Fig Loans Loan Review 2020 – READ THIS BEFORE Applying!

However, before you go out and take a loan from the provider, there are some important considerations you may need to make.

In our thorough analysis of the platform, we seek to uncover everything you need to know about the service. Read on so as to be in a position to make an informed decision when choosing whether or not to sign up.

-

- 1.Visit the Fig Loans website and click “Apply” then select your state from the list.

- 2. Click “Save” to start registration process where you need to enter your email and password, as well as a referral code if you have one.

- 3. Once you submit your registration details, you will get access to the customer disclosures. Read and agree to them then click “Submit.”

- 4. Next, review and accept the loan terms and conditions, which will be specific to your application then submit your application.

- 5. The team will take one business day to assess the application and give an email notification showing the decision they reach.

-

- 1.Visit the Fig Loans website and click “Apply” then select your state from the list.

- 2. Click “Save” to start registration process where you need to enter your email and password, as well as a referral code if you have one.

- 3. Once you submit your registration details, you will get access to the customer disclosures. Read and agree to them then click “Submit.”

- 4. Next, review and accept the loan terms and conditions, which will be specific to your application then submit your application.

- 5. The team will take one business day to assess the application and give an email notification showing the decision they reach.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

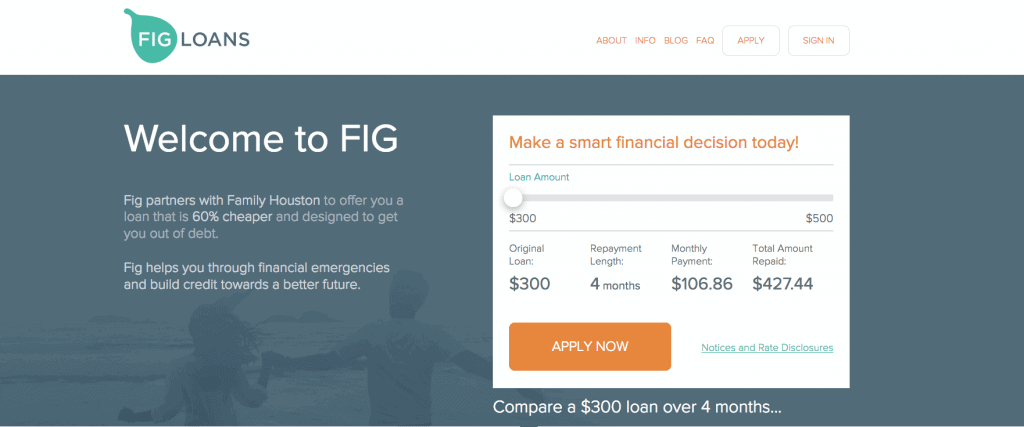

Fig Loans prides itself in flexibility and transparency, and it excels at both. It offers friendly loan rates and does not charge late payment or prepayment fees. With the objective of helping users build credit, it reports to the three major credit bureaus. However, services are only available in five states and loan limits are quite low.What is Fig Loans?

Fig Loans started out in Houston, Texas in 2015 and is a direct lending service offered by Fig Tech Inc. It currently operates from Sugarland, Texas and offers services in five states.

Originally, it started out as a collaboration between United Way Thrive and Fig. At the time, the founders of the company made cold calls to 50 non-profits to find out more about payday loans in Texas.

Only Jackie from United Way picked the call, starting off a healthy partnership with the representatives from Fig. Initially, they worked together with Family Houston and started out offering installment loans in Texas.

The lender’s flexible repayment policy had its origins back then and continues to be a hallmark of the service.

Pros and Cons of a Fig Loans Loan

Pros

- Highly competitive APRs, much lower than most competitors

- An opportunity to build your credit score and access better financing options

- No prepayment, late payment, processing or origination fees

- If you have problems repaying, they work with you on an alternative repayment plan

- Lots of positive online reviews

- You might qualify for a discount for early loan repayment instead of the penalty most short-term lenders charge

Cons

- Only offers services in five states

- Has low loan limits

Fig Loans VS personal loan lenders how does it compare?

Fig Loans started in Houston Texas in 2015 and has to date made inways into four other states where it offers personal loans to poor credit borrowers. Fig loan application and processing is done online and borrowers get to enjoy some of the fastest funds disbursement. Unlike its competition that maintain a wide range of loans, say payday, instalment, and personal loans, Fig will only offer one multi-purpose loan type. We sought to determine how the lender compares to such other personal loan providers as Opploans, LendUp, and Oportun and tabulated their key features.

Fig Loan

- Borrow personal loans of between $300 to $750

- Minimum credit score set at 450 FICO

- Loan APR ranges from 28% to 198% (depending on credit score)

- Loan repayment period is set at between 4 and 6 months

Opploans

- Borrow limit $500 to $5,000

- Bad credit score is allowed

- Annual payment rate starts from 99% to 199%

- Payment period of 9 to 36 months

LendUp

- Loan amount of $100 – $1,000

- No credit score check

- An annual payment rate of 30% to 180%

- Loan repayment period of 1 to 12 months

Oportun

- Loan amount starts from $300 to $9,000

- No minimum credit score required

- Annual rates fall between 20% to 67%

- Loan should be repaid in a span of 6 to 46 months

How does a Fig Loans loan work?

At the heart of Fig Loans philosophy is a mission to offer financial products that meet both its users’ immediate financial needs and secure their financial future. The idea behind it is to provide the kind of loan you would get from friends and family.

It thus operates on a transparent pricing model and has no hidden fees. Furthermore, the service provider offers discounts to customers who make early repayments. Their reasoning is that good credit decisions deserve a reward.

The lender also offers a great level of flexibility, never charging users for late payments or any other unexpected developments. It supports custom payment plans where necessary and provides a number of options for reaching customer support.

And to help customers improve their credit rating, they report to the three major credit bureaus. Ultimately, their objective is to help users reach financial freedom by creating good history that can allow them to access regular financing options.

The APRs are super friendly right from the onset, and could be equivalent to less than $4 for every $100 that you borrow. That is a much lower rate than you are likely to find with any other short term lender. And after the repayment of your first loan, you may qualify for a 20% discount on almost every subsequent loan.

Another differentiating factor is that the lender will consider your application on the basis of the personal information you provide. They will also look at the transaction history on the bank account that you provide. Though it considers all applicants, you stand a higher chance of qualifying if your credit score is 450 or above.

The only real downside to the service provider has to do with the fact that it offers low ceiling loan amounts. It thus may not be ideal for meeting the needs of all possible applicants. It also has limited reach as it only serves five states.

What loan products does Fig Loans offer?

Fig Loans offers four main loan products at present. These include:

- Fig Loan

This is the flagship loan offered on the platform and it provides $300 to $750 with loan terms ranging from 4 to 6 months. The period is extendable and does not require any additional fee or interest.

It is ideal for someone who has an emergency expense or wants to refinance a high interest loan such as a payday loan.

- Builder

As the name implies, the essence of this loan is to assist borrowers to build credit. It is therefore cheaper than a regular loan. If you successfully apply for this loan, you will get the funds in an escrow account.

You will then need to make repayments as you would with any other loan, but will only be able to access the amount from escrow at the end of the repayment period. These loans are typically much larger than other options from the lender. Consequently, they maximize their potential benefits on your credit at the end of the day.

Consider this loan if you do not need funds immediately and can make regular monthly repayments. Note that any late payments will reflect on your rating with the three major credit bureaus. But you can make prepayment at any time to access the escrowed funds.

- Fig36

Also referred to as supercharging non-profit lending, this product is a partnership between fig and non-profit community organizations. The idea of the product is to help such organizations assist the communities under their charge.

It allows the organizations to access top of the range services to provide Wall Street class service to their patrons. The organizations can then lend directly to their communities as they understand them best.

However, the program is still in limited beta in Texas and will expand to other states sometime in 2019.

What other store services does Fig Loans offer?

Fig Loans does not offer any other store services at present.

Fig Loans Account Creation and Borrowing Process

Here is how to create an account on the platform and start borrowing:

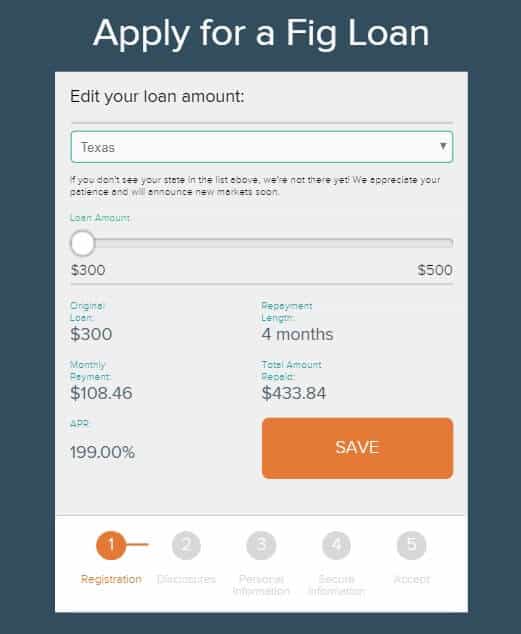

1.Visit the Fig Loans website and click “Apply” then select your state from the list.

Next, select the loan amount that you want to access. On your first application, the cap will be $300.

It will also show you the repayment period, the amount you can expect to repay per installment and the applicable APR.

2. Click “Save” to start registration process where you need to enter your email and password, as well as a referral code if you have one.

If you have been referred by an existing user, you both qualify for a $10 discount on your loan repayment.

3. Once you submit your registration details, you will get access to the customer disclosures. Read and agree to them then click “Submit.”

On the next step, you need to enter personal information which includes your social security number and bank details.

4. Next, review and accept the loan terms and conditions, which will be specific to your application then submit your application.

5. The team will take one business day to assess the application and give an email notification showing the decision they reach.

Remember to stay on top of your repayments or risk damaging your credit score. Though there are no fees for late payment, good repayment habits will contribute to a good credit score on the major bureaus.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Fig Loans Loan

Fig has one of the most easily accessible qualification criteria for its applicants. Here are the requirements you need to meet:

- Be a resident of one of the states in which it provides services

- Have a valid bank account

- Be at least 18 years of age

- Not be a covered borrower under the Military Act

- Have a regular income source

- Receive paychecks via direct deposit

- Have a traditional bank account in your name, with at least 90 days history

Information Borrowers Need to Provide to Get Fig Loans Loan

Here are some of the details you will need to provide when applying for any of the loans on the platform:

- Email address

- Social security number

- Verification of bank account

- Address

What states are accepted for Fig Loans loans?

Fig Loans is working to extend its services to other states, but at the moment, these are the only states it covers:

What are Fig Loans loan borrowing costs?

Fig loans outlines its interest rate system clearly on the website showing the range one can expect to pay according to circumstances. Here is the layout for its flagship loan product:

- First loan – 176% to 190%

- Second loan – 176% to 190%

- Third loan – 156% to 170%

- Fourth loan – 136% to 150%

- Fifth loan – 106% to 119%

- Sixth loan – 76% to 89%

- For credit builder loans – 28% APR

However, the site points out that the actual APR may vary according to your repayment history and other factors.

Fig Loans Customer Support

The lender’s customer support has sparkling reviews online from happy customers. Customers have lots of avenues through which they can reach support. These include text message, phone, email and online chat.

Customers also have the opportunity to make the changes they need either online or via text message. Using this feature, it is possible to get a custom repayment plan.

Based on the reliability of its customer support, this is one of the few short-term lenders that are highly recommended by past and present customers.

Is it safe to borrow from Fig Loans?

Yes. It is safe to borrow from Fig Loans. The lender does not require a lot of sensitive personal information from borrowers. Additionally, its site makes use of standard industry security protocol to protect the information under its charge.

There have been no accounts of users encountering any safety concerns when dealing with the lender.

Fig Loans Review Verdict

Fig Loans is a refreshing deviation from the norm in as far as short-term lenders are concerned. Everything about it has a focus on the customer experience and on meeting user needs. While most other little dollar lenders seem to prey on those with poor or no credit histories, this one is out to help.

It does not charge origination or late payment fees and encourages healthy credit habits by incentivizing early payments. The site allows struggling borrowers to seek reprieve by suggesting custom repayment plans.

Its APRs are among the lowest in this category of lenders and the customer support system is above par in more ways than one. Overall, this is one of the best lenders for times when you need a short-term financial fix.

It is only unfortunate that the services are available in only five states and that the loan amounts are so low. Otherwise, everything else about the service is excellent.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

Can I qualify for a Fig Loan if I have bad credit?

Yes, the lender does not look at the traditional credit score. Rather, it assesses your ability to repay on the basis of your existing loans, bank account and income.

Why does the lender require verification of my bank account?

This is because the lender will not check your credit history when assessing your loan application. Rather, it will make a decision based on the accuracy of the information that you submit during the application process. And that will determine your ability to repay the loan if approved.

What does bank account verification entail?

Basically, it involves authorizing your bank to share your account statement with the lender. It does not however link your bank account to the lender’s system. And the lender does not access your login information.

What if I cannot make a payment on time?

The lender offers flexibility to borrowers, by providing free payment extensions. They can even allow you to split the payment in half if that is what you need to keep up with payments.

Can I make loan repayments using credit card?

Yes. You can use your debit card to make repayments. Note however that additional charges may apply if you choose this option.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up