How to Buy the Best 5G Stocks of 2021

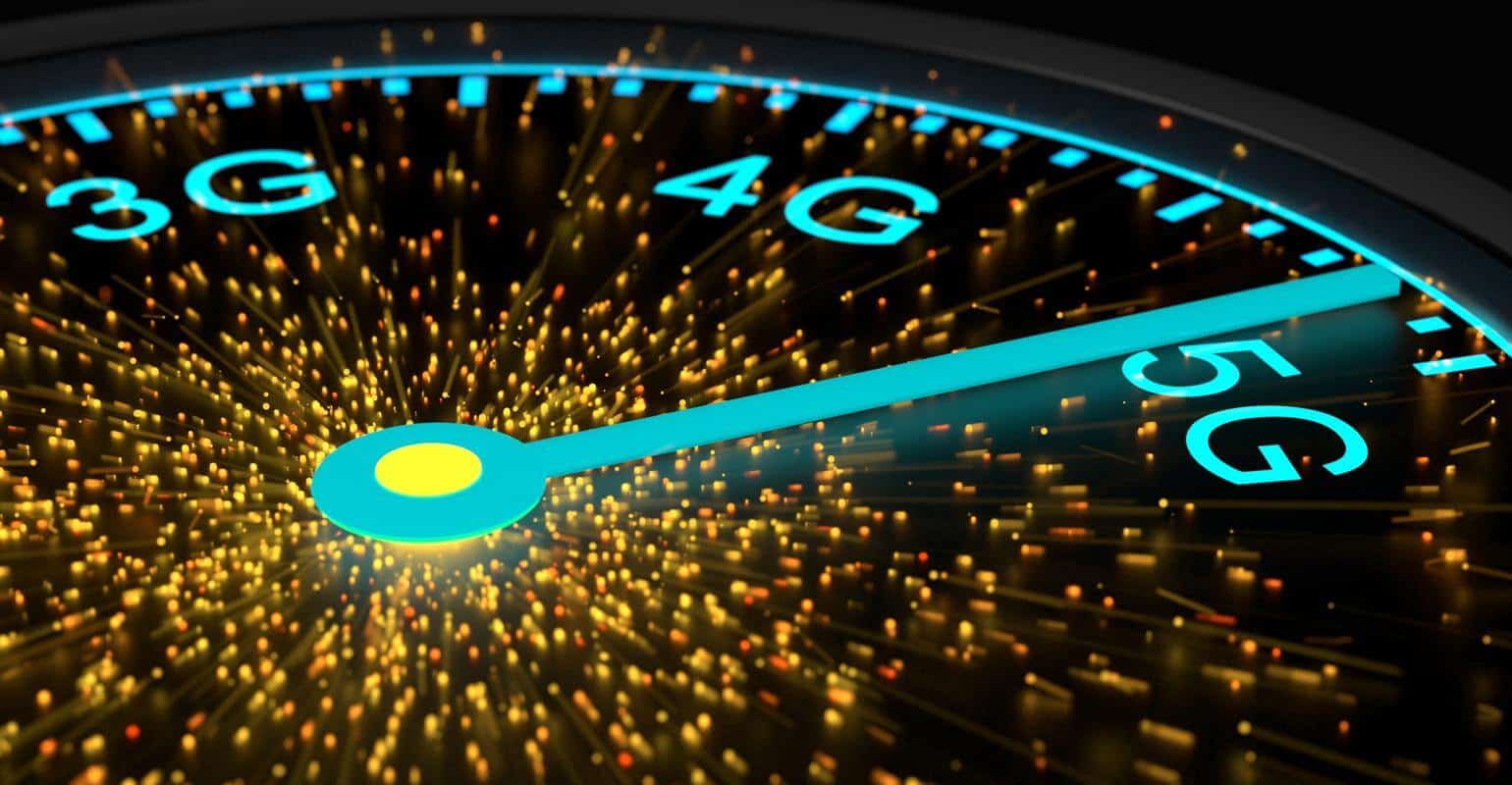

In the coming years, most countries around the world will begin to switch from 4G to 5G cellular networks, ushering in a new wave of innovation and digitalisation. 5G will bring about speeds approaching several gigabits per second (about 50x faster than 4G), better reliability, and will enable a more connected and intelligent world.

The industry is still nascent, with delays, engineering challenges and cross-border controversies slowing its development. However, many believe that 5G will usher in a new digital gold rush by enabling new and disruptive technologies that simply could not function on 4G networks. In this context, many companies are looking to profit from the 5G gold rush, and now may be a good time to buy 5G stocks.

Considering buying 5G stocks today? In this guide, we will introduce 5G technology and 5G stock investing, review some of the best 5G stocks in 2021 and show you where to buy them!

-

-

Buy 5G Stocks in 3 Quick Steps

In a hurry? No problem. Simply following these 3 steps is all you need to get started buying 5G stocks now!

[three-steps id=”202485″]Where To Buy 5G Stocks?

Before buying 5G stocks, you will need to open an account with a licensed online stock broker. Below are some of the best names in the online broking business.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

How To Buy 5G Stocks Using eToro

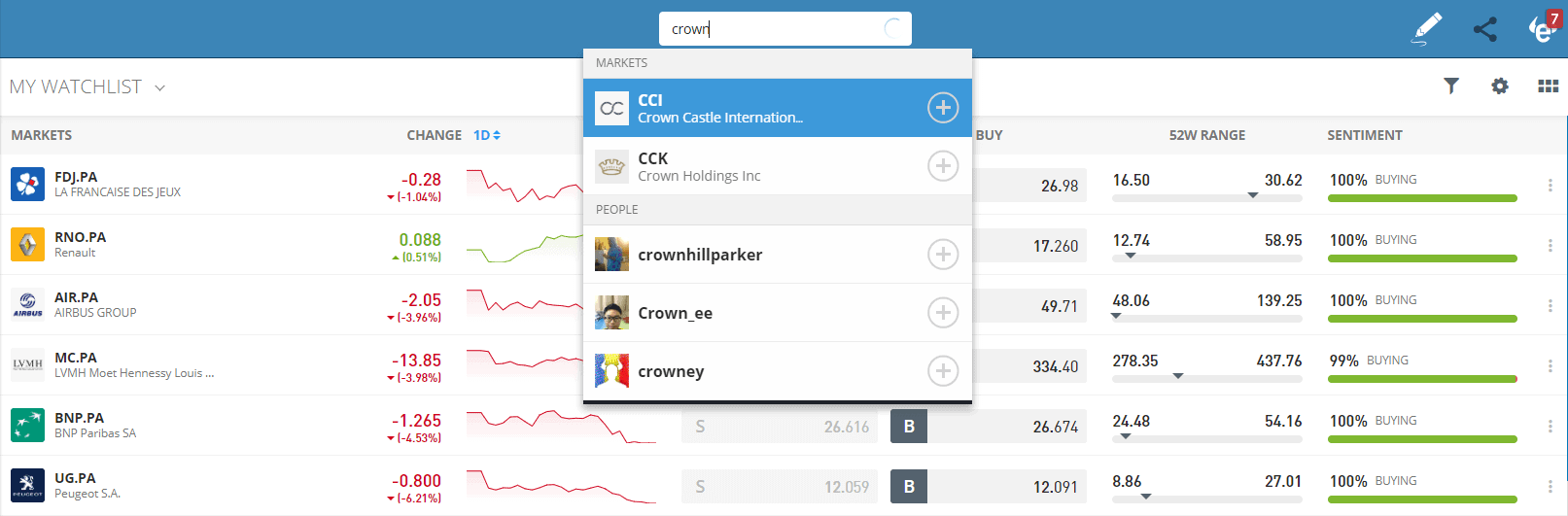

Step 1: Search for your preferred 5G stock

Choose the 5G stock you want to buy then look for it (or for its ticker) in the eToro search bar. You will see both stocks and user names appear: the latter will help you find other traders, review their past performances and trade alongside them as part of eToro’s flagship CopyTrader social trading system.

Below, we use Crown Castle International (reviewed in this article) as an example.

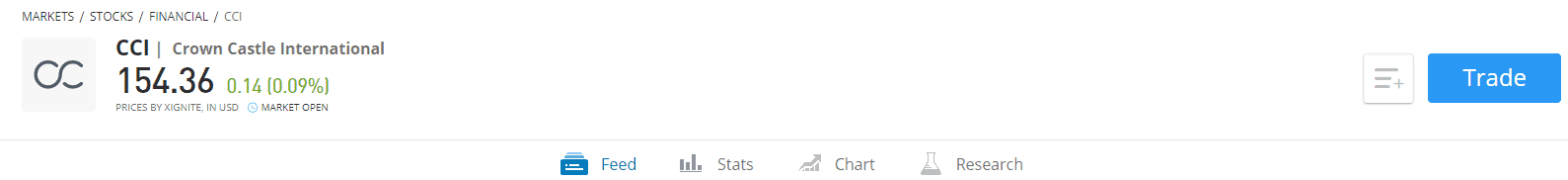

Step 2: Click “Trade”

Once you reviewed the stock and want to buy it, click the “trade” button to get started with the trading interface. Make sure that you’re using eToro’s “Virtual Portfolio” (eToro’s free demo account) for paper trading or your own portfolio if you want to invest your own money.

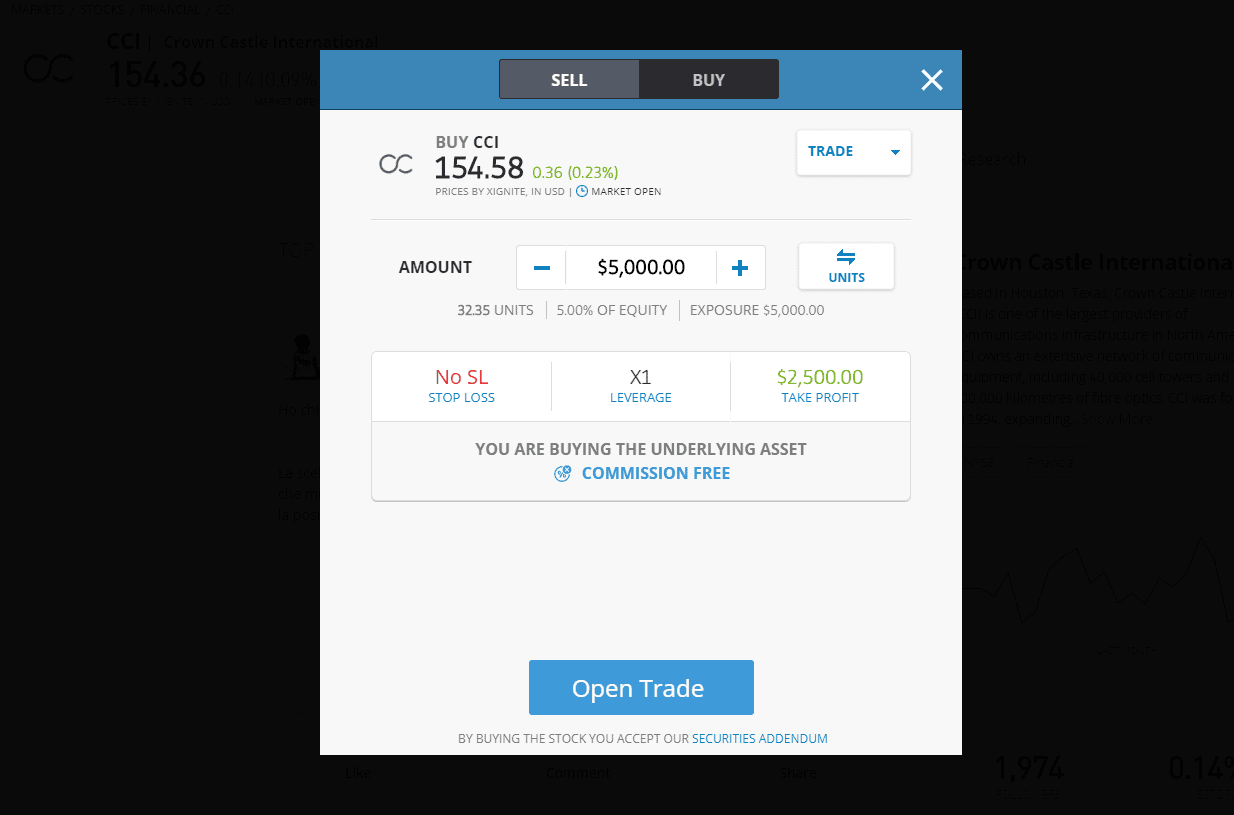

Step 3: Choose how much to buy and specify your options

Clicking “Trade” will take you to the trading window, where you can specify how much to buy or sell with what options.

On eToro, long (“buy”) orders without leverage are executed directly, and all other trades are made via CFD. The default trade is a market order, but you can specify a limit and even use special order types (take-profit and stop-loss).

You can then specify how much you want to buy, in terms of the number of shares or dollar amount to committing to the trade. If you wish to increase your exposure, you may add leverage to your trade (up to 3:1 for stocks). Leveraged trading amplifies the risk, so make sure you understand well the position you’re taking before executing your order.

In the trading window, you will see a recap of the fees (if you trade via CFDs, direct orders are commission-free) and of the exposure (in dollar amount and in the percentage of your equity) that trade entails.

Before opening a trade, make sure you understand the risks & the fees and that you have done your own careful research, particularly if you are using leverage.

Ready to trade? Simply click “Open Trade” to get started!

Background on 5G Technology

5G (G stands for “generation”) is the new generation of cellular networks, delivering average speeds over 50 times faster than legacy 4G networks. While the maximum theoretical speeds of 3G and 4G where 42Mbps and 1Gbps (gigabit per second), 5G offers a maximum theoretical speed of 10Gpbs, the equivalent of an ultra-HD movie downloaded in under a second.

The raw speed is not simply a matter of convenience: it will enable new technologies with endless potential commercial applications. As homes, cars, planes and personal devices become more and more intelligent, the “Internet of Things” (IoT) becomes increasingly omnipresent. In this context, the need for faster data transmission is growing more acute.

As an example, cars may already have partial self-driving functions thanks to 4G networks, but will not be able to communicate together to enable generalized self-driving until much faster speeds are unlocked. Similarly, “augmented reality” technologies (think of the Pokémon GO game) are emerging but remain largely impractical because of insufficient data transmission speeds. In this context, 5G has the potential to unlock new technologies that were still science-fiction material just a few years ago.

Nevertheless, 5G technology comes with specific engineering challenges. The waves used for 3G and 4G could be transmitted over long distances by a network of cell towers and were able to penetrate most surfaces, easily allowing indoor use. 5G, however, relies on much higher frequency waves that need antennas located close to each other and that cannot penetrate most surfaces, requiring line-of-sight to operate properly. Consequently, a colossal infrastructure revamp will be needed before 5G can be broadly adopted, representing a very lucrative opportunity for many companies.

On the surface, there is no such thing as the “5G industry”, since 5G is merely a technology that will enable new innovations. That being said, the best 5G stocks are not all scattered across the spectrum of industries: several segments of the economy will benefit more than the rest from this technological revolution.

How to Invest in 5G Stocks

The 5G revolution will transform many industries in waves. The first boom will likely come from building the 5G infrastructure, as well as building 5G-compatible chips for personal devices. Only then will there be the necessary “baseline” technology to allow more advanced uses (think remote health, augmented reality, autonomous vehicles) to develop.

Consequently, investing in 5G stocks can take many forms. From infrastructure and microchips to 5G-enabled devices and services, the range of commercial applications is wide. To help guide you in your analysis of the companies that will benefit most from this new technology, below are some aspects to consider in buying 5G stocks.

- Proof of Concept

The first question to ask is what kind of 5G application is the company providing or planning to develop? An existing wireless carrier with large-scale 4G coverage or a cell tower operator is much more likely to realize its 5G commercial promises than an unproven AR/VR or remote healthcare company. While the theoretical applications of 5G may be limitless, 5G-enabled autonomous vehicles are not yet around the corner, significantly increasing the risk of an investment.

- Size and Scalability of the Market

Once you have identified companies with the right technological capabilities to leverage 5G technology, you then need to ask yourself about the size of the market. For example, the market for 5G-enabled smartphones is massive, both in the short and the long-term, while the market for 5G “smart shelves” in retail stores may be a niche in the foreseeable future. When in doubt, you should consider giving more weight to companies with large, proven markets.

- Diversification of Revenue Sources

While 5G technology is slowly being rolled out across the world, the timeline and probability of success in commercial applications is still unclear. 5G remains a nascent technology, so companies that bank their future on it may not be able to survive until a market for their products is fully developed. Consequently, while 5G is not yet an everyday reality, you should make sure that your preferred companies have other revenue sources to stay afloat until a market is there for them to tap.

- Return on Investment Horizon

Lastly, you should make sure that your investment horizon matches the timeline for the company’s investments in 5G technology to pay off. As an example, while installing cell towers or inserting chips on 5G-enabled devices will be the first steps in the technology’s development, more advanced use cases (autonomous driving, smart grid etc.) will take much longer to materialize, significantly widening the required investment window.

While the above list brings up specific points to bear in mind when investing in 5G stocks, they do not constitute the full story. Much like when investing in any other assets, it is important that you read each company’s financial statements and its press coverage to understand all the risks before buying a given stock.

The Best 5G Stocks to Buy in 2021

Now that we’ve reviewed the basics of 5G technology and discussed some factors to bear in mind when buying 5G stocks, here is our list of the best 5G stocks to buy in 2021.

1. Qualcomm

Qualcomm is one of the world’s largest chipmakers and semiconductor companies. It boasts a large portfolio of intellectual property in 5G technology and recently obtained a settlement with Apple, allowing Qualcomm to supply chips for Apple’s upcoming 5G-compatible phones. In addition to providing chips for handsets, Qualcomm also supplies equipment that can be used for PCs and autonomous vehicles, giving it exposure to many new 5G-enabled technologies and markets.

While Qualcomm’s stock price recently suffered from the coronavirus crisis, the company’s outlook is bright. The company’s leverage is limited, and its ample cash resources will allow it to weather the economic slowdown. Analysts covering the stock currently rate Qualcomm as a Hold/Buy, with average price targets at $91 (vs. a current stock price of $78).

Qualcomm should be in prime position to benefit from the growth in demand for 5G chips when the technology is rolled out, and investors in the meantime can profit from its 3.3% dividend yield, comfortably covered by its free cash flows.

2. Intel / Taiwan Semiconductors

Two other semiconductor companies with strong upside potential thanks to the 5G boom are Intel Corporation and Taiwan Semiconductors. While Intel sold its smartphone modem business to Apple in 2019, 5G remains an important part of its strategy for the future, and the chipmaker has plans to manufacture 5G-compatible microchips for computers and connected devices.

Meanwhile, Taiwan Semiconductors is one of the largest manufacturers of microchips for smartphones in the world and has invested heavily to supply 5G-compatible technology. As smartphone and connected device sales continue rising thanks to the 5G boom, Taiwan Semi stands to benefit strongly from the uptick in demand.

3. Qorvo and Skyworks Solutions

Both Qorvo and Skyworks Solutions are suppliers of radio frequency (“RF”) chips, primarily for mobile. While they do not manufacture modems and processors (unlike Qualcomm), they both have large contracts with Apple to deliver RF chips for the upcoming 5G-compatible iPhone.

Because these two companies have the same business model and are both closely tied to Apple for their revenues, their exposure to the 5G boom and to the >$10 billion dollar RF chips market is very similar. Further, as more and more devices require mobile RF chips, both companies stand a comparable chance of benefiting from further demand.

In addition to the exposure they provide to mobile 5G applications, both companies are involved in other areas of 5G. Skyworks deploys small cell solutions to help relaying 5G in difficult environments, and Qorvo develops technologies to make 5G base stations more efficient. Ultimately, the fate of these two 5G stocks will depend on their ability to beat one another to win lucrative contracts in mobile 5G while finding ways to profitably diversify into other segments of the 5G market.

4. Ericsson

Ericsson is a storied Swedish communications equipment company. It is one of the pioneers of 5G technology and has begun commercializing 5G technology in Europe, Asia and the Americas. Its key 5G technologies include 5G capable handsets and platforms & networks allowing businesses to develop 5G-powered IoT and industrial solutions.

As security concerns recently grew around the importance of China’s Huawei in the 5G sector, many eyes have turned to Ericsson to be a preferred 5G technology provider for Europe and North America. Ericsson already participates in research programs, hardware development projects and live testing of 5G technology with leading telecoms clients around the world, including AT&T, Verizon and China Mobile, among others.

Ericsson’s stock barely suffered from the coronavirus crisis, and its large net cash position and recent return to profitability suggest that the company is in good health. At the time of writing, analyst consensus on Ericsson was mostly in “Buy” territory, with average price targets forecasting 20% upside.

5. Nokia

Nokia is a strong competitor to Ericsson and Huawei, with dozens of signed commercial 5G deals, a self-reported 22% market share in the worldwide 5G equipment business. Nokia supplies 5G products and services ranging from radio and cloud services to automation and security hardware and software. The company is making the US and European markets a priority, and aims to eventually build 5G networks all around the world.

While its stock has been struggling lately, Nokia has invested heavily in 5G R&D and the perspective that its efforts will pay off and solidify its position in the 5G equipment market make the stock an attractive buy.

6. Verizon Communications

A solid risk-reward proposition for more long-term investors is to buy major telecom companies, Verizon in particular. As 5G is rolled out in the United States, Verizon is set to be one of the largest wireless providers to deliver 5G technology to end-users and end-devices.

Verizon is the leader in the US broadband market, with exceptional 3G/4G coverage and an early lead in 5G coverage. Indeed, Verizon owns almost twice as much millimeter-wave spectrum for 5G deployment as its debt-laden archrival AT&T. Meanwhile, as rivals T-Mobile and Sprint are busy implementing their recently approved mega-merger, more of the 5G pie may be available for Verizon.

With robust sales totaling over $130 billion in 2019, strong operating and profit margins (24% and 14%, respectively), a whopping 32% return on equity, moderate leverage and a 4.4% dividend yield amply covered by free cash flows, Verizon looks comfortably positioned for the future. At the time of writing, analysts considered Verizon a “Hold”, with price targets suggesting a 10% upside potential.

7. T-Mobile/Sprint

T-Mobile and Sprint are the third and fourth players in the US telecoms market, long struggling behind AT&T and Verizon. Their recently approved merger will change the companies’ fate however, allowing them to deploy significant amounts of capital to build a rival 5G network.

T-Mobile recently announced that it would invest upward of $40 billion in the next 3 years to build a nationwide 5G network capable of rivaling its larger peers. While the company may ultimately remain third in the US market, the merger of two small companies gives this new large player more room to grow and gives the stock potentially more upside.

8. BT Group / Deutsche Telekom

Deutsche Telekom is the largest telecoms company in Europe, while BT Group is in charge of Openreach, the broadband network all other UK carriers must use. These two groups are the natural leaders in the development of 5G networks in the UK and Europe, providing 5G access to many of the largest cities on the continent.

Deutsche Telekom plans to cover almost 100% of Germany with 5G by 2025, while BT Group intends to become the undisputed leader in 5G for the United Kingdom. Given their respective size and their early leads in their home markets, both companies are uniquely placed to lead the charge in the development of 5G. Consequently, these two 5G stocks will allow you to gain exposure to the development of 5G in Europe, albeit to varying degrees.

9. Apple

No list of the best 5G stocks to buy would be complete without Apple. With products sold all around the world, a market cap that once topped $1 trillion, massive profits and a gigantic pile of cash for R&D, dividends and buybacks, Apple is one of the world’s best-known and most successful companies.

Apple has signed contracts with Qualcomm to purchase 5G chips and is expected to release its new 5G-enabled iPhones, Apple Watches and iPads this year. Many of 5G’s breakthroughs will be made possible via 5G-enabled devices, and Apple will be at the forefront of the consumer 5G market by enabling innovation via its products.

Not only is Apple expected to sell millions of 5G enabled phones, tablets and other smart objects, but the advent of 5G technologies will bring about newer applications, driving increased revenues from the App Store. Consequently, Apple will be one of the main players to ride the upcoming 5G wave.

10. Xiaomi

Xiaomi is the largest smartphone seller in China, ahead of Apple and Samsung. It recently released 5G-enabled phones in China and India, another of its major markets, and is expected to roll out new models over time. Beyond smartphones, Xiaomi develops and sells a wide range of IoT connected devices at much lower price points than peers, with large market shares in its segments in China and India.

This smartphone maker thus offers a bet on a broader democratization of 5G, particularly since its smartphones are on average much more affordable than popular upmarket brands and thus are better fitted for emerging markets. As such, the reach (in terms of number of customers) of Xiaomi’s 5G-enabled devices is one of the widest in the world.

Should I Buy 5G Stocks?

In this guide, we discussed the promises of 5G technology, covered some key points to keep in mind to invest in 5G stocks and reviewed some of the best 5G stocks in 2021. Since 5G is a new technology that is still in its infancy, buying 5G stocks can be incredibly rewarding but is also risky. The use cases are very wide, and the investment horizons vary significantly, leaving a lot of options for you to choose from.

However, we cannot provide you with detailed investment advice, and deciding which 5G stocks to buy is ultimately your decision. Like any other stocks, make sure to read carefully every company’s financial statements, press coverage and expert commentary to make sure you are comfortable with your investment decisions.

For additional stock trading resources, have a look at our stock investing and stock trading guides!

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

What are the main categories of 5G stocks?

5G is a new technology that will resonate across the economy, so there is no 5G industry per se. However, when talking about 5G stocks, we often refer to 5G chip and device makers, wireless companies, cell tower operators or 5G components manufacturers.

What are the main issues with 5G?

5G uses high-frequency waves that need to be transmitted over short distances with direct line of sight. Consequently, the existing 4G infrastructure is inadequate for 5G development, and much more needs to be built. On top of engineering issues, cross-border disputes over which country’s companies will build 5G networks have slowed down the technology’s development in recent years.

Is 5G fundamentally different from 4G?

Beyond the issue of wave frequency and penetrability, 5G is simply much, much faster than 4G. On average, 5G will allow data transmission up to 50x faster than 4G, opening the door for countless new technologies.

Should I buy 5G stocks directly or via CFDs?

This depends on your investment horizon. CFDs incur daily rollover fees so they are more suited toward short-term positions. 5G is a nascent technology so its benefits will not be felt immediately, making it more suited for long-term positions via direct stock buying.

Can I buy foreign 5G stocks if I’m not from the same country?

Of course! All you need is an online broker that offers stocks listed on the right exchanges. The brokers listed in this article all offer a wide range of exchanges!

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Ericsson is a storied Swedish communications equipment company. It is one of the pioneers of 5G technology and has begun commercializing 5G technology in Europe, Asia and the Americas. Its key 5G technologies include 5G capable handsets and platforms & networks allowing businesses to develop 5G-powered IoT and industrial solutions.

Ericsson is a storied Swedish communications equipment company. It is one of the pioneers of 5G technology and has begun commercializing 5G technology in Europe, Asia and the Americas. Its key 5G technologies include 5G capable handsets and platforms & networks allowing businesses to develop 5G-powered IoT and industrial solutions.

No list of the best 5G stocks to buy would be complete without Apple. With products sold all around the world, a market cap that once topped $1 trillion, massive profits and a gigantic pile of cash for R&D, dividends and buybacks, Apple is one of the world’s best-known and most successful companies.

No list of the best 5G stocks to buy would be complete without Apple. With products sold all around the world, a market cap that once topped $1 trillion, massive profits and a gigantic pile of cash for R&D, dividends and buybacks, Apple is one of the world’s best-known and most successful companies.