Tech stocks have emerged as big winners of the pandemic as lockdowns force businesses and consumers to rely on technology to shop, work, and play.

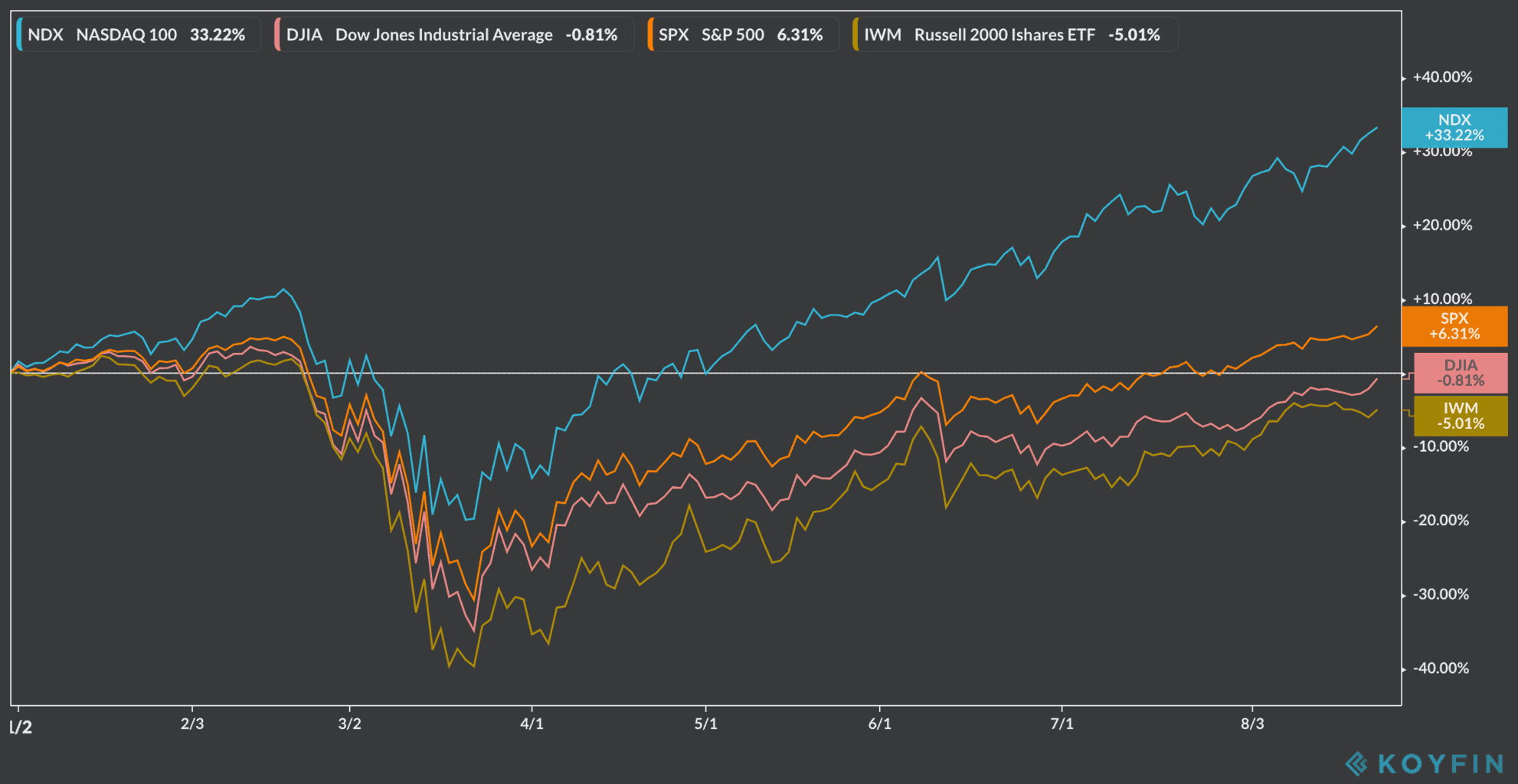

This tech boom is reflected by the gains of the tech-heavy Nasdaq 100 index, which jumped 33% g this year after hitting fresh all-time highs On Monday, outperforming other broad-market indexes including the S&P 500, the Russell 1000 and the Dow Jones by 27%, 34%, and 38% respectively.

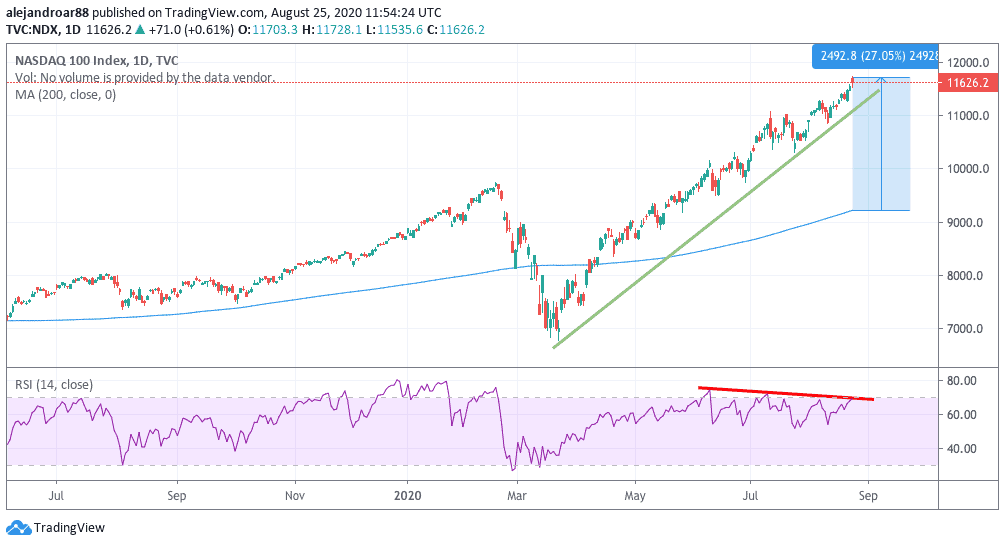

With a lot of stocks in this sector trading at lofty valuations and the Nasdaq stretching roughly 27% above its 200-day moving average, experts surveyed by CNBC talked about what comes next for these stocks as well as the broader market.

Nasdaq 100 index YTD performance vs. other broad-market indexes – Source: Koyfin

Future growth may be priced into tech stocks already

David Bailin, chief investment officer at Citigroup Private Bank, pointed out that the future of many tech stocks is already priced in, which may mean that share prices might stay relatively flat in months or even years to come.

He said: “Take a look back at the history of Microsoft. There was a period when, for five years, their earnings and cash flow trebled and the stock was relatively flat.”

He added that although tech continues to be an attractive sector, more value-oriented companies such as industrials and even small tech firms and foreign stocks are currently offering more upside as their valuations are more conservative than those of high-flying big tech companies.

Sector rotation is expected

“I think you could see a bit of a rotation maybe in some of the high flyers”, said Stephanie Link, chief investment strategist at Hightower.

She added: “But I think you want to still have exposure to secular growth tech, because they really do have these amazing total addressable markets and this amazing growth potential”.

Other experts have also warned that a major risks for the market at the moment is sector rotation – a move away from growth stocks to value stocks triggered by a progressive economic recovery.

Considering what some see as overstretched valuations, any massive move away from big tech could push the Nasdaq 100 down in a move known as mean reversion.

Tech stocks will emerge stronger than they were before the pandemic

However, Jim Suva, managing director at Citi, added that tech stocks will get out of the pandemic much stronger than how there entered it, pointing to the upcoming rise of 5G technology and their ability to deploy extra resources into innovation and talent hiring as potential catalysts from stronger future growth.

Suva said: “Things are going to be stronger, there’s going to be more innovation, there’s going to be more new products coming out”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account