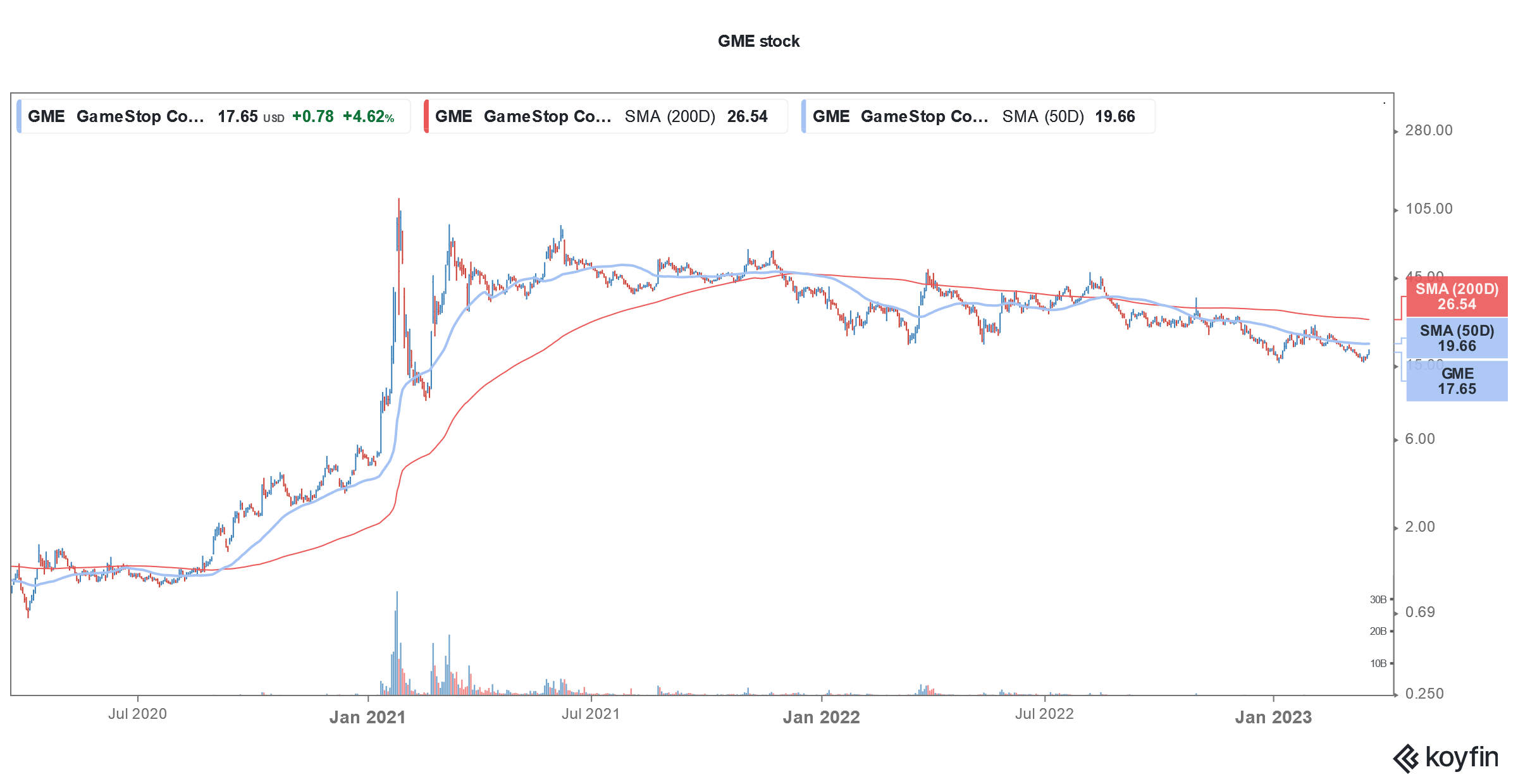

Meme stock darling GameStop (NYSE: GME) is trading sharply higher in US premarket price action today after reporting a surprise profit for the fourth quarter of the fiscal year 2022. Is a short squeeze coming?

GameStop reported revenues of $2.23 billion in the fiscal fourth quarter that ended on January 28. While sales were below the $2.25 billion that it posted in the corresponding quarter in the previous fiscal year, they were ahead of the $2.18 billion that analysts were expecting.

In the full fiscal year, the company reported revenues of $5.93 billion which were slightly below the $6.01 billion that it generated in the previous fiscal year.

GameStop reported better-than-expected revenues

While sales of gaming hardware have been in a perennial decline, GameStop said that sales of collectibles increased YoY terming it as “an area in which the Company continues prioritizing long-term growth.”

Meanwhile, GameStop posted a net profit of $48.2 million in the quarter while analysts were expecting it to post a loss. It is the first time in two years that GameStop has posted a profit.

The company has been working to cut costs and has lowered its retail footprint drastically over the last two years. It has instead been working to increase online sales. GameStop has also trimmed its workforce in order to reduce its cost base.

GME has reduced its cost base

In the fiscal fourth quarter of 2022, GameStop’s SG&A (selling, general, and administrative) expenses were 20.4% of revenues as compared to 23.9% in the corresponding quarter in the previous fiscal year.

During the earnings call, GME CEO Matt Furlong said, “Although there is a lot of hard work and necessary execution in front of us, GameStop is a much healthier business today than it was at the start of 2021.” He added that the company now has “a path to full-year profitability.”

Furlong joined GME after activist investor Ryan Cohen started to take an active interest in the company and took over as the chairman. Cohen is the largest GME stockholder and has been driving several changes at the company.

As has been the case for almost two years, GME did not provide any guidance nor did it take any analyst questions.

GameStop reduced inventory

Like many other retail companies, GameStop was saddled with excess inventory. However, it managed to lower its inventory to $682.9 million, down from $915 million in the previous fiscal year.

The company ended the fiscal year with cash and cash equivalents of $1.391 billion and has little debt on its balance sheet.

Thanks to the meme stock frenzy, GME is now an almost debt-free company. Like fellow meme stocks, GameStop raised cash by selling shares multiple times. However, while the stock sale helped it become debt free, it has also led to a bloated share count.

GameStop called off the FTX partnership

GameStop has been working to increase its revenue streams and also diversified into digital assets. Last year, it announced a partnership with now-bankrupt FTX. However, the deal was called off within two months.

There has been turmoil in cryptocurrency markets. While the market has recovered in 2023, it is still way below the 2021 highs.

GME is working on profitability

During the earnings call, Furlong said, “Looking ahead, we’re aggressively focused on year-over-year profitability improvement while still pursuing pragmatic long-term growth.”

It highlighted several steps that it is taking to achieve the goals. These include cutting costs in Europe, where it has already initiated partial wind-downs and exits in some countries. It is also working to get better terms from vendors and ensuring to get full console allocation to meet demand.

It is also expanding the high-margin toys and collectible business. Furlong concluded the earnings call by saying, “We’re going to aggressively pursue further cost containment, efficiency, profitability and pragmatic growth in the categories where we can consistently delight our customers.”

Wall Street is still not impressed with GameStop

Meanwhile, Wall Street analysts are still not convinced about GME. In a client note, Wedbush analyst Michael Pachter said, “Long-term headwinds include potential liquidity challenges and changing gamer preferences, with greater appetites for cloud, digital mobile and subscription.”

Pachter, who has a $5.3 target price on GameStop emphasized, “The shares remain at trading levels that are disconnected from the fundamentals of the business due to irrational support from some retail investors.”

Is a short squeeze coming in GME stock?

Traders now see another short squeeze rally in GME stock. During the 2021 short squeeze, retail traders got the best of Wall Street hedge funds as their buying support took names like GameStop and AMC Entertainment to astronomical levels.

Funds that were short on meme stocks suffered massive losses as the shares soared on the short squeeze. However, the rally soon reversed course and the macroeconomic slowdown and higher interest rates did not help the cause of meme stocks either.

GameStop’s surprise profit has charged up meme stock traders and even AMC shares are up sharply in premarkets. Meanwhile, it remains to be seen how long the rally can stretch amid the broader market weakness.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account