Former Lordstown Motors’ (NYSE: RIDE) CEO Steve Burns sold 4,345,647 shares between May 5 and May 15 as the former executive continues to trim his stake in the troubled EV (electric vehicle) company.

Burns stepped down as the company’s CEO in June 2021 months after Hindenburg Research accused the company of misconduct. Along with Burns, CFO Julio Rodriguez also quit the company with immediate effect then.

Steve Burns continues to sell Lordstown Motors

Notably, in its report, Hindenburg Motors had accused Lordstown Motors of fraud. Commenting on the company’s pre-orders it said “Our conversations with former employees, business partners and an extensive document review show that the company’s orders are largely fictitious and used as a prop to raise capital and confer legitimacy.”

After the allegations, Lordstown Motors constituted a committee. It refuted many of the allegations and said, “The Special Committee’s investigation concluded that the Hindenburg Report is, in significant respects, false and misleading. In particular, its challenges to the viability of Lordstown Motors’ technology and timeline to start of production are not accurate.”

It did however admit that its investigation identified “issues regarding the accuracy of certain statements regarding the Company’s pre-orders.”

RIDE’s production is running behind schedule

Meanwhile, Lordstown Motors’ production is running way behind schedule – as is the case with almost all the startup EV companies. Shortly after commencing deliveries, it issued a recall which raised fears about the model.

The company did resume deliveries last month but its woes look far from over. And it has warned of bankruptcy if Foxconn walks out from the proposed investment.

Lordstown Motors did a reverse stock split

Earlier this month, Lordstown completed a 1:15 reverse stock split to meet the minimum exchange listing requirements.

While announcing the reverse stock split, RIDE said that the transaction would also help close the deal with Foxconn.

It said, “if the reverse split causes the Class A common stock price to remain above $1.00 per share for 10 consecutive trading days and Nasdaq notifies the Company that the Bid Price Requirement has been satisfied, that may satisfy Foxconn’s (incorrect) interpretation of the closing condition and cause Foxconn to close the transaction.”

It, however, warned, “No assurance can be given regarding the impact of the Reverse Stock Split on the stock price or that Foxconn will meet its obligation to close, even if the stock price remains above $1.00 for the 10 trading-day period. While the Company remains willing to negotiate with Foxconn in an effort to resolve its disputes, no agreement currently exists and the Company cannot predict whether such an agreement will be reached in the future.”

Startup EV companies face the heat

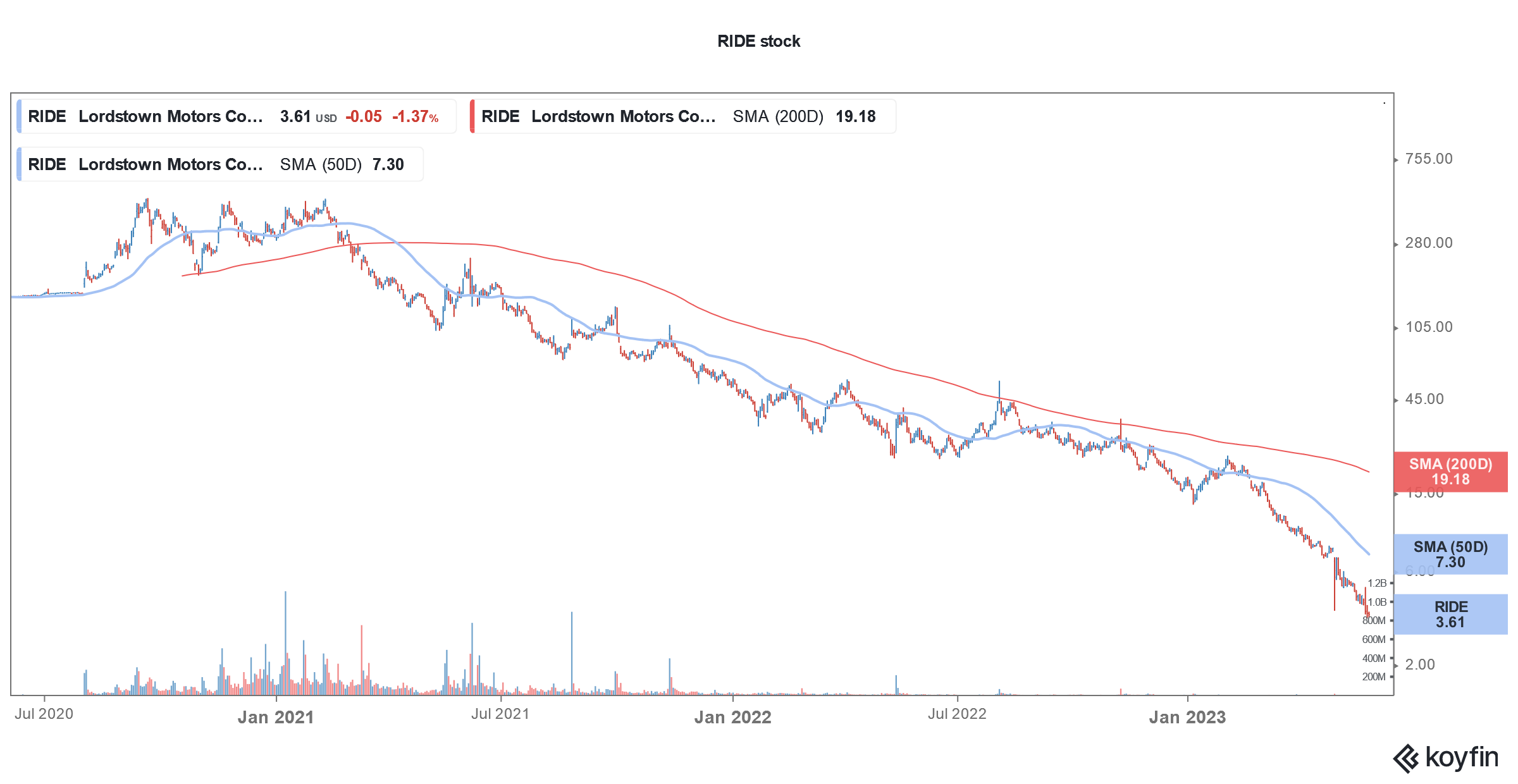

Startup EV companies are facing the heat which is reflected in their stock prices. On the execution front most are running way behind schedule. On the other hand, their losses and cash burn continue to balloon which puts the very survival of the business at risk.

Many startup EV companies have raised capital over the last year to fund their burgeoning cash burn. These include the relatively well-funded Rivian which raised $1.3 billion through a convertible note earlier this year.

In order to raise more cash, EV startup Arrival did a reverse merger with Kensington Capital Acquisition Corp. V. It was a rare case where a company opted for a second SPAC reverse merger.

SPAC bubble has burst

In 2020, SPAC IPOs hit a new record and the total money collected by these blank cheque companies was more than what they did in the previous 10 years. Lordstown Motors too went public through a SPAC reverse merger in 2020.

The SPAC mania continued in 2021 and it was another record year but cracks began to appear in the back half of the year.

For little-known startup companies, SPAC was a good tool to go public in a red-hot IPO market. 2020 and 2021 were good years for new listings, and through SPAC reverse merger companies managed to go public much sooner than traditional IPOs.

The regulatory arbitrage between traditional IPOs and SPACs also helped fuel the industry’s growth. While companies are barred from projecting future earnings in a traditional IPO, they could generously do so in SPAC reverse merger.

Companies provided forward projections stretching as far as 10 years which helped markets value them based on future earnings. Incidentally, almost all of the companies that went public through SPAC mergers were loss-making growth companies that were difficult to value based on traditional valuation metrics.

Lordstown Motors has disappointed with the execution

Lordstown Motors currently sells the Endurance pickup which is pitted against Ford F-150 Lightning – whose ICE (internal combustion engine) model is America’s best-selling pickup for over four decades.

So far, Lordstown Motors has disappointed with its execution and the company faces an uphill task as it tries to compete in an increasingly competitive EV market.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account