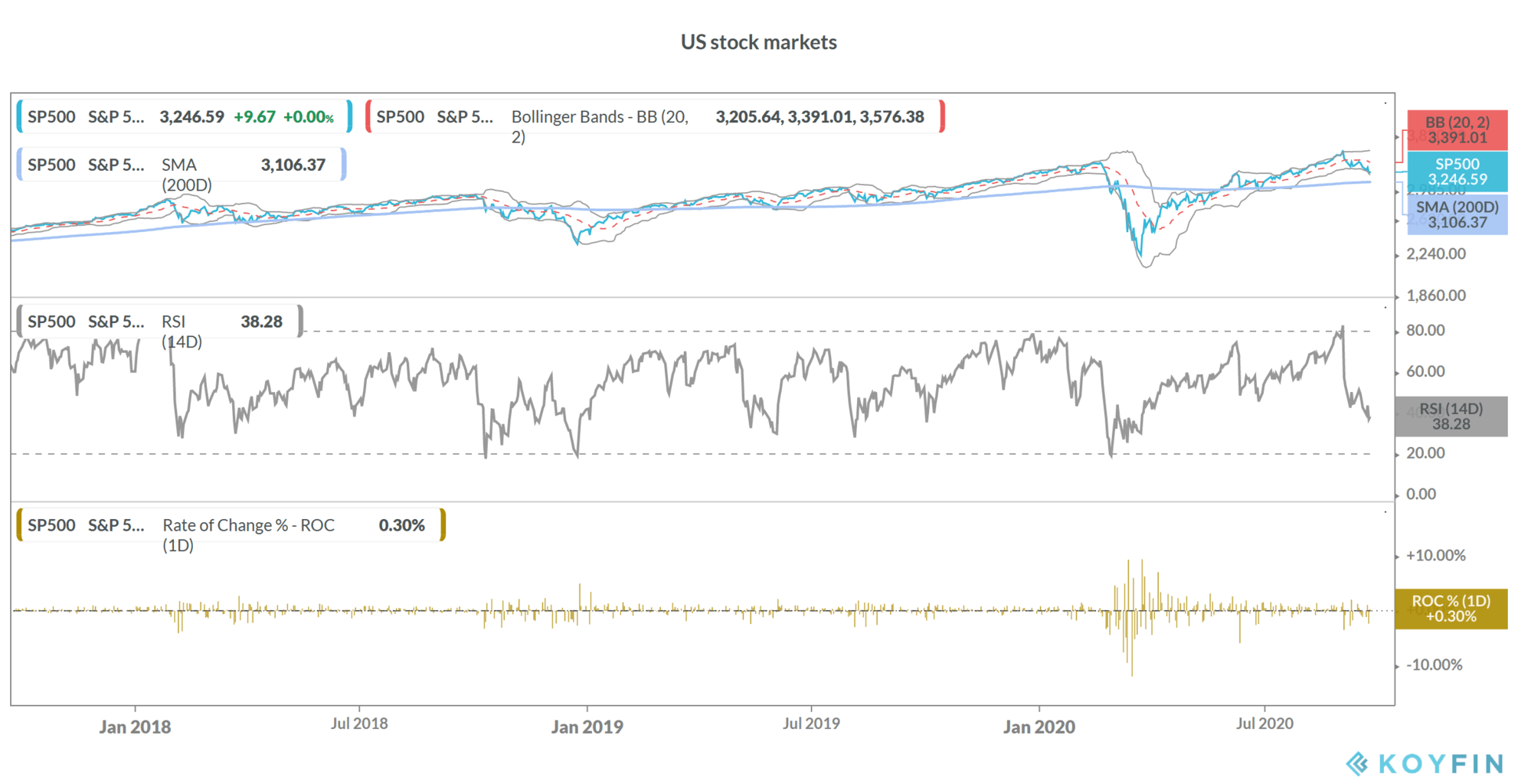

US stock markets have plunged in September and look set to close with a loss in the month after five consecutive months of gains. What’re analysts advising amid the volatility in markets?

US stock markets have looked weak this month. The S&P 500 closed at a record high of 3,580.84 on 2 September and is now down 9.3% from the closing high. While US stock markets closed with gains on Thursday, futures are pointing to a weak opening today. Tech stocks have especially looked weak and have weighed heavily on the broader markets.

What’re analysts advising as US stock markets fall

The recent sell-off in US stock markets has raised fears among investors. US stock market valuations are running way ahead of their long term average even as the pandemic is taking a toll on the economy.

Nomura Asset Management’s Ilan Chaitowitz advises against selling stocks after the recent sell-off. “With seven late stage vaccine trials reading out over the next few months — several could be in the Oct/Nov time frame — and each with 85% likelihood of success as a base case — it seems myopic for market participants to be dumping stocks today in the apparent fear of a resurgent lethal global pandemic,” said Chaitowitz.

Sector rotation from tech

Barclays analysts Ajay Rajadhyaksha and Amrut Nashikkar also sound optimistic. “Equity valuations are elevated, but much of the premium sits in mega-cap U.S. tech stocks. We expect some of this to dissipate as the march to normalcy continues and favor U.S. cyclicals and healthcare, as well as European equities over U.S. large tech,” the two analysts noted.

Jim Cramer, the host of Mad Money show on CNBC also advises shifting from tech to beaten down sectors. There are several ways that you can play the sector rotation theme as we discussed in a previous article.

Is the worst over for US stock markets?

Mona Mahajan of Allianz Global Investors also feels that the worst is behind for US stock markets. While she does not rule out another 5-7% fall in the S&P 500, she said that “We view further consolidation as perhaps tactical opportunities as we get into 2021.”

Mahajan added, “We’d be comfortable with starting to buy and add at these levels.” “The expectations are for a 25% rebound in S&P earnings next year. That combined with low rates as committed by the Fed could be a good backdrop for risk assets broadly.”

The US Fed is not expected to increase rates anytime soon. At the FOMC (Federal Open Market Committee) meeting earlier this month, the US central bank said that it does not expect to raise rates until 2023.

Also, given the new inflation targeting approach that Fed chair Jerome Powell announced last month, the Fed might not raise rates in a hurry even after 2023.

Watch out for US elections

“A lot of institutional investors buyers, especially, are perhaps waiting to see how the election results play out,” said Mahajan. She added, “Really, the downside potential comes around the election period itself. If we get a contested election results, that period of uncertainty could weigh on markets.”

US President Donald Trump hasn’t ruled out the possibility that he wouldn’t contest the elections. He hasn’t committed to a peaceful transfer of power also if he is not elected in the November presidential elections.

Where to invest as US stock markets display volatility?

The recent correction in US stock markets could be an opportunity to build long term positions in some of the quality stocks. One approach could be to add the beaten down sectors as they should rise sharply once we have a credible vaccine.

Also, tech stocks like Apple and Amazon have come down from their peaks and you may consider adding them to your portfolio. However, given the current volatility, you should invest for the long term.

Alternatively, you may consider investing in ETFs to build a diversified portfolio. If you are not equipped to pick individual stocks, ETFs can give you the desired exposure without having to pick individual stocks.

By investing in an ETF, you get returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs. You can also refer to our selection of some of the best online stockbrokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account