Coca-Cola (NYSE: KO) stock is trading higher in US premarket trading today after the company reported better-than-expected earnings for the first quarter of 2023. Here are the key takeaways.

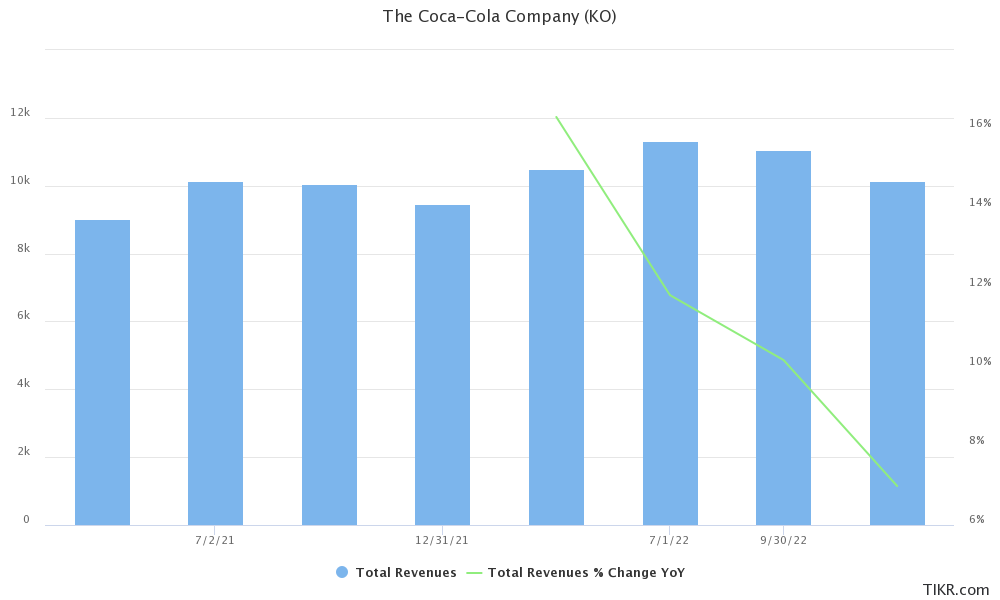

Coca-Cola reported revenues of $10.96 billion in the March quarter which was 5% higher YoY and ahead of the $10.8 billion that analysts were expecting.

The company’s organic revenues – a non-GAAP metric – rose 12% in the quarter led by 1% growth in concentrate sales and 11% attributable to price/mix.

Coca-Cola, like other consumer staple companies, has raised prices over the last year to mitigate the impact of higher inflation which has helped buoy its revenues.

Coca-Cola posts better-than-expected earnings

KO reported an adjusted EPS of 68 cents in the quarter which was higher than the 68 cents that analysts were expecting. The metric increased by 5% YoY.

The company’s operating margins compressed to 30.7% in the quarter – as compared to 32.5% in the corresponding quarter last year. It said, “Operating margin decline was primarily driven by items impacting comparability and currency headwinds.”

Coca-Cola said that it gained market share in the total non-alcoholic ready-to-drink market in the quarter.

PepsiCo to release earnings later this week

Rival PepsiCo is also set to release its earnings later this week. Overall, 30% of S&P 500 constituents including Amazon, Microsoft, Meta Platforms, Boeing, as well as Chevron are set to report their earnings this week.

Markets would especially watch the tech earnings this week before we head into May – which hasn’t historically been a good month for stocks.

Key takeaways from Coca-Cola Q1 earnings

During Q1 2023, Coca-Cola generated free cash flows of $160 million which were below the $460 million in the corresponding quarter last year.

The company said that the fall in cash flows was “largely due to the timing of working capital initiatives and payments related to acquisitions and divestitures.”

Commenting on the earnings Coca-Cola’s CEO James Quincey said, “Our system alignment is stronger than ever, and our networked organization is allowing us to adapt as needed. We continue to invest for the long term, strengthening our capabilities to drive sustainable value for our stakeholders.”

He added, “We have the right portfolio, the right strategy and the right execution to deliver in the marketplace. We are confident in our ability to deliver on our 2023 objectives.”

It forecast organic revenue growth between 7%-8% for the year – which is unchanged from the previous guidance. The company also maintained its comparable EPS growth target of between 7%-9%.

KO reported a rise in volumes

Looking at different product categories, Coca-Cola said that sparkling drinks volumes rose 3% in the quarter led by strong growth in Latin America and Asia.

The unit case volumes of Juice, value-added dairy, and plant-based beverages were similar to the last year.

The water, sports, coffee, and tea segment reported a 4% rise in unit case volumes.

Coca-Cola North America volumes were flat

Coca-Cola said that its volumes in North America were similar to the corresponding quarter last year “as growth in sparkling soft drinks and juice, value-added dairy and plant-based beverages was offset by a decline in water, sports, coffee and tea.”

Unit case volumes rose 10% in Asia Pacific – which was the highest among all the regions.

Notably, while Coca-Cola’s volume growth has sagged in developed markets, it is still growing at a brisk pace in emerging markets like India.

KO reported a 5% rise in its unit case volumes in Latin America while the metric fell 3% YoY in Europe Middle East & Africa. The segment was negatively impacted by the earthquake in Türkiye and the company’s decision to exit Russia last year.

Several US companies exited Russia after the country invaded Ukraine.

KO stock is up around 0.7% this year and is underperforming PepsiCo which has gained 2.6% this year. Nonetheless, both these companies are underperforming the S&P 500 this year.

After a strong 2022, defensive stocks have underperformed in 2023 as investors have pivoted towards beaten-down growth stocks amid hopes that the Fed would end its rate hike cycle sooner than later.

Fed’s dot plot calls for one more hike of 25 basis points this year and many market participants believe that the US central bank would pause after a 25 basis point rate hike in May – especially as annualized inflation fell to 5% in March and the lag impact of Fed’s rate hikes are yet to fully play out.

Coca-Cola stock is up just over 1% in US premarkets today and the beverage giant has a dividend yield of 2.87% as compared to PepsiCo’s 2.47% yield.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account