Alibaba stock (NYSE: BABA) fell in Hong Kong trading today amid reports that SoftBank is moving to sell more shares after having already sold the bulk of shares over the last year.

The Financial Times reported that SoftBank has sold around $7.2 billion worth of Alibaba shares this year through prepaid forward contracts. The Japanese private bank sold $29 billion worth of BABA shares last year also.

At the peak, SoftBank held over a third of Alibaba shares and once the forward contracts are settled it would hold only about a 3.8% stake in the company. At one point, SoftBank’s stake in Alibaba was valued at just under $200 billion but is now valued at under $40 billion.

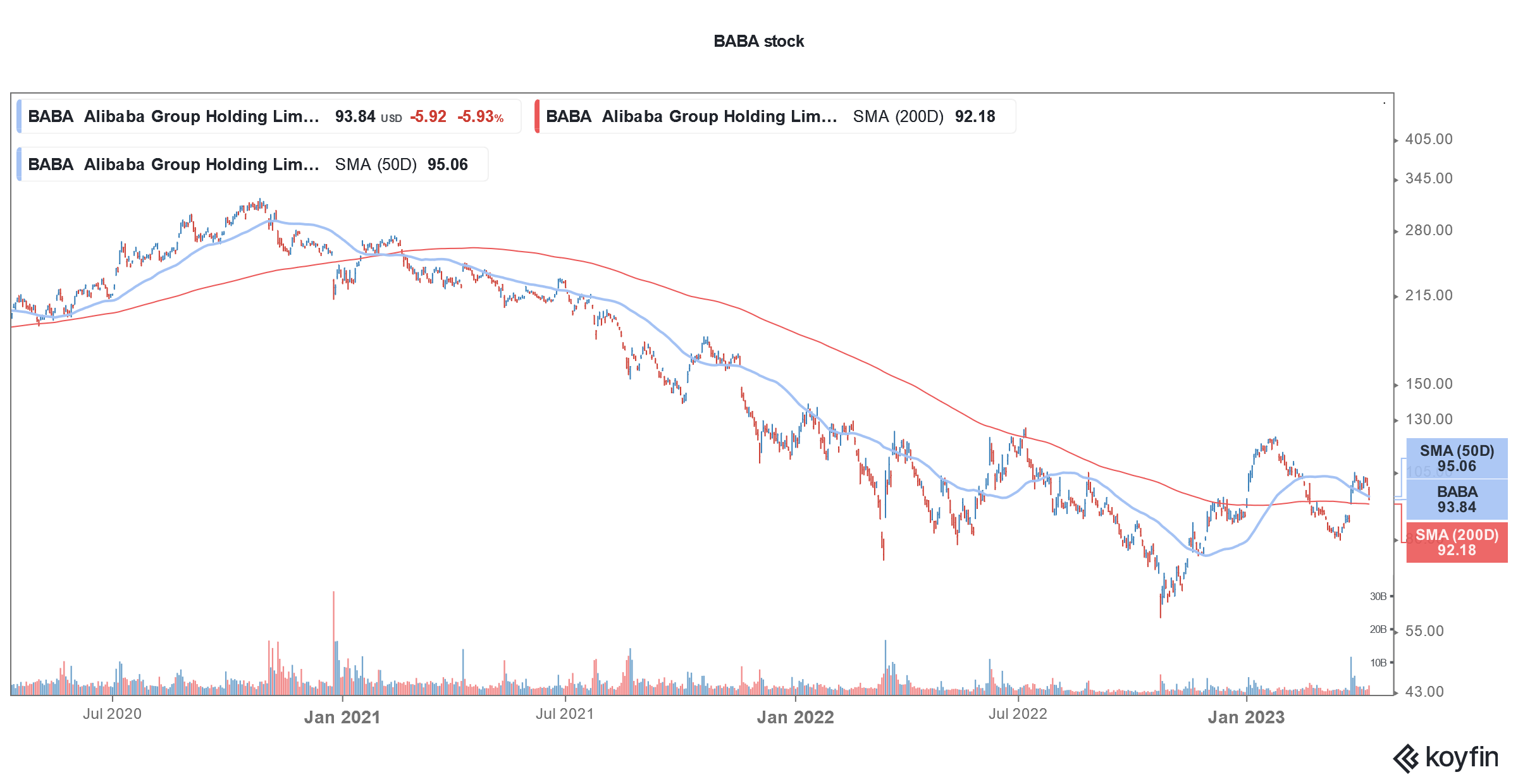

The stake value has fallen because SoftBank has gradually sold the shares and secondly Alibaba stock has underperformed badly over the last three years.

It has nonetheless been a multibagger investment for SoftBank as it paid only about $20 million for the stake two decades back.

SoftBank’s Masayoshi Son bet on Alibaba’s co-founder Jack Ma and said in an interview later that while the company did not have any revenues or business plan when he invested, he was impressed by Ma’s leadership and charisma.

SoftBank looking to sell more Alibaba shares

Last year, BABA stock briefly fell below its IPO price amid pessimism toward Chinese shares.

Alibaba and Ma became the faces of China’s tech crackdown and the company eventually paid a record $2.8 fine to settle the antitrust case.

Chinese ride-hailing app Didi was another casualty as China forced it to delist from the US within months of the blockbuster IPO.

SoftBank was also the largest DiDi stockholder. Since the tech crackdown, the Japanese giant has been cutting its stakes in Chinese companies.

SoftBank is also working towards an IPO of Arm Holdings after its sale to Nvidia was called off.

Alibaba announced a business restructuring

Meanwhile, SoftBank’s stake sale news comes at a time when Alibaba has announced a business reorganization. The stock soared on the news as markets saw it as a sign of value unlocking.

Alibaba would become a holding company and would split the business into six units. These are The Taobao Tmall Commerce Group, Cainiao Smart Logistics, Local Services Group, Global Digital Commerce Group, Cloud Intelligence Group, and Digital Media and Entertainment Group.

Alibaba said that the move would help it unlock stockholder value. In his remarks, BABA CEO Daniel Zhang said, “This transformation will empower all our businesses to become more agile, enhance decision-making, and enable faster responses to market changes.”

Morgan Stanley sees a massive upside in BABA stock

In a recent note on BABA, Morgan Stanley analysts led by Gary Yu said there is “potential for more than 2x upside to our bull case of US$200 per share.”

They added, “With gradual consumption recovery in China … and the potential catalyst of corporate restructuring, we reiterate BABA as our top pick in China Internet.”

Notably, China expects its GDP to rise “around 5%” in 2023. China’s GDP rose at an annualized pace of 3% in 2022 which was better than the 2.8% growth that analysts expected. The growth rate was however the second lowest since 1976 and the world’s second-largest economy fared poorly in only 2020 when it grew by a mere 2.2%.

China warms up to the tech sector

China has taken several decisions which show that the country is now warming up to the tech sector. It allowed the downloads of Didi apps, approved Ant Financial’s request to raise capital, and also announced overseas listing rules for domestic companies.

Many see Ma’s reappearance in China after spending almost a year abroad as a sign of China warming up to the tech sector.

As Stephen Roach, a senior fellow at Yale University told CNBC, “Jack just didn’t show up in Hangzhou because he was tired of traveling around. I think it was well orchestrated and fits with the government’s campaign to demonstrate that, you know, they are relaxing pressures on their private sectors and are welcoming the rest of the world.”

China incidentally has of late warmed up to foreign tech companies also and has hosted several foreign tech executives including Apple CEO Tim Cook.

BABA has also announced an AI chatbot

Amid the global euphoria toward generative AI and chatbots, Alibaba has also launched its own AI chatbot. Meanwhile, China is looking to censor AI and has released new rules for generative AI.

Meanwhile, Wall Street analysts are mostly positive on the stock after the reorganization and Jefferies believes that it is trading at a “meaningful discount.” Notably, Alibaba’s valuation discount with global tech peers has widened over the last couple of years as the company’s valuation multiples took a beating amid the tech crackdown.

Tim Seymour, founder, and chief investment officer of Seymour Asset Management is also constructive on Alibaba’s reorganization and said, “There’s always been a lot of value here. In fact, you get Ant for free when you invest in this company. This is great news to me. This is a wait-and-see moment.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account