Alphabet, Google’s parent company is scheduled to release its earnings for the first quarter of 2020 and the stock is already performing positively ahead of it, as analysts expect steady revenue and earnings growth from higher internet traffic boosted by stay at home restrictions caused by the coronavirus pandemic.

Estimates from various sources, including Zacks.com and Koyfin, expect revenues at Alphabet, led by chief executive Sundar Pichai (pictured), to end the quarter in a range of $40bn and $42bn, which would result in a 10% increase compared to last year’s results.

Meanwhile, analysts are forecasting earnings per share between $10.6 and $11.2, which would result in a 10% growth in earnings compared to the same quarter last year.

Jason Bazineto from Citigroup said: “We expect Google to have a greater near-term disadvantage but also have a faster recovery”. He added: “We believe Alphabet will be more resilient vs. Facebook in weathering the advertising decline due to its lower exposure to the [small business] advertiser base”.

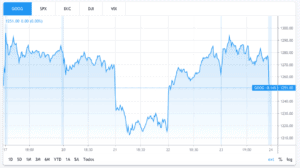

Alphabet (NASDAQ: GOOG) shares have seen a 5% gain since Tuesday, with the stock closing yesterday’s session at $1,276.31, in line with the overall performance of the market and other tech companies that will also report their quarterly results next week. The stock has lost nearly 4.5% so far this year.

The company that owns the most popular search engine in the world is among the small group of businesses benefitting from the recent coronavirus health emergency, as stay-at-home policies have resulted in a spike in internet traffic, something that Google is well-positioned to benefit from, as the search engine accounts for more than 80% of the global search volume.

Even though analysts are anticipating a mild drop in advertising revenues, Google’s primary source of income, as a result of the global economic slowdown triggered by the virus, they also expect that other revenue sources such as its cloud computing business may offset or even overturn the drop, as businesses are relying more on IT platforms to conduct their operations.

You can trade Google shares easily by picking one of our featured stock brokers or you can also choose to get exposure to Google’s share price fluctuations by trading CFDs or buying an ETF that tracks tech companies.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account