Emerging market equities, which also include Chinese stocks attract a lot of interest from investors. However, despite all the promise of economic growth in the world’s second-largest economy, Chinese markets have mostly disappointed over the last decade.

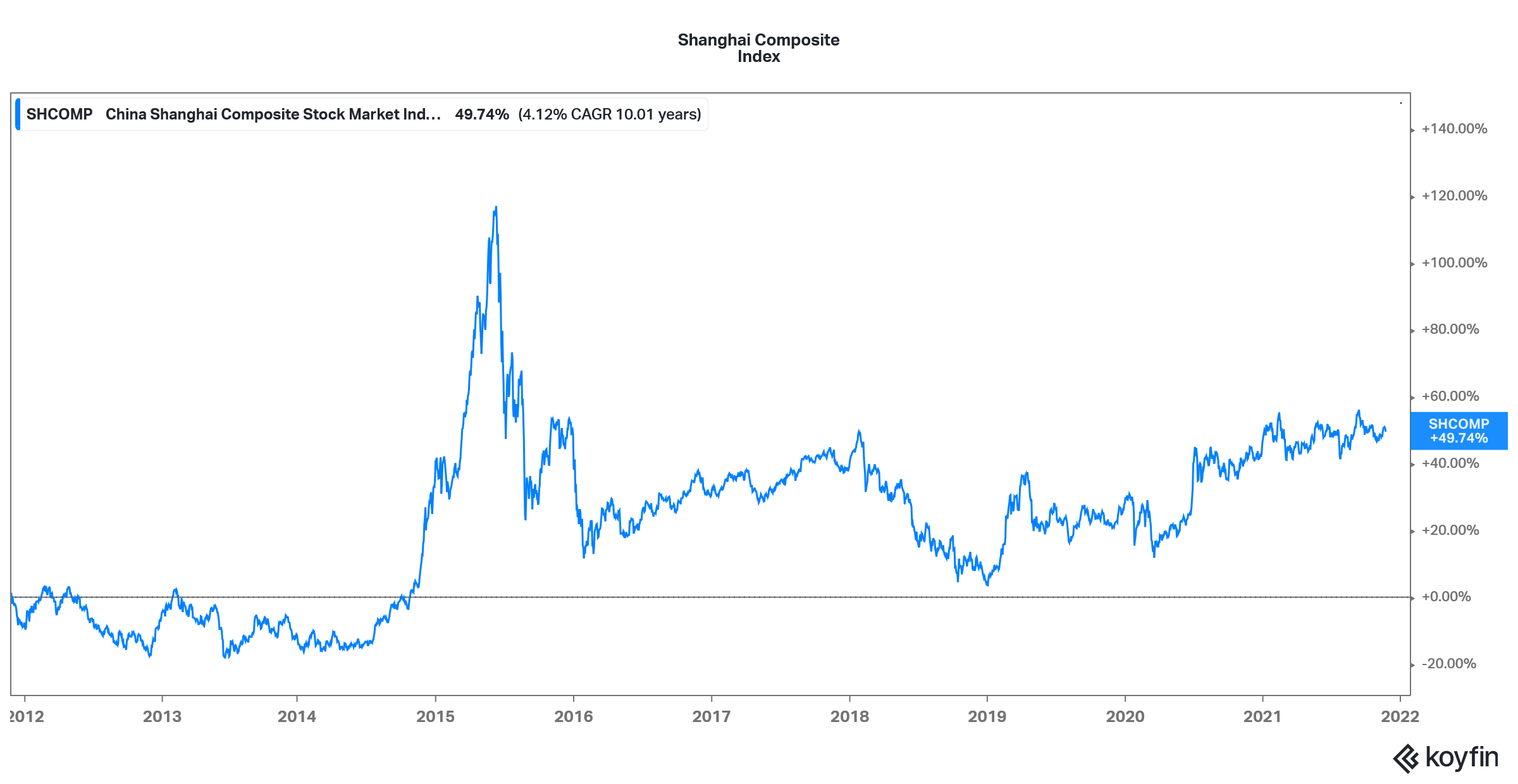

The Shanghai Composite Index is up only about 2.6% for the year, underperforming the global markets by a wide margin. The underperformance is not limited to 2021 alone and in the last five years, the index has gained only about 9.3%. While the ten-year returns look somewhat decent at 49%, it is still among the worst-performing markets during the period.

Chinese stocks have underperformed

Notably, the Shanghai Composite Index is a rare market globally which still trades below the 2007 highs. Simply put, despite being the world’s fastest-growing major economy over the last decade, Chinese stocks have not lived up to the promise.

Meanwhile, now some of the asset managers sound constructive on Chinese equities, and both BlackRock and Goldman Sachs sound bullish on Chinese stocks. Notably, both these fund houses have turned bearish on Indian stocks which have been among the best markets of 2021 even as they have pared some of the gains over the last couple of weeks.

China’s crackdown

Chinese stocks have borne the brunt of the tech crackdown in the country. The country went after several sectors including delivery companies, gaming companies, and the Edtech sector. The country also tightened the antitrust policies and Alibaba was particularly targeted. The stock has underperformed other tech stocks by a wide margin over the last year.

Chinese President Xi Jinping is pushing forward with the “common prosperity” agenda and wants to address the glaring wealth disparity in the country. However, as the Chinese Communist Party reverts back towards a more communist and socialist regime, its undoing some of the gradual reopening of the economy which it had achieved over the last two decades.

Geopolitical risks of investing in China

Notably, the geopolitical risks of investing in China have only increased over the last couple of years. The US-China rivalry is only going to increase in the years to come as more flashpoints emerge between the world’s two biggest economies. Then we have the policy uncertainty in China towards tech industries. The rumored delisting of Didi from US markets would not do any good for Chinese stocks and they would be looked at with even greater suspicion now by foreign investors.

Chinese stocks and the real estate crisis

While the debt crisis at Evergrande has somewhat abated, the Chinese real estate industry is still not out of the woods yet. There is an impending debt crisis in the Chinese real estate industry which has been pressurizing Chinese stocks. Notably, the real estate and construction sector is a major contributor to the Chinese economy even as the country has been trying to pivot towards a consumption-driven economy.

The Chinese economy is slowing down

That said, the consumption growth in China has also come down as was highlighted by Alibaba’s fiscal second-quarter 2022 earnings. To sum it up, regulatory uncertainty, a slowing economy, geopolitical risks, and the real estate debt crisis are among the prominent risks that investors would face while investing in China. To add to that, the US-listed Chinese stocks also face the risk of delisting from the US markets. While many don’t see that as a realistic possibility given the loss US investors would face in the event of a delisting, we can’t rule that out given the souring US-China relations.

Meanwhile, investing in stocks, especially those in emerging markets has always been risky. However, what matters is that whether risks are properly priced and appreciated. Despite the slowdown in China, the country remains among the fastest-growing major economies. Also, while many criticize its high-handed handling of the COVID-19 pandemic and the ambiguity over the origins of the deadly virus, the country has handled the pandemic much better than liberal western democracies.

Chinese stocks appear reasonably valued

Many fund managers including Cathie Wood of ARK Invest believe that there is a structural deterioration in the valuation of Chinese companies after the crackdown. There certainly is merit in the argument. Apart from the policy uncertainty, it seems Chinese companies might have to also invest in Xi Jinping’s common prosperity program. Alibaba has already committed billions towards the program. While the investment is “voluntary” more companies might have to commit funds towards the program.

The MSCI China Index now trades at 13 times its forward earnings which is much below other major markets, both developed as well as emerging. The low valuation multiples are indicative of the higher perceived risk of investing in Chinese stocks.

Funds pivot from Indian to Chinese stocks

The valuation disparity between Indian and Chinese stocks has prompted BlackRock, which is the largest asset manager globally, to pivot from Indian to Chinese stocks. Goldman Sachs also finds Chinese stocks attractive.

The massive underperformance of Chinese stocks as compared to Indian stocks has made the former look attractive to several fund managers. “There is more opportunity to allocate to China as the performance disparity between the two countries is one of the largest on record,” said Tom Masi, a New York-based portfolio manager.”

Where to invest in China?

Meanwhile, the question could be, which Chinese stocks should you invest in. One approach could be to look at beaten-down Chinese tech names like Alibaba. The worst seems to be over for the Chinese e-commerce giant and it should deliver good returns over the medium to long term.

Also, it would be prudent to look at Chinese stocks that are not at risk of a crackdown. Chinese EV stocks are one asset class that actually benefits from the country’s policies. China has also invested in EV stocks like NIO and Xpeng Motors. The country wants to increase EV penetration in the country and sees it as a strategic industry.

How to invest in Chinese stocks?

There are several ways to trade and invest in Chinese markets. Some of the brokers let you trade in Chinese market stocks. One can also invest in stocks of Chinese companies that are listed on the US stock markets. You can select from any of the best online stock brokers. You can also trade in the Chinese market indices through binary options. There is a list of some of the best binary options brokers.

If you are not well versed in investing in stocks and still want to have exposure to Chinese stocks, you can consider ETFs. Under the current environment, where investing in individual Chinese stocks looks a lot riskier, ETFs can be a good investment option to get exposure to China. There are ETFs that give you exposure to a basket of emerging market stocks as well as those focused on China. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account