Advance America Loan Review 2020 – READ THIS BEFORE Applying!

Advance America is one of the most widespread lending service providers in the US. It operates both online and with brick and mortar outlets across the states. Advaance America offers installment loans, payday loans title loans and can even offer a line of credit to draw down from. With a range of options available, could Advance America be right for you?

Advance America is one of the most widespread lending service providers in the US. It operates both online and with brick and mortar outlets across the states. Advaance America offers installment loans, payday loans title loans and can even offer a line of credit to draw down from. With a range of options available, could Advance America be right for you?

Read more to discover the positives and negatives of using this provider. In our review, we look at the provider itself and its services to help you make a balanced decision.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Advance America has a focus on installment loans and lines of credit and unlike most similar providers, has store locations in various states. It is available in more states than most other similar institutions. But it is not transparent on its rates and has recently faced government action on the same.

Advance America has a focus on installment loans and lines of credit and unlike most similar providers, has store locations in various states. It is available in more states than most other similar institutions. But it is not transparent on its rates and has recently faced government action on the same.What is Advance America?

Founded in 1997, under AARC LLC, a direct lender, Advance America has its headquarters in Spartanburg, SC. It currently offers its services in 28 states across the US and has over 1,900 brick and mortar locations.

As a nationally recognized financial service provider, it focuses on payday loans, installment loans, lines of credit and title loans among other services. It is fully licensed in all the states where it operates and is a founding member of the Community Financial Services Association.

Like most other installment loan providers like Balance Credit, it does not require a perfect credit score and offers fast loan approvals. You can access any of their services online, over the phone or in any one of the stores.

Pros and Cons of a Advance America Loan

Pros

- Widespread availability in 28 states and over 1,900 physical locations

- Access to multiple types of loans depending on the state where you live

- You can get a prepaid Visa card, which the lender provides without necessitating a credit check

- No credit checks for most loans

- Competitive fees in some states

- The lender is a fully accredited financial institution with national recognition

- It is a founding member of CFSA

- Licensed and regulated in all states where it operates

Cons

- High fees and rates in certain states

- No transparent framework for fee and rate assessment

- Lots of customer complaints filed against the company

- Access to customer support is restricted to working hours

- The lender recently faced a lawsuit in California for violation of interest rate limits

- Not accredited by the Better Business Bureau

- Reports of poor customer service

- Allegations of loans not following contracts

- Physical locations do not offer check cashing

Advance America vs other loan service providers

Advance America is a popular direct lender specializing in such loan types as payday loans, installment loans, title loans, and even a line of credit. Founded in 1997, Advance America and headquartered in Spartanburg, SC, the lender operates both online and land-based locations in over 28 states across the country. You need a credit score of a minimum 300 points to qualify for a loan with the lender. But how does it fair when compared to such other lenders as Ace Cash Express, Speedy Cash, and Oportun lending companies.

Advance America

- Loan limit starts from $100 to $5,000

- Requires a Credit Score of above 300

- For every $100 borrowed an interest of $22 is incurred

- Loan paid back in 2 weeks to 24 months

Ace Cash Express

- Borrowing from $100 – $2,000 (varies by state).

- No credit score check

- Fee rate on $100 starts from $25 (State dependent)

- Loan repayment period of 1 to 3 months

Speedy Cash

- Online payday loan limit is $100 – $1,500

- Accepts bad credit score

- Payday loans should be paid within 7 to 14 days depending on your pay schedule

- Annual rates of 459.90% but varies depending on state of residence

Oportun

- Loan limit starts from $300 to $9,000

- No minimum credit score required

- Annual loan APR of 20% – 67%

- Loan should be repaid in a span of 6 to 46 months

How does an Advance America loan work?

Like most business loan providers, Advance America has physical stores in a total of 28 states and is thus one of the most accessible short-term loan service providers. Borrowers can access funding by making online applications or visiting any of its retail locations. It is also possible to get services over the phone.

Regardless of the mode of application, the rates from this provider are the same. The requirements are also similar. But the key difference is in the amount of time it takes to access the funding.

For online applications, the typical wait period is 2 business days. However, in case you make your application before 10:30 AM Eastern Time, you might be fortunate to get same-day funding. But for in-person application, you can receive funds immediately after approval.

Depending on your state of residence, you might get different rates and fees for your loan. This is because every state has its own set of regulations governing loan fees. In a majority of states, regulators determine the maximum amount a payday lender can charge as fees.

And in all of such states, Advance America charges that maximum. For instance, in California, for every $100 you borrow, you need to pay $17.

But in other states where regulations are more stringent, the lender charges lower rates as compared to other lenders. In lax states such as Wisconsin, you would have to pay $22 for every $100 you borrow. Though this amount is high, it is still lower than most competitors.

All in all, the bottom line is that whether or not you pay a high rate to a great extent depends on where you live. Similarly, the amount you can borrow and the length of term also depends on your state of residence at the time you borrow.

The lender’s installment loans have much longer repayment periods than payday loans. But their fees over the extended life of the loan are much higher than taking out a personal loan from a bank.

You can borrow any amount between $100 and $5,000. For payday loans, the maximum term is 31 days and applicants need a credit score of between 300 and 640. The provider does not however disclose the minimum annual income requirement.

For its lines of credit, you have some measure of control over the repayment amounts. Moreover, you would only need to pay interest over the amount you use, not the full sum. It might be the least costly option for anyone in need of emergency cash.

Installment loans, on the other hand, offer a higher amount of money than payday loans. Furthermore, they have a longer repayment period and allow you to repay it in multiple installments, hence the name.

You can choose between a bi-weekly and monthly payment cycle and the loan term is between 12 months and 24 months. The amount you qualify for will depend on your state and so will the applicable rate. Make payment using cash or ACH.

Title loans in most states range from $300 to $5,000. One of the most common options under this category is the car title loan. You can use your car’s title, if you have one, to get a loan while continuing to use the car.

For this option, you do not require a bank account. The accessible amount will depend on the year, make, model, mileage and series of the car in question. Rates on this type of loan are lower than for most other loans because you set up your car as collateral.

The lender will place a lien on the car title after appraising its value and approve your personal loan instantly. Note that you need to bring the car in for valuation and inspection.

Despite of the fact that Advance America has lots of store locations, it does not offer all of the services other lenders offer. For instance, though you can apply for a loan in-person, you cannot cash a check or get assistance with taxes at such locations.

What loan products does Advance America offer?

Advance America offers a wide range of loan products to suit the needs and circumstances of its various patrons. Consider some of them:

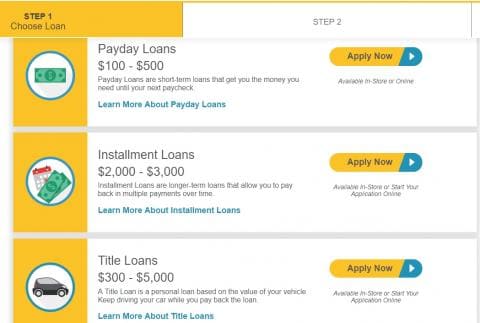

- Payday loans

- Installment loans

- Cash advances

- Line of credit

- Title loans

- Online loans

What other store services does Advance America offer?

Advance America also offers a number of other store services including:

- Prepaid debit cards (Visa)

- MoneyGram

Advance America Account Creation and Borrowing Process

Creating an account and borrowing from Advance America is not a complex process. Follow these steps:

1. Visit the platform’s official site, advanceamerica.net and select “Apply Now.”

The first thing you will need to do is enter your state. You can also click on the “Use my current location” tab.

2. It will take you to a page showing all available loans. Select the loan you want to take out.

On this page, you can also learn more about the loan you have in mind by clicking on “Learn More.”

3. After choosing your loan, click “Apply Now” then select whether you want to continue the application online or in-store.

For in-store applications, you can initiate the process online and complete it at a physical location.

4. Choose your preferred option and then click on the relevant tab. Create your account and then enter the required personal information.

This will include personal information such as your address and phone number and then financial information which includes your bank account details and income information.

6. Once you are done with filling out the details, go through the disclosures and accept the terms then submit your application.

The automated system will analyze your application. If it approves the application, you may have to submit additional information such as proof of identity and proof of income.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Advance America Loan

Here are the qualifications for getting a loan from the lender:

- Have a steady source of income but not necessarily from employment

- Not bankrupt

- At least 18 years of age or state limit

- Be a permanent US resident or US citizen

Information Borrowers Need to Provide to Get Advance America Loan

When filling out your loan application, there are some documents you will need and some information you will have to fill out. These include:

- Social security number

- Most recent proof of income

- Proof of an active checking account

- Proof of residence e.g. utility bill

- Check (depending on state)

- Valid government-issued ID

- Personal information e.g. phone number and address

- Financial information e.g. annual income and bank account information

What states are accepted for Advance America loans?

Advance America operates brick and mortar stores in all of the following states:

- Alabama

- California

- Colorado

- Delaware

- Florida

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Michigan

- Mississippi

- Missouri

- Nebraska

- Nevada

- Ohio

- Oklahoma

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- Wisconsin

- Wyoming

What are Advance America loan borrowing costs?

The lender does not transparently provide information about the borrowing costs associated with various loans. Borrowers will get a rate calculation during the application process based on the state of residence and other factors.

Advance America Customer Support

If online reviews are anything to go by, the customer support team for this company is not the most reliable. There could be an element of truth to the claim in view of the overwhelming number of customer complaints currently filed.

Furthermore, support is only available during specific hours and not around the clock.

Is it safe to borrow from Advance America?

Since Advance America is a regulated and licensed entity, it can be said to be a safe lender. However, keep in mind that the state of California filed a lawsuit against the lender for illegal lending rates. It is therefore wise to always confirm your state’s legal rates before signing up for any of its loans.

Advance America Review Verdict

After our comprehensive analysis of Advance America, it emerges that even though it is a relatively reliable player, there are some rough edges to iron out. Among its most outstanding highlights is its widespread accessibility across states and in numerous physical stores.

It also has a wide range of loan options and the loan ceiling is not as low as some of its competitors.

The lender, however, needs some work on the customer support and effective handling of customer complaints. It would also do well to offer greater transparency in its rating system.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Glossary of Loaning Terms

FAQ

Does Advance America check credit ratings before loan approval?

For payday loans, the lender does check credit ratings. But for other loans, it does not check your rating. It may, however, assess your eligibility using an Experian custom rating model.

Does Advance America offer loan refinancing?

That will depend on the state in which you reside. Use the tool on the official site to check the regulations that apply in your state.

Are there any advantages to repaying my loan early?

Yes. To start with, you will not pay any prepayment fees. And in some states, you may qualify for a partial refund of the required interest rate.

Will a late payment affect my credit score?

No. While it will affect your future interest rates, loan amount and loan terms with the lender, there will be no report made to the three main credit bureaus, Experian, Equifax and TransUnion.

What if I am unable to make a payment on the due date?

The provider is flexible enough to work with you on an alternative payment arrangement. But to access this feature, you need to contact the customer support team in-store or over the phone.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up