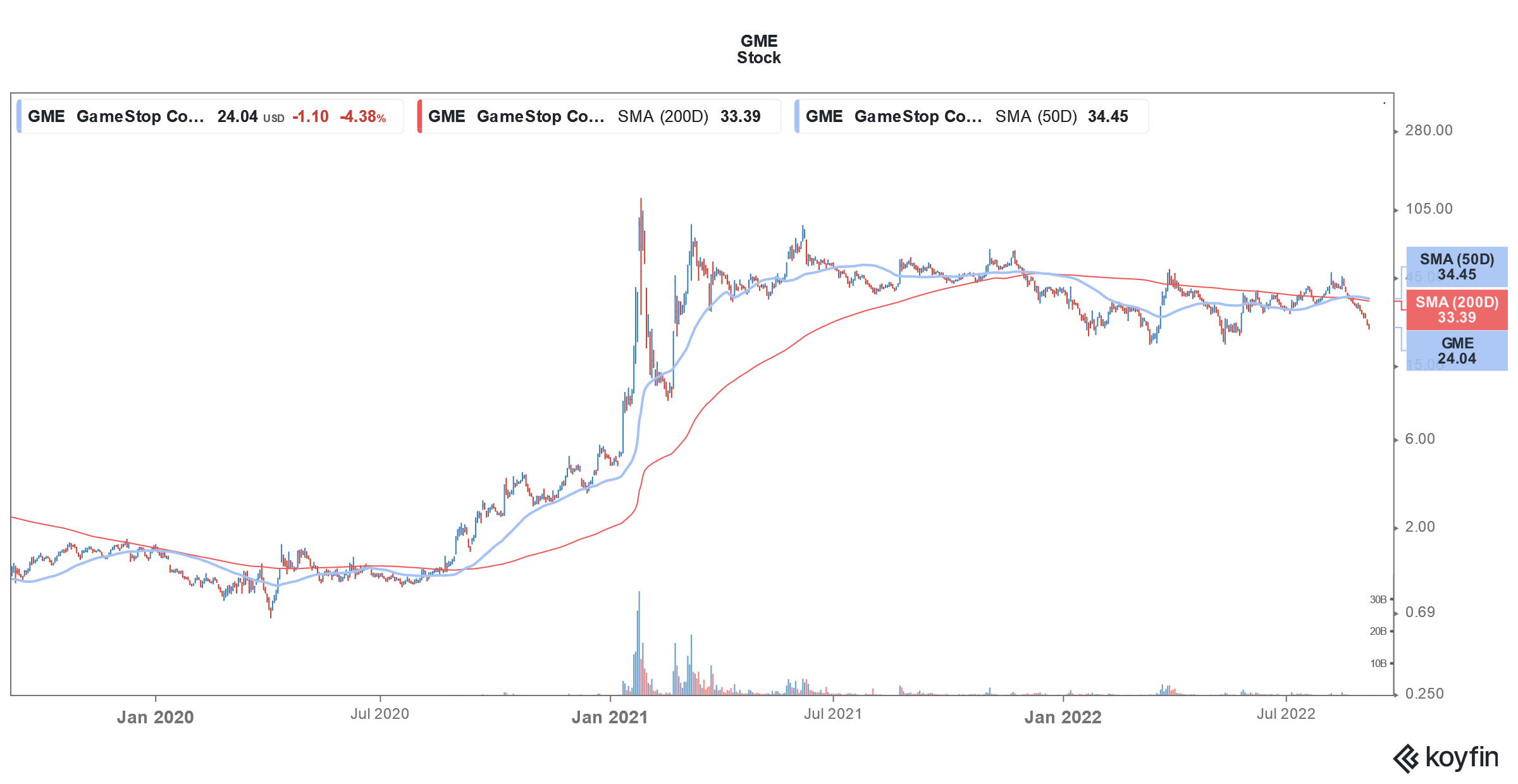

GameStop has lost almost a third of its market cap this year as the carnage in meme stocks has continued. Like fellow meme companies, GME has also been looking at “alternate” ways to create stockholder wealth. It recently split its stock, a step which was welcomed by its retail investors.

AMC Entertainment also gave a preferred stock per common stock to its stockholders. The company also offered NFTs previously to stockholders. They also enjoy free popcorn at its cinemas.

As for GameStop, the company has been trying to turn around the business and diversify from a brick-and-mortar gaming retailer. The strategy hasn’t yielded much, at least when it comes to the numbers.

GameStop posted mixed earnings in the second quarter

GameStop posted revenues of $1.14 billion in the second quarter which was below the $1.18 billion that it had posted in the corresponding period last year. The revenues also fell short of the $1.27 billion that analysts were expecting. The company meanwhile said that sales of collectibles rose to $223.2 million from $177.2 million.

GameStop has been trying to grow the business as part of its turnaround efforts. However, higher collectible sales could not offset the steep fall in hardware and software sales and GME’s revenues fell on a YoY basis.

Meanwhile, GameStop posted an adjusted loss per share of 35 cents which was below the 42 cents that analysts were expecting. Its per-share loss was nonetheless wider than the 21 cents that it posted in the corresponding quarter last year.

GME did not provide any guidance

As has been the case for almost two years, GME did not provide any guidance nor did it take any analyst questions. GameStop CEO Matt Furlong began the earnings call by appreciating, “stockholders’ unrivaled enthusiasm, passion and support.” He added, “As we work to transform GameStop, these remain unique tailwinds for us, ones we always recognize and value.”

Furlong joined GME after activist investor Ryan Cohen started to take an active interest in the company. Cohen is the largest GME stockholder and has been driving several changes at the company.

GameStop also hired Mike Recupero as the CFO. However, the company fired him in July as part of cost cuts. GME also announced several layoffs that month.

GameStop is looking to increase its target market

In March 2021, while releasing its Q4 2020 earnings, GameStop said that it is looking to expand its market size. It said, “We are continuing the work to expand our addressable market by growing GameStop’s product catalog. This includes growing our product offerings across PC gaming, computers, monitors, game tables, mobile gaming and gaming TVs, to name only a few.”

It expects its target market to rise five-fold with the changes. Also, it would help reduce the cyclicity in its business by ending its reliance on console launches.

GME announced a partnership with FTX

GameStop announced a partnership with cryptocurrency exchange FTX. FTX, which was founded by Sam Bankman-Fried, has been bailing out several small crypto exchanges. Sam Bankman-Fried also took a stake in Robinhood. Many speculated that he would eventually acquire Robinhood. However, given the dual share structure, he won’t be able to take control of the company without getting the founders on board.

Commenting on the FTX deal, GameStop said, “The partnership is intended to introduce more GameStop customers to FTX’s community and its marketplaces for digital assets. In addition to collaborating with FTX on new ecommerce and online marketing initiatives, GameStop will begin carrying FTX gift cards in select stores.”

It added, “During the term of the partnership, GameStop will be FTX’s preferred retail partner in the United States.” Meanwhile, the company did not provide any financial details of the deal.

Wall Street analysts are bearish on GameStop

Wall Street analysts continue to remain bearish on GameStop and most don’t buy the turnaround under Cohen. Wedbush Securities analyst Michael Pachter, who is bearish on GME, said before the earnings call that with Cohen, “you have a guy who has a lot of success in selling merchandise to people who make recurring purchases, like dog owners.”

Notably, Cohen rose to fame with Chewy, which he co-founded and later sold. He successfully took on giants like Amazon with Chewy and many expect him to repeat the magic at GameStop also.

However, Pachter said, “He’s trying to apply that model to a consumer who does not make recurring purchases. And he’s competing with console manufacturers who deliver games electronically and consumers who prefer to download games electronically as well.”

While Cohen has been trying to position GME as a tech company and has hired many executives from tech giants like Amazon and Alphabet, not all are convinced that hiring tech executives would help turn around GameStop.

GME is debt free now

Thanks to the meme stock frenzy, GME is now a debt-free company. It had $908.9 million as cash on its balance sheet at the end of the second quarter. Like fellow meme stocks, GameStop raised cash by selling shares multiple times. However, while the stock sale helped it become debt free, it has also led to a bloated share count.

In his final comments during the earnings call, Furlong said, “we’re working to accomplish something unprecedented in our industry, transform a legacy brick-and-mortar retailer into a technology-led organization that meets customers’ needs through stores, e-commerce properties in both digital marketplaces and new online communities.”

He added, “Our path to becoming a more diversified and tech-centric business is one that obviously carries risk and will take time.”

That said, GameStop is operating in a tough environment where gaming is moving online. Even online gaming is witnessing a slowdown and Nvidia’s gaming revenues fell by a third in the most recent quarters. Amid a sagging core gaming retail business, GME has pivoted to NFT marketplace and now the FTX partnership to revive its fortunes.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account