U.S. Bank Loan Review 2020 – READ THIS BEFORE Applying!

The U.S. Bank has been operational for more than 150 years and has created a noteworthy legacy and financial record in that span of time. Offering a full range of products, the bank is considered a worthwhile alternative for customers looking for the big bank experience.

The U.S. Bank has been operational for more than 150 years and has created a noteworthy legacy and financial record in that span of time. Offering a full range of products, the bank is considered a worthwhile alternative for customers looking for the big bank experience.

It falls just outside the scope of the big four and comes with a distinct set of merits for its users. In as far as loans are concerned, the bank has a wide variety of options with varying terms and rates to suit different users.

In this review, we will take a look at the various available options and their terms as well as the strengths and weaknesses of this large financial player as a loan service provider.

-

- Account Creation

- 1.Go to the U.S. Bank official site and click on “Personal” or “Business” depending on the type of account you want to create.

- 2. Keep following the prompts on the screen to select the account that suits your needs.

- 3. Next, click on “Get Started” if you are new to the bank.

- 4. You will get the list of requirements for opening an account with the bank and then select whether it is an individual or joint account.

- 5. Once you are done, you can view your results and make amendments if necessary. Complete the application process by making a deposit ($25 minimum).

- Borrowing Process

- 1.If you have opted to apply online, you will at this point see the local branch which you need to visit for closing, plus the bank’s disclosure statement.

- 2. Next, submit your application and wait for approval. If your application gets approved, you could have the funds in as few as two or three business days.

- 3. Following approval, you will get the funds via direct deposit to your bank account or via cashier’s check.

-

- Account Creation

- 1.Go to the U.S. Bank official site and click on “Personal” or “Business” depending on the type of account you want to create.

- 2. Keep following the prompts on the screen to select the account that suits your needs.

- 3. Next, click on “Get Started” if you are new to the bank.

- 4. You will get the list of requirements for opening an account with the bank and then select whether it is an individual or joint account.

- 5. Once you are done, you can view your results and make amendments if necessary. Complete the application process by making a deposit ($25 minimum).

- Borrowing Process

- 1.If you have opted to apply online, you will at this point see the local branch which you need to visit for closing, plus the bank’s disclosure statement.

- 2. Next, submit your application and wait for approval. If your application gets approved, you could have the funds in as few as two or three business days.

- 3. Following approval, you will get the funds via direct deposit to your bank account or via cashier’s check.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

U.S. Bank is one of few large financial institutions to offer personal loans at competitive rates. Furthermore, like other lenders such as Opploans, it has multiple other loan options to suit the needs and circumstances of its customers. It does take quite a bit to qualify for any of the loans but it has flexible terms and a host of other convenient features.

U.S. Bank is one of few large financial institutions to offer personal loans at competitive rates. Furthermore, like other lenders such as Opploans, it has multiple other loan options to suit the needs and circumstances of its customers. It does take quite a bit to qualify for any of the loans but it has flexible terms and a host of other convenient features.What is U.S. Bank?

Founded in 1863, the U.S. Bank has more than a century of experience and is currently among the largest financial institutions in the US.

Back in 1863 when the bank first opened its doors in Cincinnati, it went under the name First National Bank of Cincinnati. But following a series of mergers, it formally took on the current name at the turn of the century.

Today, it has over 3,100 branches across 25 states, with at least 74,000 employees and is managing assets worth over $467 billion.

It is headquartered in Minneapolis and rated the fifth largest bank in the United States with a customer base exceeding 18 million. In a majority of states where it operates, it is the largest financial player.

The bank has a diverse business mix. But its core focal points revolve around corporate and commercial banking as well as consumer and business banking among other services.

Unlike some large US and international banks such as Bank of America and Chase, the U.S. Bank offers personal loans. Let’s find out more about them.

Pros and Cons of a U.S. Bank Loan

Pros

- The bank’s website has a wealth of information if you are willing to click around to find it

- Customer service is available via a toll-free number

- Ideal for large corporations and businesses requiring seven-figure financing

- It’s among the large and well-established financial institutions in the US

- Branches are present in states underserved by the big four

- Rates are lower than other lenders like Goldman Sachs and Wells Fargo who target the same consumers

Cons

- Applicants need a good credit score to qualify for loans, but details on the exact score are scarce

- S. Bank loans attract an early loan repayment fee

- The bank hides rate details in the fine print

- Only operational in 25 states and thus not accessible to residents of the East Coast, Gulf States or Michigan

- S. personal loan amounts are not as high as at other similar banks

- Low loan maximum for online applicants ($25,000)

- Applicants cannot calculate personal loan rates as the bank is not transparent on its rating system. Rates change daily and vary according to customer location

U.S Bank Vs online personal and installment loan providers, how does it compare?

U.S Bank has been around for more than a century and is one of the biggest banking institutions in the country. During this time, it has not only created a solid reputation but also created one of the widest listing of loan products – from personal to installment, mortgage, and student loans. But how does it compare to such modern online based lenders as Advance America, Rise Credit, and Oportun? Here is a tabulation of their key features:

U.S Bank

- Borrow personal loans of between $3,000 and $25,000

- Minimum credit score of 500 FICO

- Personal loan APR ranges from 6.49% to 17.99%

- Loan repayment periods of between 12 and 48 months

Advance America

- Loan limit starts from $100 to $5,000

- Requires a Credit Score of above 300

- For every $100 borrowed an interest of $22 is incurred

- Weekly and monthly payback installments

Rise Credit

- Offers loan from between $500 to $5000

- Bad credit score is allowed

- Annual rates starts from as low as 36% to as high as 299%

- Depending on the state, the repayment term ranges from 7 to 26 months

Oportun

- Loan amount starts from $300 to $9,000

- No minimum credit score required

- Annual rates fall between 20% to 67%

- Loan should be repaid in a span of 6 to 46 months

How does a U.S. Bank loan work?

The U.S. Bank is among the few lenders who offer personal loan terms as short as 12 months. For applicants who can make repayment within a year, the rates are attractive with significant savings on interest. However, it is noteworthy that if you repay in less than a year, you will have to pay a prepayment penalty.

For borrowers looking to get high loan amounts, the personal loan is rather limiting. There are other lenders offering limits higher than $25,000. The bank allows for joint applications on some loans (Premier) but does not allow co-signing.

Customers hoping to qualify for the best loan rates would do well to take out a minimum loan of $5,000 under a loan term of 12 to 48 months. It is also best to set up automatic payments from your personal checking account at the bank, since this attracts an interest.

What loan products does U.S. Bank offer?

The U.S. Bank offers various types of loans. These include:

Personal loans

- Premier loans – The premier loan is unsecured which means that loan applicants do not have to have collateral for backing up the loan. The loan duration ranges between one and five years. For online applicants, the loan amount ranges between $3,000 and $25,000. However, someone who applies in person at one of the bank branches can qualify for up to $50,000.

- Simple loans – For customers who need cash urgently, this option offers up to $1,000. And its terms may be better than the typical payday loan.

Auto Loans

For bank patrons who want to buy a car or refinance an existing auto loan, the U.S. Bank offers auto loans.

Business Loans

- Business term loans – Borrowers can access up to $1 million for terms of up to 80 months. The rate for this type of loan is 3.49% but it can go lower with automated payments from a U.S. Bank account. The origination fee is $75 and collateral can take the form of vehicles, equipment or assets. Full amortization can go as long as 7 years. And for equipment purchase loans, you can use the purchased items as collateral.

- SBA loans – The borrowing amount here ranges from $250,000 to $11.25 million with a term length between 7 and 20 years. Origination fee is 0-3.5% and the collateral varies from one product to the next.

- Lines of credit – Credit limits are $250,000 for a cash flow manager but could go as high as $2 million for a business. The loans under this category are all under annual terms with the maximum being 5 years. Collateral can take the form of commercial property including business and business equity.

U.S. Bank Account Creation and Borrowing Process

Account Creation

If you meet all the required criteria for account opening, here is the procedure you need to follow:

1.Go to the U.S. Bank official site and click on “Personal” or “Business” depending on the type of account you want to create.

2. Keep following the prompts on the screen to select the account that suits your needs.

To illustrate, if you are opening a personal checking account, you will have to select a Silver, Gold or Platinum account.

3. Next, click on “Get Started” if you are new to the bank.

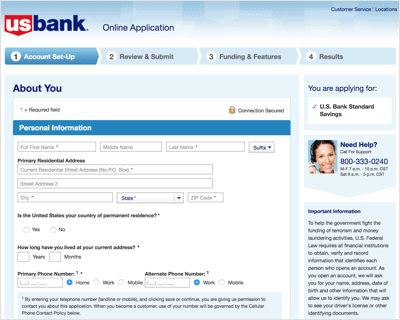

4. You will get the list of requirements for opening an account with the bank and then select whether it is an individual or joint account.

On the next page, fill out all the required personal information (name & contact information). As you fill out the details, you will get access to additional forms where you need to fill out application details and customization.

5. Once you are done, you can view your results and make amendments if necessary. Complete the application process by making a deposit ($25 minimum).

Borrowing Process

You can make your application for the loan online, in person at one of the branches or by phone. Regardless of the mode of application, you will need to supply the required information listed below.

After submitting all the necessary information, review your application.

1.If you have opted to apply online, you will at this point see the local branch which you need to visit for closing, plus the bank’s disclosure statement.

2. Next, submit your application and wait for approval. If your application gets approved, you could have the funds in as few as two or three business days.

However, if the bank requires more paperwork before approving the application, it could take anywhere between three and five days.

3. Following approval, you will get the funds via direct deposit to your bank account or via cashier’s check.

Note that the bank will either approve or deny a loan application within a span of 24 hours and that the longest it may take for the funds to reflect is 7 business days.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Below are the details that you are likely to provide to get a loan:

Eligibility Criteria for U.S. Bank Loan

- S. Bank customer

- Minimum eligible age of 18 or state minimum (whichever one is higher)

- An account that has been open for a minimum of 120 days

- A resident of a state with U.S. Bank branch locations

- No minimum income or credit score specifications, but the bank will evaluate factors such as cash flow, annual income and housing costs during application.

- For business loan applicants, you need to have been in business for at least 2 years

Information Borrowers Need to Provide to Get U.S. Bank Loan

These are the details you will need to submit when applying for the loan:

- Full name

- Phone number

- Date of birth

- Address

- Length of time at the specified address

- Loan amount

- Loan term

- Loan purpose

- Basic banking activity

- Individual taxpayer identification number or social security number

- Employment information if applicable

- For auto loan private party purchase with lien or refinancing, payoff amount and lienholder name

What states are accepted for U.S. Bank loans?

U.S. Banks operates in 25 states, most of which are in the West Coast, Upper Midwest and Mountain States. Here are the states in which you will find branches:

What are U.S. Bank borrowing costs?

Loan Cost Personal loan APRs 7.49% to 17.99% depending on credit score and other factors Personal loan origination fee $50 Personal loan late fee $25 to $38 Personal loan prepayment fee 1% if you choose to pay off loan within the first year with a $50 minimum and $100 maximum Personal loan returned payment fee $29 Business loan rate 3.49% The costs associated with other types of loans vary from day to day and according to location.

U.S. Bank Customer Support

The customer support team gets a mix of reviews from patrons. Given the size of the institution, this does not come as a surprise.

Customer service is reachable via a toll-free number, which is convenient and offers immediate assistance. There is also chat and email customer support and the option of visiting one of their 3,000+ branches in 25 states.

On the website’s customer service page, you can actually find the direct lines for regional support teams.

In most cases, customers complain about impersonal service and say that the bank is unresponsive to their issues.

But on the plus side, the fact that there are many ways to contact them is a major highlight that we should not overlook.

Is it safe to borrow from U.S. Bank?

U.S. Bank is a reputable entity registered with the FDIC, and there are therefore no safety concerns when borrowing from the institution. It is safe to borrow from the bank.

U.S. Bank Review Verdict

The U.S. Bank is among the largest financial institutions in the US with about a century and a half of experience in the field. Like Money Mutual and Rise Credit, It offers a wide range of loan options to its customers at relatively competitive fees.

Though it is one of very few financiers to charge an early payment fee, it offers flexibility in loan rates and terms. Its customer support team is far from ideal and its rating system is not the most transparent.

Overall, the bank is a strong contender in the field but does not offer the lowest market rates. It also has significant improvements to make with regard to customer support and transparency.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

Why should I opt for a U.S. Bank personal loan instead of a credit card?

Personal loans typically offer lower interest rates compared to typical credit card rates. And this is particularly advantageous for large purchases which usually take longer to pay off.

What is an unsecured personal loan?

An unsecured personal loan is one for which no collateral is required to back up the loan. Note that because this poses a higher risk to the bank, it attracts higher fees than secured loans.

What is the interest rate discount for automatic payments through a U.S. Bank account?

Borrowers who set up automatic payments through their checking accounts at the bank qualify for a 2% discount on interest rates.

What are SBA loans?

These are loans that are partially guaranteed by the Small Business Administration enabling SMEs to access reasonable credit rates and terms.

What determines the term length of various loans?

In most cases, the term length depends on the reason or purpose for which you are applying for the loan. For instance, a real estate loan can have a term of up to 25 years while a working capital loan can only have up to 7 years.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up