Coinbase stock (NYSE: COIN) gained almost 7.5% yesterday and rose to the highest level since March after Atlantic Equities upgraded the stock to overweight.

Analyst Simon Clinch sees Coinbase stock as a long-term opportunity despite the short-term volatility.

According to Clinch, “The company is regaining custody asset share and is also leveraging its trust credentials to exercise pricing power — both important steps towards building resilience in the model.”

Coinbase stock soars after analyst upgrade

He added, “While risks remain in the form of a weak volume backdrop, recession, regulation, and market prices, we believe that Coinbase’s recent actions allow investors to look through towards the longer-term opportunity.”

Notably, crypto prices have rebounded this year after last year’s slump. While the market is still below the November 2021 highs, the sentiments are a lot better now than they were a few months back.

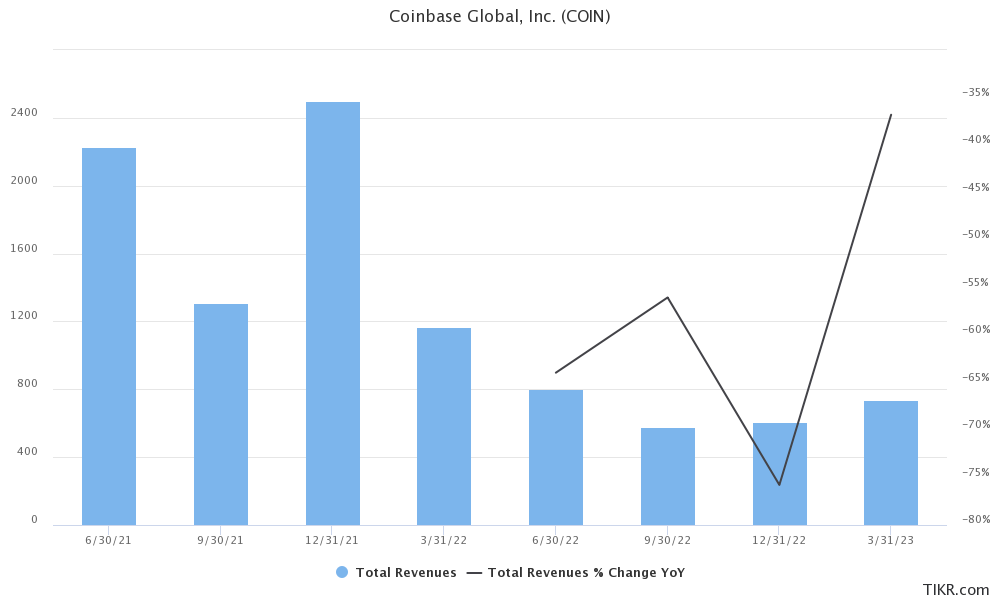

Also, Coinbase is tightening its belts and focusing on cost cuts to return back to profitability. In the first quarter of 2023, its revenues rose 22% to $736 million – which was far ahead of the $655 million that analysts expected.

COIN posted better-than-expected earnings in Q1 2023

Also, its net loss of $79 million was much narrower than what the markets expected – largely because of the cost cuts. Despite the 22% rise in revenues, Coinbase’s operating expenses fell 24% which helped it post an adjusted EBITDA of $284 million.

The return to adjusted EBITDA profitability was no mean feat for COIN. It reported a net loss of $2.62 billion in 2022 compared with a net profit of $3.15 billion in 2021. Last year, the company posted an adjusted EBITDA loss of $371 million – versus a positive adjusted EBITDA of $4.09 billion in 2021.

In its shareholder letter, Coinbase said, “This quarter represented a turning point in our drive towards building a company that is more efficient and financially disciplined; a company that is able to do more for less. We reduced costs, doubled down on operational excellence and risk management, and continue to drive product innovation and regulatory clarity.”

Clinch is supportive of the company’s cost-cut moves and said, “These actions are building resilience in the business model, and we believe enables investors to think longer-term once more.”

Atlantic Equities says Coinbase is the “best expression of crypto”

Atlantic Equities raised Coinbase’s 2023 and 2024 revenue estimates by 8.2% and 7.4% respectively.

In his note, Clinch said that Coinbase is the “best expression of crypto.” He added, “a 10% move in crypto market cap impacts our target by about 7-8%, making Coinbase the best way to express a view on the crypto market.”

Cathie Wood has been buying COIN stock

Cathie Wood of ARK Invest bought more Coinbase shares earlier this month. The stock is the fourth-largest holding of the flagship ARK Innovation ETF (ARKK) and the second-largest holding of the ARK Fintech Innovation ETF (ARKF).

ARK Investment Management is now the second largest stockholder of Coinbase after Vanguard.

Meanwhile, Wood sold Nvidia shares in January and missed the humongous rally in its stock which lifted its market cap to $1 trillion yesterday. She has however justified her move and said that Nvidia shares are overpriced.

That said, after Nvidia’s bumper earnings last week multiple analysts raised their target prices on the stock and see more upside ahead for the company.

Wood missed the rally in Nvidia stock

Some analysts believe that the stock is cheaper now than it was before the earnings. UBS analyst Timothy Arcuri said, “From a valuation perspective, our EPS went up far more than the stock so we believe it is actually now less expensive than it was into earnings which opens up some more room to run.”

Notably, Nvidia’s revenue guidance for the fiscal second quarter was 50% higher than what Wall Street was expecting.

Baird said that it expects Nvidia’s annualized per-share earnings to reach $10 over the next few quarters which would mean a PE multiple of around 40 at current prices.

Coinbase is pushing for crypto regulations in the US

Coinbase has long been advocating for a regulatory and legal framework for cryptocurrencies. When FTX collapsed last year, it tried to pitch itself as a better alternative that is better governed. It also touted its publicly available financials by virtue of being a listed company.

In its Q1 2023 shareholder letter, while referring to the Wells Notice that the SEC sent to it, Coinbase said, “We see this as an opportunity to continue pushing for a clear rule book in the US for crypto regulations.”

It added, “The US can’t afford to fall behind on this important technology that can update the financial system and keep 1 million jobs in America. We are heartened to see the continuation of broad bi-partisan support for crypto legislation and will continue to advocate for rules for our industry.”

Notably, several crypto executives have warned that the US risks missing out on crypto investments and related jobs due to the regulatory crackdown and uncertain legal framework.

Coming back to Coinbase stock, the stock has gained over 60% this year – tracking the gains of bitcoin and other crypto assets. It however remains well below its all-time highs amid the regulatory crackdown on cryptos.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account