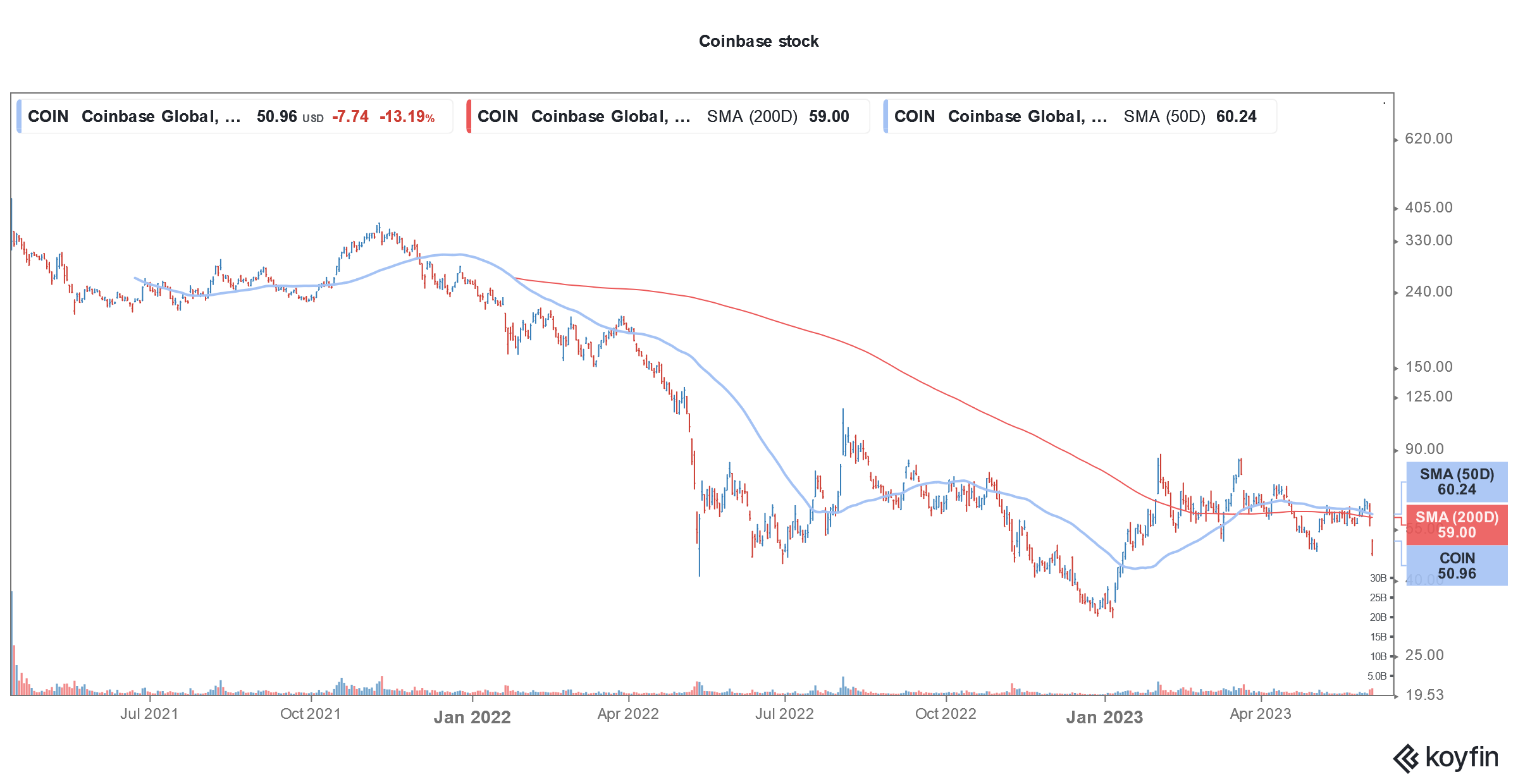

Coinbase stock (NYSE: COIN) is down sharply in early US price action today after the US SEC sued it for allegedly breaking US security laws.

In its complaint, the SEC alleged that Coinbase let its customers trade in multiple cryptos which were unregistered securities.

“Coinbase has never registered with the SEC as a broker, national securities exchange, or clearing agency, thus evading the disclosure regime that Congress has established for our securities markets,” said the SEC in its 101-page long chargesheet filed in the federal court.

SEC sues Coinbase for flouting US security laws

It added, “All the while, Coinbase has earned billions of dollars in revenues by, among other things, collecting transaction fees from investors whom Coinbase has deprived of the disclosures and protections that registration entails and thus exposed to significant risk.”

Notably, SEC’s lawsuit against Coinbase comes a day after a similar lawsuit against Binance.

Coinbase responds to the allegations

Meanwhile, Coinbase has responded to the allegations and Coinbase chief legal officer Paul Grewal told CNBC that “The SEC’s reliance on an enforcement-only approach in the absence of clear rules for the digital asset industry is hurting America’s economic competitiveness and companies like Coinbase that have a demonstrated commitment to compliance.”

He added, “The solution is legislation that allows fair rules for the road to be developed transparently and applied equally, not litigation. In the meantime, we’ll continue to operate our business as usual.”

SEC has cracked down on cryptocurrencies

The SEC has cracked down on cryptocurrencies over the last year and had previously sent a Wells Notice to Coinbase.

In its Q1 2023 shareholder letter, while referring to the Wells Notice that the SEC sent to it, Coinbase said, “We see this as an opportunity to continue pushing for a clear rule book in the US for crypto regulations.”

It added, “The US can’t afford to fall behind on this important technology that can update the financial system and keep 1 million jobs in America. We are heartened to see the continuation of broad bi-partisan support for crypto legislation and will continue to advocate for rules for our industry.”

Coinbase has long been advocating for a regulatory and legal framework for cryptocurrencies. When FTX collapsed last year, it tried to pitch itself as a better alternative that is better governed. It also touted its publicly available financials by virtue of being a listed company.

SEC chair Gary Gensler doubts the need for more digital assets

SEC chair Gary Gensler – who has a hawkish stance on cryptos and digital assets – took yet another swipe at them and doubted the very need for more digital assets.

“We already have digital currency. It’s called the U.S. dollar. It’s called the euro or it’s called the yen, they’re all digital right now. We already have digital investments,” said Gensler speaking with CNBC.

He added “The investing public has the benefit of the US securities laws. Crypto should be no different, and these platforms, these intermediaries need to come into compliance.”

Crypto trading activity has sagged

Meanwhile, crypto trading activity is now a fraction of the peak – in part due to the SEC’s crackdown.

In the first quarter of 2023, while Coinbase’s revenues rose 22% to $736 million – which was far ahead of the $655 million that analysts expected – they were way below the 2021 highs.

Also, far from being hugely profitable as was the case in 2021, Coinbase is now posting losses. It is however tightening its belts and focusing on cost cuts to return back to profitability.

Coinbase turned adjusted EBITDA positive in Q1 2023

Coinbase posted a net loss of $79 million in Q1 2023 which was much narrower than what the markets expected – largely because of the cost cuts. Despite the 22% rise in revenues, Coinbase’s operating expenses fell 24% which helped it post an adjusted EBITDA of $284 million.

The return to adjusted EBITDA profitability was no mean feat for COIN. It reported a net loss of $2.62 billion in 2022 compared with a net profit of $3.15 billion in 2021. Last year, the company posted an adjusted EBITDA loss of $371 million – versus a positive adjusted EBITDA of $4.09 billion in 2021.

In its shareholder letter, Coinbase said, “This quarter represented a turning point in our drive towards building a company that is more efficient and financially disciplined; a company that is able to do more for less. We reduced costs, doubled down on operational excellence and risk management, and continue to drive product innovation and regulatory clarity.”

COIN stock crashes after SEC lawsuit

Coinbase stock has whipsawed over the last year amid the volatility in crypto prices. It is nonetheless outperforming the markets amid the rise in crypto prices this year.

Cathie Wood of ARK Invest bought more Coinbase shares last month. The stock is the fourth-largest holding of the flagship ARK Innovation ETF (ARKK) and the second-largest holding of the ARK Fintech Innovation ETF (ARKF).

ARK Investment Management is now the second largest stockholder of Coinbase after Vanguard.

Meanwhile, Wood sold Nvidia shares in January and missed the humongous rally in its stock which lifted its market cap to $1 trillion yesterday. She has however justified her move and said that Nvidia shares are overpriced.

That said, after Nvidia’s bumper earnings last week multiple analysts raised their target prices on the stock and see more upside ahead for the company.

As for Coinbase, the SEC’s crackdown and lack of comprehensive crypto regulations are a key headwind. While many observers see cryptos as a good diversification tool, several regulators see them as speculative and have cracked down on the nascent industry.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account